USD/JPY Forecast: Has it gone too far? Top-tier consumer data, trade headlines

- USD/JPY's advance has reversed amid trade headlines and mixed US data.

- Mid-East tensions, trade developments, and US consumer data are all of interest.

- Early January's chart is painting a moderately bullish picture.

- The FX Poll is showing that experts are divided on the next moves.

Walking the walk or only talking the talk? Mid-East tensions have been dominant as Iran hit back at the US, but the outright war still has low chances. USD/JPY benefited from upbeat US figures and calm on the trade front. The same themes are likely to continue rocking the currency pair – albeit in a different order.

This week in USD/JPY: Mid-East tensions dominate trading

Iraq has remained the scene of the Mid-East tensions, with Iran hitting US bases with missiles. The attack – coming as retaliation for the American killing of Iran's Qassem Suleimani – seemed to inflict limited damage. That allowed markets to calm and USD/JPY to advance. President Donald Trump's message – that included no new military intentions and even an olive branch – further boosted the pair.

The greenback was been buoyed by upbeat data during most of the week. Contrary to the manufacturing sector, the ISM Non-Manufacturing Purchasing Managers' Index beat expected and reflected the health of the US consumer. The ADP employment report also exceeded estimates.

However, Non-Farm Payrolls missed expectations with an increase of only 145,000 jobs in December, below 164,000 expected and even higher projections following the ADP data. Moreover, wage growth decelerated from 3.1% to 2.9%.

Analysis: Expect more dollar falls as the Fed may cut rates

Trade talks – which had a substantial impact on trading in 2019 – were pushed to the back burner in the first full week of 2020. China confirmed that Vice Premier Liu He will be traveling to Washington to sign the Phase One trade deal.

US events: Trade signing ceremony, retail sales and more

Developments in the Middle East will likely remain a market-moving force even if tensions wane. While the US dollar tends to have a mixed reaction against some currencies – it falls behind the yen when the situation worsens.

As long as oil continues flowing from the region and tensions refrain from turning into open war, markets may calm down, and the dollar may gain ground.

Sino-American trade relations return to the limelight as the world's largest economies are scheduled to sign the first phase of the trade deal. The agreement was reached in mid-December and will be made fully public. The ceremony is unlikely to trigger any market movement, but the details of the accord and hints about the next phases may rock markets.

The US economic calendar will also keep traders busy. The Consumer Price Index (CPI) figures for December will be watched for any sign of inflation as the Federal Reserve is skeptical that prices can rise significantly. Annual Core CPI stood at 2.3% in November, and any change would rock the dollar.

The Fed's Beige Book – providing anecdotal evidence about the economy – is of interest on Wednesday, but investors could already be eyeing Thursday's Retail Sales report for December.

November's figures showed modest growth of 0.2% on the headline and 0.1% in the all-important Control Group. Those statistics probably failed to capture the Black Friday sales – as the shopping festivity came late in the month. The data for December already includes all the Christmas shopping figures. The control group – or "core of the core" – carries expectations for a more significant rise of 0.3%.

Friday is also a busy day, kicking off with Building Permits and Housing Starts – which have been healthy of late. More importantly, the University of Michigan's preliminary Consumer Sentiment Index is forecast to remain at elevated levels close to 100 points.

Overall, consumer prices, sales, and sentiment are the upcoming prominent data releases.

Here are the top US events as they appear on the forex calendar:

Japan: The home for geopolitical worries

The yen will likely continue attracting safe-haven flows. The clashes in the Middle East have replaced concerns about the global economy while North Korea remains in the background.

The rogue Asian nation promised a "Christmas present" to the US – something that never materialized. Nevertheless, worsening relations between Pyongyang and Washington may return to the spotlight.

In Japan, Machinery Orders figures for November are of interest, and they are expected to recover.

Here are the events lined up in Japan:

USD/JPY Technical Analysis

Dollar/yen's recovery has sent it above the 50, 100, and 200-day Simple Moving Averages. While upside momentum is weak, the general picture remains bullish.

Fierce resistance awaits at 109.75, which capped USD/JPY three times in the past two months. A break above this level opens the door to 110.65, a swing high from May, 111.05, which was the gap line that month, and 111.65, which was a resistance line beforehand.

Significant support awaits at 108.95, which is the confluence of resistance from October and the 50-day SMA. Next, 108.45 provided support in November. The 2020 low of 107.60 is the next level to watch. Further down, 107 is a round number that also cushioned USD/JPY in mid-September.

USD/JPY Sentiment

While the Mid-East crisis may have ended, concerns about US-Sino trade relations may renew flows to the yen. Moreover, without a jump in retail sales or inflation, the chances of another Fed rate cut remain significant and that could weigh on the dollar.

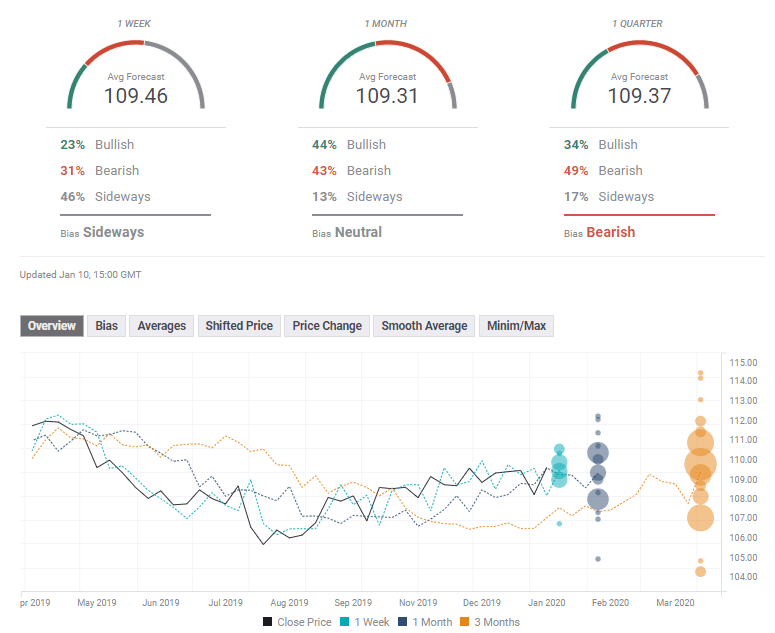

The FX Poll is showing that experts are divided on the next moves for USD/JPY. While on average they expect no significant movement, opinions diverge, with a 1,000 gap between the highest and lowest targets for three months. The targets have been marginally upgraded in the past week.

Related Forecasts

- USD/JPY Price Forecast 2020: A journey from trade fears to high-stakes elections

- GBP/USD Forecast: Which way out of the wedge? Fundamentals and technicals battle it out.

- EUR/USD Forecast: Dollar rules in a messy world

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637142494504722401.png&w=1536&q=95)