USD/JPY

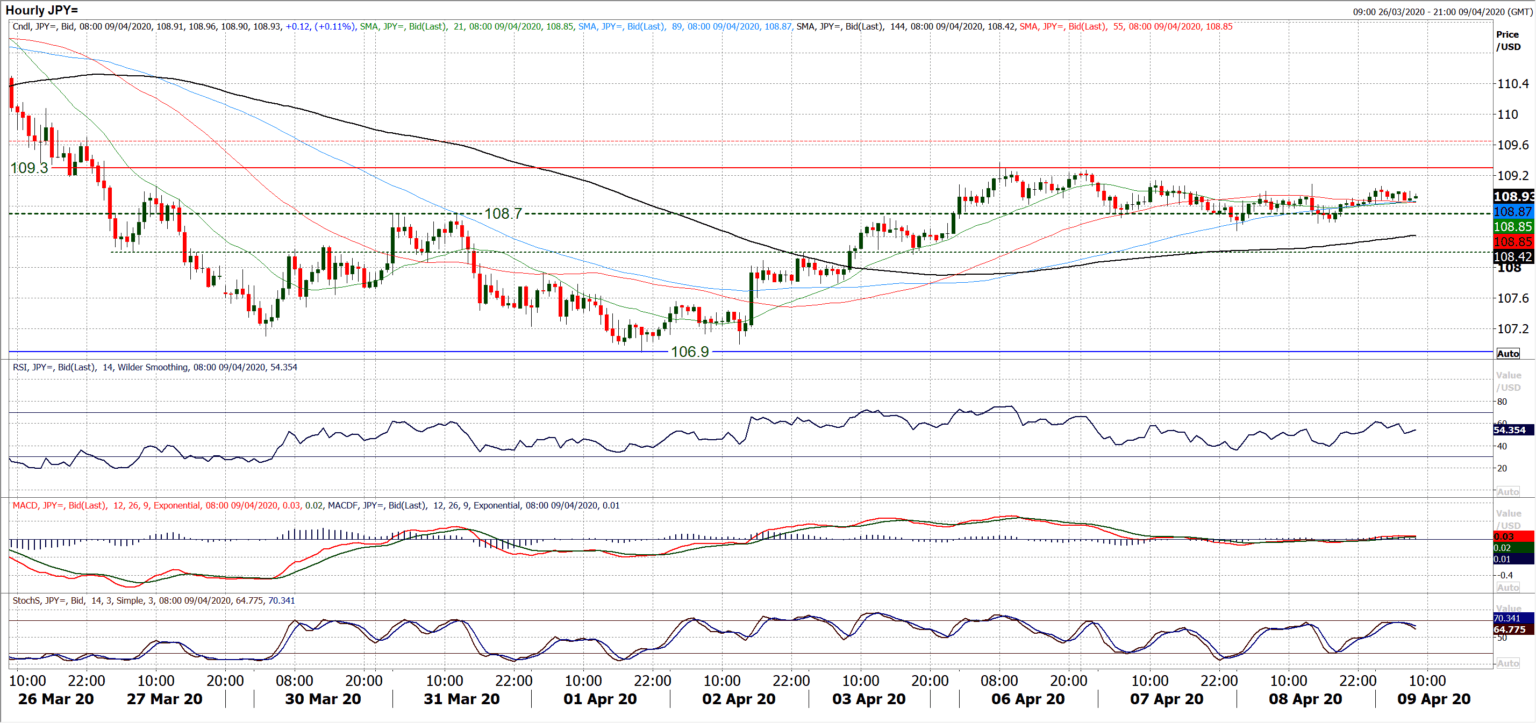

Having seen the rebound tail off in the past couple of sessions, yesterday’s small-bodied, tight ranged candle has done little to shake the market out of a growing consolidation. There are some risk events on the immediate horizon today (OPEC+ and the Eurogroup meeting) but this could also be a case of embattled traders limping towards the Easter break. This comes as momentum indicators have settled close to their respective neutral points, and moving averages have been converging to flatten off (there are just 35 pips separating all four moving averages we cover). The hourly chart reflects this consolidation too, with the market gravitating around 108.70 over recent days, whilst hourly RSI has stabilised between 35/65. The rally has faltered around 109.30 which is old overhead supply but the support forming around 108.70 (the previous breakout) suggests a lack of conviction either way for now. We are subsequently neutral on Dollar/Yen. Above 109.30 would improve again, but there is considerable overhead resistance around 109.60/109.70 to restrict the bulls. A move below 108.15 (an old pivot) would begin to leave a negative bias and increase downside pressure once more.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0400 as trading conditions thin out

EUR/USD trades with mild losses near 1.0400 on Tuesday. The expectation that the US Federal Reserve will deliver fewer rate cuts in 2025 provides some support for the US Dollar. Trading volumes are likely to remain low heading into the Christmas break.

GBP/USD consolidates below 1.2550 on stronger US Dollar

GBP/USD consolidates in a range below 1.2550 on Tuesday, within striking distance of its lowest level since May touched last week. The sustained US Dollar rebound and the technical setup suggest that the pair remains exposed to downside risks.

Gold holds above $2,600, bulls non-committed on hawkish Fed outlook

Gold trades in a narrow channel above $2,600 on Tuesday, albeit lacking strong follow-through buying. Geopolitical tensions and trade war fears lend support to the safe-haven XAU/USD, while the Fed’s hawkish shift acts as a tailwind for the USD and caps the precious metal.

IRS says crypto staking should be taxed in response to lawsuit

In a filing on Monday, the US International Revenue Service stated that the rewards gotten from staking cryptocurrencies should be taxed, responding to a lawsuit from couple Joshua and Jessica Jarrett.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.