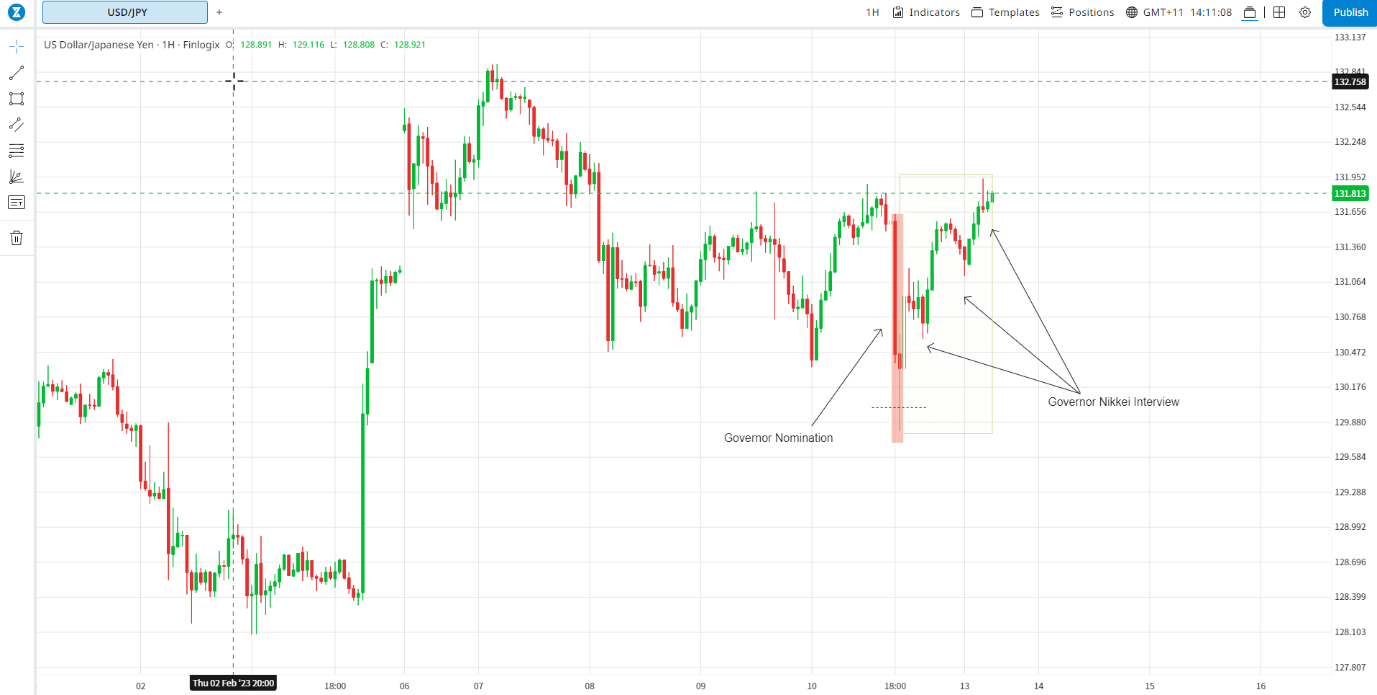

USD/JPY and the new governor to be announced

BoJ Governor nomination triggers a more volatile JPY

USD/JPY: BoJ Governor nomination drags USD/JPY back down to 130.00-level.

It had been a relatively stable end to the week (last week) for the major foreign exchange rates until the BoJ Governor nomination was announced.

It has resulted in USD/JPY falling back towards the 130.00-level. For the last week as a hole, the dollar has consolidating at higher levels following the release of the blowout NFP report on Friday 3th of Feb.

The dollar index has traded within a narrow range between 102.641 and 103.964 as it remains above the year to date low from the previous week of 100.82.

The main highlight from last week for the US dollar has been comments from fed speakers including Fed Chair Powell that continued to strike a hawkish tone by signalling that further rate hikes are needed to combat upside inflation risks.

However, the updated comments have not been even more hawkish as feared in response to the blow out NFP report with Fed Cahir Powell and New York Fed President Williams both signalling that they remain comfortable with plans for two more 25bps rate hikes.

A view that is now fully priced into the US rate market which has limited further upside for US rates and the US dollar.

The upward move for US short rates since the end of last week has not been fully matched by rates at the long end of the curve resulting in the US rate curve becoming even more inverted which continues to create concern over the risk of recession.

As Bloomberg highlighted on 09/02/2023, the yield spread between the 2-year and 10-year UST bonds widened further at one point last Friday to a fresh high of 86bps which was the widest margin since the early 1980’s.

US rate market participants are now awaiting the release of the latest US CPI report this week on Tuesday for a fresh catalyst.(already covered by me on the last research) US economists are expecting a stronger CPI report that should continue to provide more support for the US dollar in the near-term.

The stronger US dollar has helped to keep USD/JPY trading above the 130.00-level this week for the longest period since early January.

Fluctuations in the yen have been driven by intensifying speculation over who the Japanese government is likely to choose to be the next BoJ Governor.

It has just been reported by the Nikkei that the Japanese government has chosen to nominate Kazuo Ueda, a professor and former BoJ board member to be the next Governor.

He was a BoJ Board member back between 1998 and 2005.

According to reports, he was offered the post after the government’s first choice of the current Deputy Governor Masayoshi Amamiya refused to take the post.

The choice of Kazuo Ueda as the next Governor has taken market participants by surprise as he was not considered as one of the leading candidates.

The knee jerk reaction has been for the yen to strengthen moving USD/JPY back closer to the 130.00-level reflecting a combination of uncertainty over Kazuo Ueda’s monetary policy views and that the continuity candidate Masayoshi Amamiya chose not to take the job.

However, if the government’s first choice was to nominate Masayoshi Amamiya it would suggest that Kazuo Ueda does not hold widely different views on monetary policy as their second-choice candidate.

At the same time, it has been reported that the government has nominated Shinichi Uchida and Ryozo Himino as BoJ Deputy Governors.

Shinichi Uchida has worked closely with Amamiya and Kuroda in managing monetary policy over the past decade and will be a similar minded replacement for current Deputy Governor Amamiya.

Overall, I still believe the direction of travel is towards a further normalization of policy and are expecting YCC to come to an end this year.

The new Governor nomination does not appear to have increased the risk of an even faster pace of normalization in our view although market participants are understandably wary given the heightened uncertainty over Ueda’s views on policy. In my view, recent and upcoming inflation, and wage data, as well as bond market developments are key for the BoJ’s policy outlook, regardless of who the governor is. No one can be persistently dovish or hawkish – views will change when the facts change.

Author

ACY Securities Team

ACY Securities

ACY Securities is one of Australia's fastest growing multi-asset online trading providers, offering ultra-low-cost trading, rock-solid execution, technologically superior account management and premium market analysis. The key pi