USD gains ease following a three-day winning streak

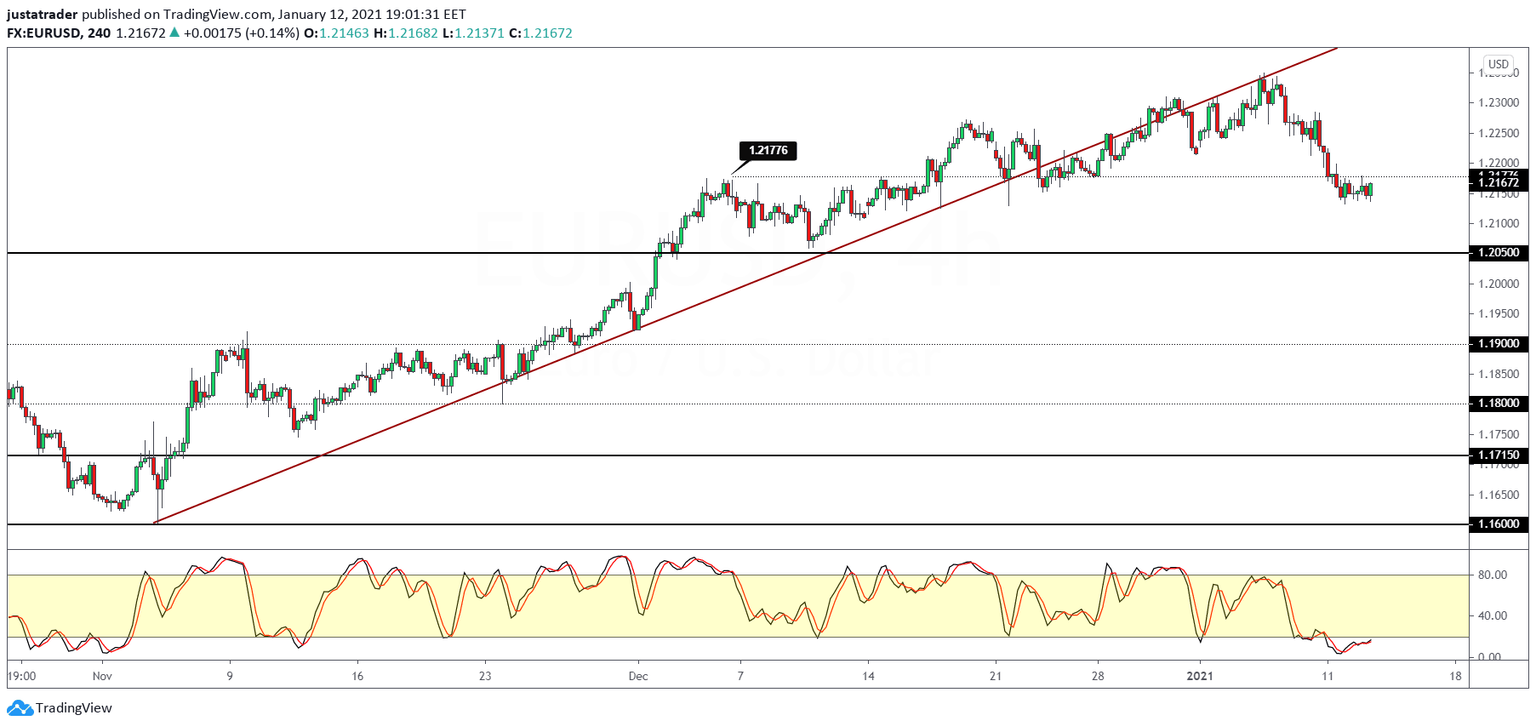

EUR/USD Consolidates Below 1.218

The euro currency is catching a bid following the dollar weakness on Tuesday.

The dollar’s gain came to a halt after three consecutive days of gains. This has pushed the euro to test the 21 December lows of 1.2133.

Price action has been broadly flat after pulling back off the lows intraday. However, the euro will need to break out strongly above the 1.2180 level.

Only a strong close above this level will see further gains coming up. To the downside, a continuation could see the 1.2050 level of support coming under the test of support next.

Sterling Snaps Back Higher On BoE Official Comments

The British pound sterling is posting strong gains on Tuesday. This comes following comments from a BoE official who was speaking out against negative rates.

The gains saw the GBPUSD breaking past the 1.3500 level. This invalidates the descending triangle pattern. Prices continue to rise past the trend line as well.

This has pushed the GBPUSD to test a two day high following the recent declines over the last week.

Despite the short term gains, the bias still remains to the downside. But this could change if the GBPUSD can rise above the January 4 highs of 1.3700.

WTI Crude Oil Inches Higher

Oil prices continue to post modest gains with price action managing to rise above the trend line. As a result, WTI crude oil prices are now close to the next round number level of 53.00.

On the intraday charts, we see the bearish divergence on the Stochastics which is suggesting a lower high.

Therefore, there is a risk of prices posting a correction in the near term unless oil prices can continue higher.

To the downside, the recent swing lows near 51.53 remain the key level to watch.

A break down below this level could potentially set the stage for a correction down to the 49.00 handle.

Gold Prices Set To Close Flat Yet Again

The precious metal is likely to close flat once again, marking a flat print for the second consecutive day.

Although prices rose higher intraday, the gains quickly disappeared. There is a possibility of prices forming a bearish flag pattern currently.

Therefore, if gold prices break down below the 1817.80 level of support, this view will be validated.

The bearish flat pattern potentially signals a stronger correction to the downside. This could push prices down to the November 30th lows near 1770.00.

Author

Orbex Team

Orbex