USD: How effective will the Fed's measures be for the dollar's prospects?

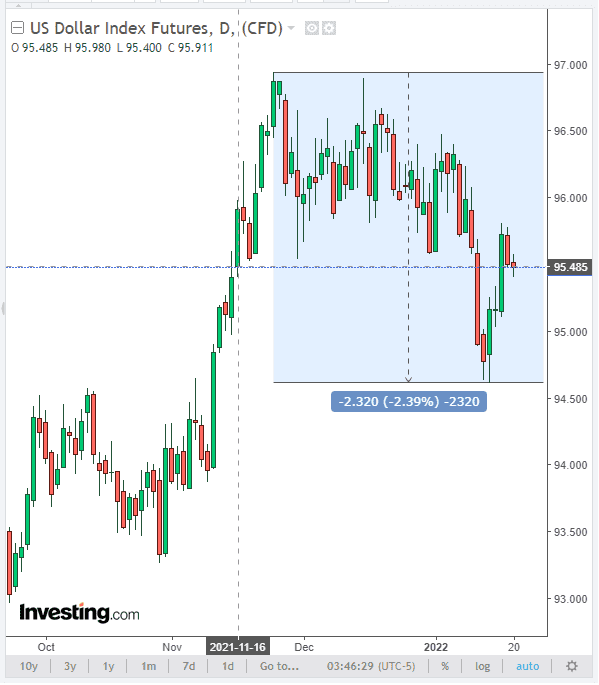

US government bond yields have stalled. At the time of publication of this article, the yield on 10-year US bonds was 1.849%, down from a local 2-year high of 1.897% reached on Wednesday. Along with the decline in government bond yields, the dollar is also declining. Thus, the DXY dollar index, which reflects the value of the dollar against a basket of 6 major currencies, was at the time of publication of this article near the 95.49 mark, remaining in the area below the recent range between the levels of 96.94 and 95.54.

Investors are evaluating the prospects for the dollar (in line with the upcoming Fed rate hikes) and the threat of accelerating inflation in the US. Earlier this month, the US Department of Labor Statistics reported that consumer prices rose 7.0% (on an annualized basis) in December after rising 6.8% in November. This corresponds to highs almost 40 years ago. Core inflation (excluding food products and energy) rose in December by 5.5% (in annual terms). Thus, inflation has been exceeding the Fed's target of 2% for several months in a row, and its growth at such a pace is forcing investors to fix long positions on the dollar: they fear that the Fed may be late with measures to tighten monetary policy. Market participants have already priced in 3 Fed rate hikes this year, and it appears that some of them believe that this will not be enough to curb skyrocketing inflation in the US.

On the other hand, if the Fed starts raising interest rates at an accelerated pace, then the higher cost of financing could negatively affect demand and economic growth, while inflation remains high for some time. So quickly curb it, most likely, will not work. In response to such a scenario, the dollar may be inclined to weaken. Recall that the next meeting of the Committee on operations on the open market of the US Federal Reserve should be held on January 25-26.

Author

Yuri Papshev

Independent Analyst

Independent trader and analyst at Forex market. Trade experience - more than 10 years. In trade Yuri Papshev uses a combination of fundamental and technical analysis.