USD/JPY Analysis: Short-term neutral, bulls in the driver’s seat

USD/JPY Current Price: 108.60

- The Japanese adjusted trade deficit resulted in ¥-97.2B in September.

- US Treasury yields posted a modest intraday advance, so did equities.

- USD/JPY retaining its short-term bullish stance, critical resistance at 109.31.

The USD/JPY pair settled around 108.60, recovering after a soft start to the day. The Japanese yen enjoyed some temporal demand at the beginning of the day, with the pair falling to 105.28, as concerns about Brexit developments favored the safe-haven currency. The dismal mood was short-lived but didn’t turn into a positive one. By the end of the day, equities closed with modest daily gains, while government bond yields ticked marginally higher, backing the pair’s recovery.

Japan published this Monday the September Merchandise Trade Balance, which posted a smaller-than-anticipated adjusted deficit of ¥-97.2B. In the same month, Imports declined by 1.5%, while exports slid 5.2%. It’s a bank holiday in Japan this Tuesday, which means no macroeconomic announcement will be made.

USD/JPY short-term technical outlook

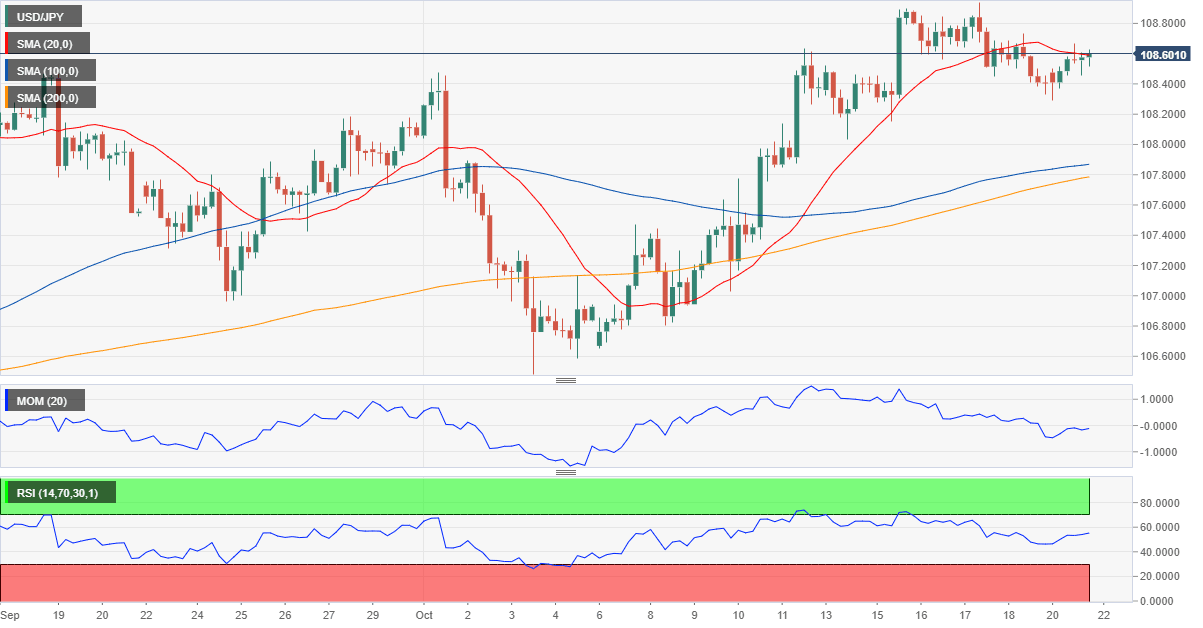

The USD/JPY pair has bounced from around the 23.6% retracement of its latest daily advance, which indicates that bulls retain control of the pair. In the short-term, however, the 4-hour chart shows that it remained capped by a directionless 20 SMA, while technical indicators remain flat around their midlines, reflecting the ongoing wait-and-see stance. The bullish case remains alive, with buyers targeting 109.31, August monthly high.

Support levels: 108.25 108.00 107.75

Resistance levels: 108.65 109.00 109.35

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.