USD/JPY Forecast: Bears ready to jump in

USD/JPY Current price: 103.62

- US Treasury yields and equities advanced, providing support to USD/JPY.

- Japanese markets will remain open this Thursday, while the rest of Asia will be out.

- USD/JPY maintains a neutral stance just above the 103.15 support.

The USD/JPY pair is trading around 103.60, unchanged on a daily basis. The pair started the day on the back foot, falling within range, and recovered during US trading hours amid the renewed dollar’s demand. The positive tone of Wall Street and higher US Treasury yields provided support.

On Wednesday, the Bank of Japan published the Minutes of its latest meeting. The document showed that policymakers could consider tweaking its current bond-buying program to “enhance sustainability” in the longer-run. The country published the October Leading Economic Index, which improved to 94.3, while the Coincident Index contracted to 89.4. Japan will have its markets open this Thursday, and the country will publish the November Corporate Service Price Index.

USD/JPY short-term technical outlook

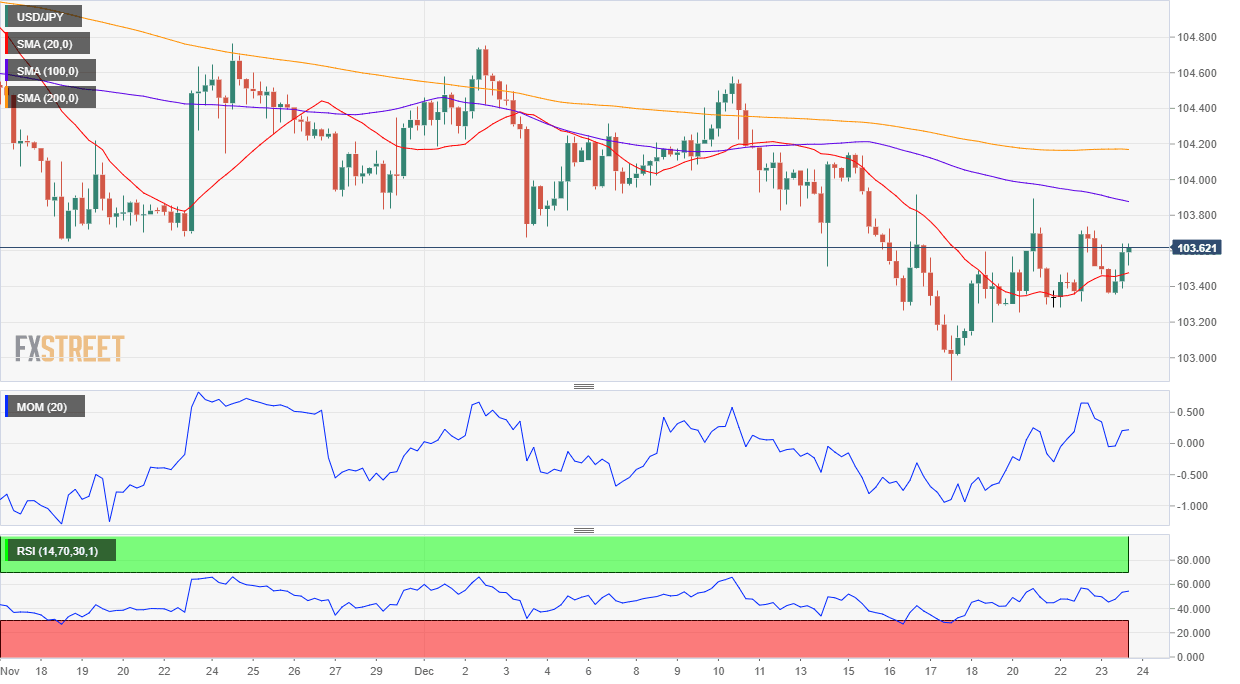

The USD/JPY pair is neutral-to-bearish according to intraday charts, but holding above the 103.15 support, a line in the sand, as below it, bears will likely increase their bets. In the 4-hour chart, the pair has been consolidating above a flat 20 SMA, while the longer ones maintain their bearish slopes. Technical indicators remain around their midlines without clear directional strength.

Support levels: 103.15 102.70 102.20

Resistance levels: 103.50 103.90 104.30

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.