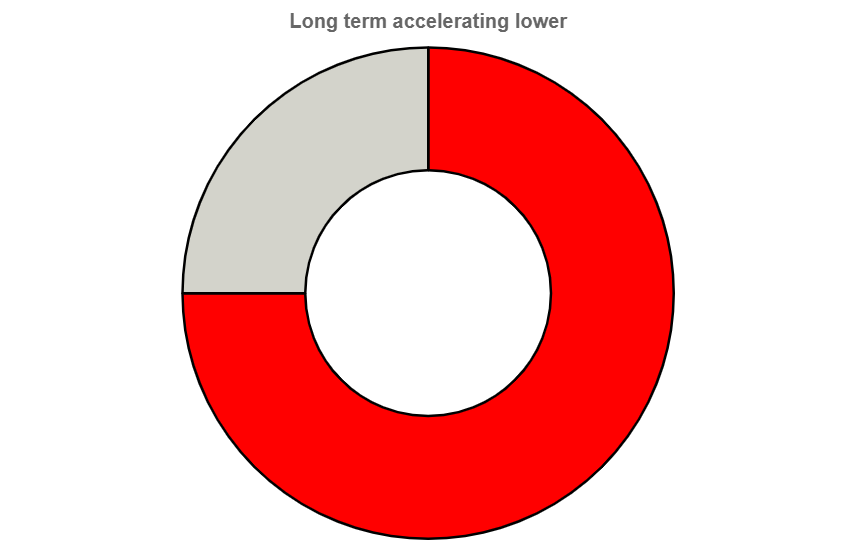

Strongest trend lower

Using the VolatilityMarkets software to structure a USDCHF trend following trade idea.

Part 1) Introduction

VolatilityMarkets suggests trend-inspired trades that capitalize on market trends.

In the short term USDCHF has been accelerating lower. In the long term USDCHF has been accelerating lower. With the long term trend being the stronger of the two, we propose a short trade idea with a time horizon.

Part 2) Trade idea details

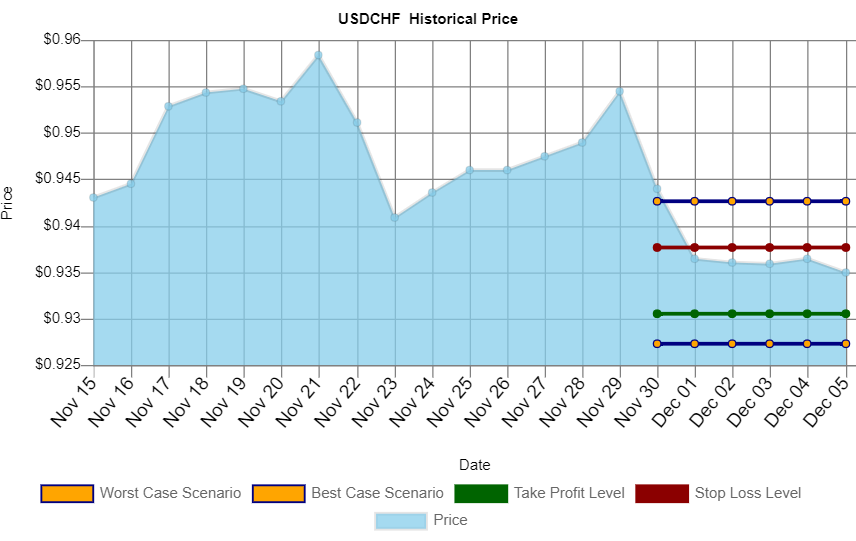

2A) Trade idea graph

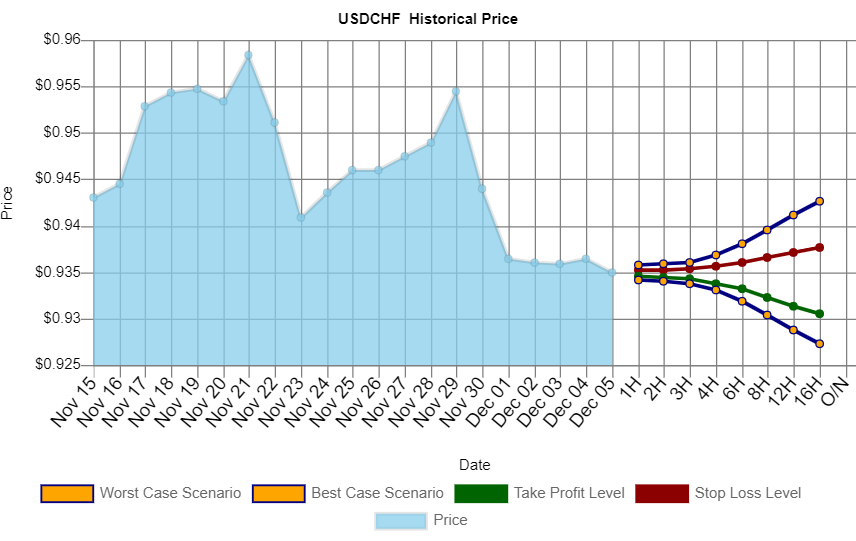

2b) Intraday predictions

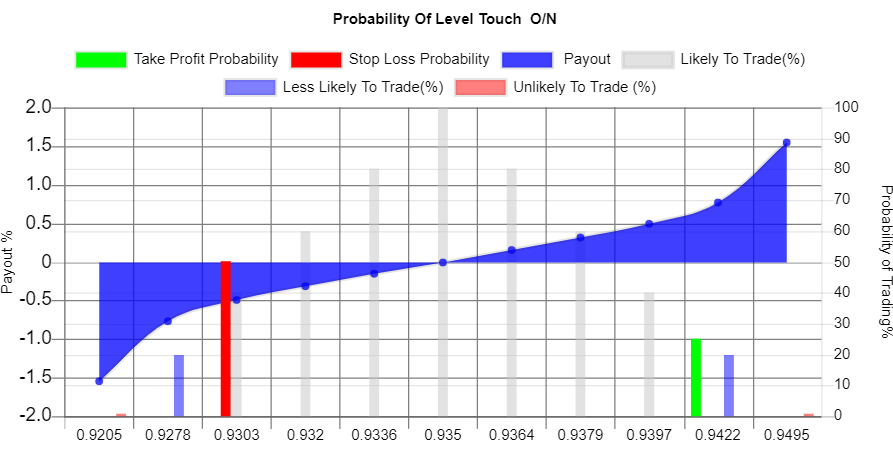

Sell $ 354,129 USD or 3.54 lots of USDCHF, take profit at $ 0.9305 level with 25.0% odds for a $ 1,709 USD gain, stop out at $ 0.9376 with 50.03% odds for a $ 1,000 USD loss through O/N time horizon

Part 3) USD/CHF trend analysis

USDCHF last price was $ 0.934974. The long term trend accelerating lower is stronger than the short term trend accelerating lower. This trade goes short when the price was moving lower and accelerating over the past 20 days.

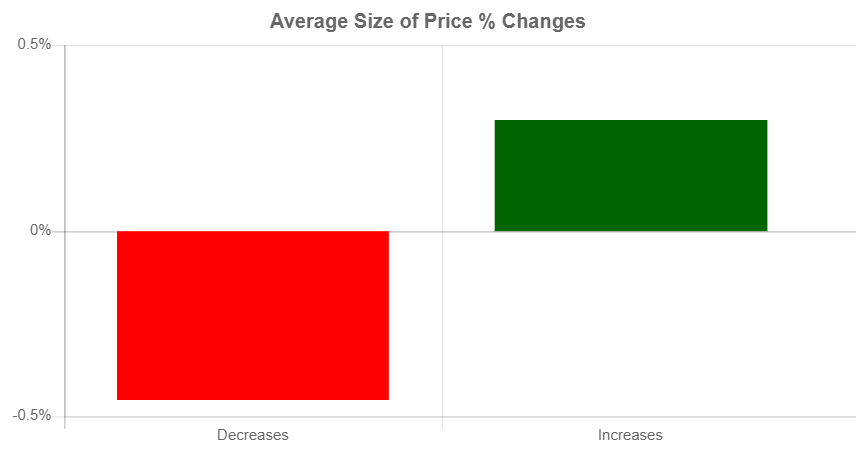

Part 4) USD/CHF value analysis

Over the past 20 days, the USDCHF price increased 11 days and decreased 9 days. For every up day, there were 0.82 down days. The average return on days where the price increased is 0.2969% The average return on days where the price decreased is -0.4554% Over the past 20 Days, the price has decreased by -0.86% percent. Over the past 20 days, the average return per day has been -0.043% percent.

Part 5) USD/CHF worst/best case scenario analysis

Within 1 week, our worst case scenario where we are 95% certain that this level won't trade for USDCHF, is $ 0.92727 , and the best case scenario overnight is $ 0.942678 . levels outside of this range are unlikely, but still possible, to trade. We are 50% confident that $ 0.9376 could trade and that $ 0.9305 could trade. These levels are within statistical probability.

Key takeaways

-

Price today $ 0.934974.

-

Over the past 20 days, the USDCHF price increased 11 days and decreased 9 Days.

-

For every up day, there were 0.82 down days.

-

The average return on days where the price increased is 0.2969%

-

The average return on days where the price decreased is -0.4554%.

-

Over the past 20 Days, the price has decreased by -0.86% percent.

-

Over the past 20 days, the average return per day has been -0.043% percent.

-

Over the past 20 days, The price has on average been accelerating: 0.0647 pips per day lower.

-

Over the last session, the price decreased by -15.41 pips.

-

Over the last session, the price decreased by -0.1648 %.

-

Over the last session, the price accelerated by 9.61 pips.

Volatility Markets provides trend following trade ideas for momentum traders. The Volatility Markets Newswire measures the direction and acceleration of a security and then structures a trade idea to capitalize on the trend. While trends have been shown to exist in markets over the past 100 years, they are no guarantee of future asset prices. You should take these ideas lightly and at your own risk.

Recommended Content

Editors’ Picks

EUR/USD eases to daily lows near 1.0260

Better-than-expected results from the US docket on Friday lend wings to the US Dollar and spark a corrective decline in EUR/USD to the area of daily lows near 1.0260.

GBP/USD remains under pressure on strong Dollar, data

GBP/USD remains on track to close another week of losses on Friday, hovering around the 1.2190 zone against the backdrop of the bullish bias in the Greenback and poor results from the UK calendar.

Gold recedes from tops, retests $2,700

The daily improvement in the Greenback motivates Gold prices to give away part of the weekly strong advance and slip back to the vicinity of the $2,700 region per troy ounce at the end of the week.

Five keys to trading Trump 2.0 with Gold, Stocks and the US Dollar Premium

Donald Trump returns to the White House, which impacts the trading environment. An immediate impact on market reaction functions, tariff talk and regulation will be seen. Tax cuts and the fate of the Federal Reserve will be in the background.

Hedara bulls aim for all-time highs

Hedara’s price extends its gains, trading at $0.384 on Friday after rallying more than 38% this week. Hedara announces partnership with Vaultik and World Gemological Institute to tokenize $3 billion in diamonds and gemstones

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.