USD/JPY Forecast: Bulls needing a reason to keep buying

USD/JPY Current price: 108.27

- The BOJ left its monetary policy unchanged, pledged to keep supporting the economy.

- US CB Consumer Confidence expected to have improved to 114.1 in April.

- USD/JPY could extend gains in the upcoming session, needs to break 108.50.

The USD/JPY pair extended its advance to 108.42 this Tuesday, as the greenback got some love across the board early London, although with limited gains and already changing course. The pair trades at around 108.25, retaining modest intraday gains.

Generally speaking, the market’s mood is sour, with European indexes trading in the red, and US government bond yields ticking higher. Major pairs hold within familiar levels, as investors remain focused on first-tier events scheduled for later in this week.

During the Asian session, the Bank of Japan had a monetary policy meeting, and as widely anticipated, policymakers left the current policy unchanged. Governor Haruhiko Kuroda said that they would ease monetary policy further without hesitation as needed, and warned that consumption will likely stall at low levels amid the state of emergency curbs.

The US will publish the April Richmond Fed Manufacturing Index and some housing-related data. It will also unveil CB Consumer Confidence, foreseen in April at 113.1 from 109.7 in the previous month.

USD/JPY short-term technical outlook

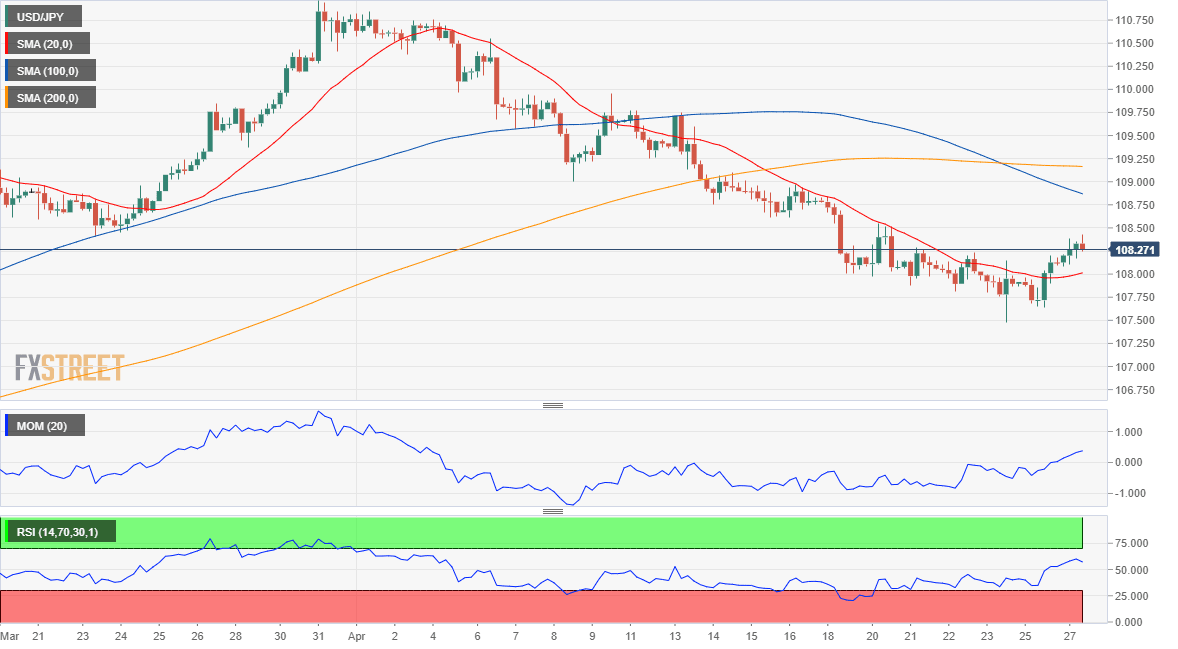

The near-term picture for the USD/JPY pair provides a neutral-to-bullish perspective. The pair is above a flat 20 SMA, although the 100 SMA accelerated its decline below the 200 SMA, both above the current level. Technical indicators have lost their bullish strength but hold near their daily highs well above their midlines. The pair needs to surpass the 108.50 resistance level to confirm a bullish continuation ahead.

Support levels: 108.00 107.65 107.20

Resistance levels: 108.50 108.90 109.30

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.