USD/JPY Forecast: Direction still depends on yields’ behaviour

USD/JPY Current price: 108.78

- US Treasury yields bounced ahead of the close, limiting USD/JPY slide.

- Global equities run on upbeat US data boosting hopes for a sooner economic recovery.

- USD/JPY is technically bearish, should accelerate its slide once below 108.60.

The USD/JPY pair fell for a second consecutive week, settling on Friday near the low set at 108.60. The pair posted a modest advance on Friday as US Treasury yields bounced from weekly lows but remained well below their recent multi-month highs. The yield on the 10-year Treasury note settled at 1.59%, after falling to 1.52% mid-week. Global indexes rallied, fueled by upbeat US data, limiting JPY gains.

Japan didn’t publish macroeconomic figures on Friday but will start the week releasing the March Merchandise Trade Balance Total, expected to post a surplus of ¥490 billion. The country will also publish February Industrial Production, foreseen at -2.6% YoY, and Capacity Utilization, expected at 3.2%.

USD/JPY short-term technical outlook

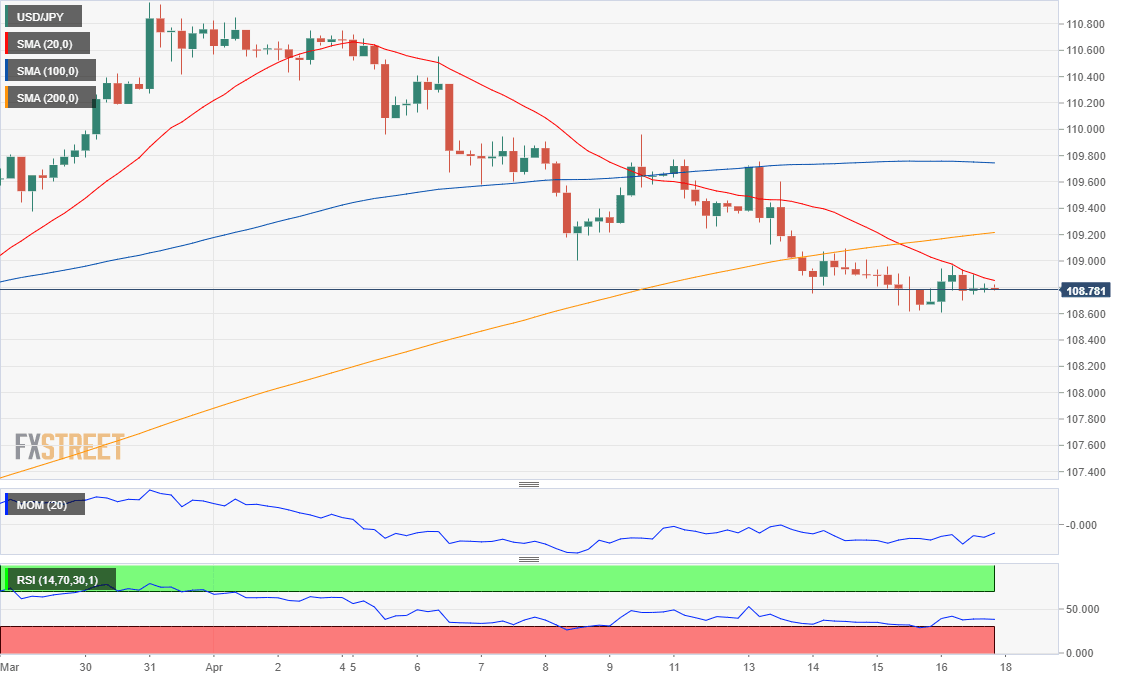

The USD/JPY pair is bearish, according to the daily chart, as the pair has extended its decline below a now flat 20 SMA, while the longer ones stand over 300 pips below the current level. Meanwhile, technical indicators maintain their bearish slopes within negative levels, having partially lost their downward strength. In the 4-hours chart, the risk is also skewed to the downside, as the 20 SMA acts as intraday resistance while heading south below the longer ones. Technical indicators are directionless within negative levels, with the RSI consolidating at around 37.

Support levels: 108.60 108.20 107.90

Resistance levels: 109.00 109.45 110.90

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.