USD/JPY Elliott Wave technical analysis [Video]

![USD/JPY Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDJPY/five-thousand-japanese-yen-notes-on-many-dollars-background-30615054_XtraLarge.jpg)

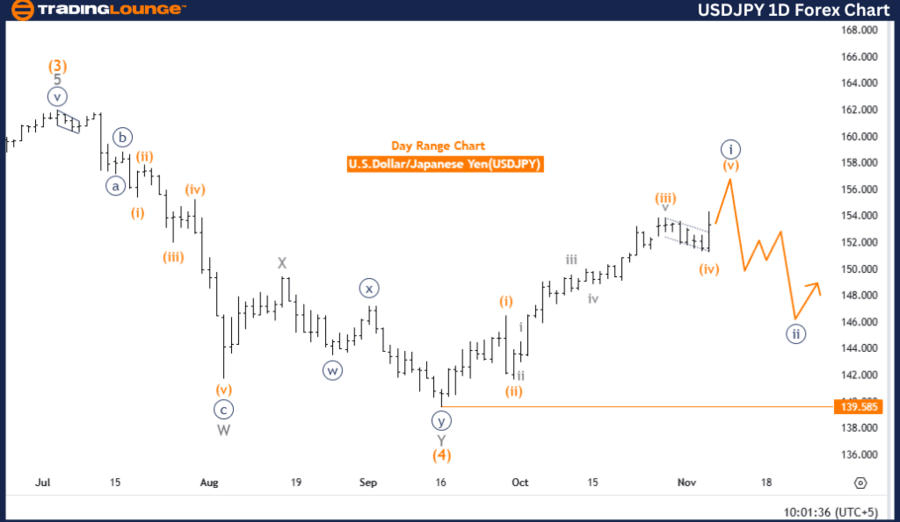

USDJPY (U.S. Dollar/Japanese Yen).

Chart focus: Elliott Wave technical analysis

-

Function: Trend.

-

Mode: Impulsive.

-

Wave structure: Navy Blue Wave 1.

-

Position: Within Gray Wave 1.

-

Direction for lower degree: Transition to Navy Blue Wave 2.

-

Details: Navy Blue Wave 1 within Gray Wave 1 continues its development, nearing potential completion.

Current USD/JPY Elliott Wave overview

The USDJPY day chart illustrates a robust upward trend in an impulsive mode, specifically through the movement of navy blue wave 1 within the larger gray wave 1 structure. Navy blue wave 1 is approaching the final stages of its progression, signaling that it may soon complete, leading to a potential shift towards navy blue wave 2, marking the onset of a corrective phase.

This possible transition to navy blue wave 2 indicates that upon the completion of navy blue wave 1, a pullback or retracement could emerge, representing an adjustment phase within the ongoing primary trend. The key invalidation level to monitor is 139.585; a break below this level would invalidate the current wave structure and could imply a shift in momentum, potentially affecting the bullish outlook.

Short-term outlook and key levels

In the immediate term, USDJPY is expected to continue its upward trend until navy blue wave 1 completes. As this wave nears its potential endpoint, short-term gains remain plausible, assuming the price does not breach the invalidation level. The primary focus remains on the impending completion of navy blue wave 1 within gray wave 1, with traders closely watching for any indicators of a shift into the corrective navy blue wave 2 phase.

Summary

In conclusion, USDJPY maintains its upward trajectory, driven by navy blue wave 1 within the broader gray wave 1 structure. The next crucial phase involves observing for a potential shift into navy blue wave 2, particularly as navy blue wave 1 approaches completion near the wave cancel invalidation level of 139.585.

USDJPY (U.S. Dollar/Japanese Yen).

Chart focus: Elliott Wave technical analysis

-

Function: Trend.

-

Mode: Impulsive.

-

Wave structure: Orange Wave 5.

-

Position: Within Navy Blue Wave 1.

-

Direction for lower degree: Transition to Navy Blue Wave 2.

-

Details: Orange Wave 4 has completed, and Orange Wave 5 is now underway.

Current USD/JPY Elliott Wave overview

The USDJPY 4-hour chart shows a strong upward trend in impulsive mode, focusing on orange wave 5 within the larger structure of navy blue wave 1. The recent completion of orange wave 4 marks the beginning of orange wave 5, which generally signifies continued bullish momentum with further upward movement expected as it progresses.

In the broader structure, navy blue wave 1 is leading towards an eventual navy blue wave 2. This progression suggests that, after orange wave 5 completes, a corrective phase may begin. Until this transition to navy blue wave 2 occurs, the trend remains bullish, supported by the impulsive nature of orange wave 5.

Key levels and immediate trend focus

A critical level to watch is the wave cancel invalid level at 151.298. Any break below this threshold would invalidate the current wave structure, indicating a possible shift in momentum away from the bullish trend. As long as the price remains above this level, the bullish structure is likely to persist, with orange wave 5 anticipated to drive further gains.

Summary

In summary, USDJPY is in a bullish trend on the 4-hour chart, with orange wave 5 pushing the momentum within navy blue wave 1. Provided the price remains above the invalidation level of 151.298, the pair is expected to continue its upward movement in the short term. The primary focus is on the completion of orange wave 5, after which a shift into the corrective navy blue wave 2 phase may be anticipated.

Technical analyst: Malik Awais.

Current USD/JPY Elliott Wave overview [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.