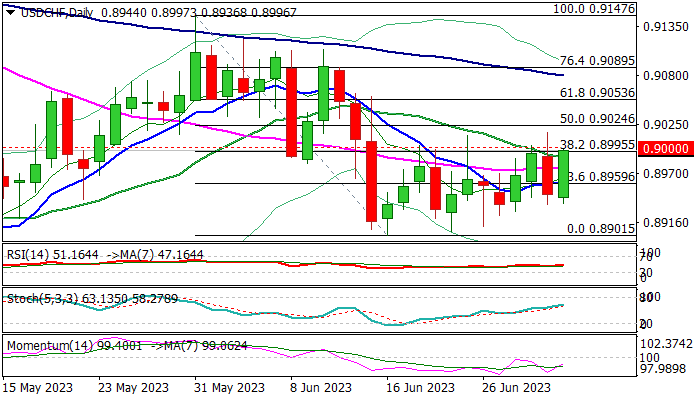

USD/CHF

USDCHF jumped in European trading on Monday, as inflation in Switzerland fell significantly in June, increasing pressure on franc.

Swiss CPI dropped to 1.7% from 2.2% in May and below 1.8% forecast, returning to the SNB’s 0%-2% target zone for the first time since January 2022.

Lower inflation made the Swiss franc less attractive, although markets still expect the central bank to raise interest rates at least one more time, despite favorable June CPI numbers.

Fresh post-data advance is pressuring pivotal 0.90 resistance zone (psychological / Fibo 38.2% of 0.9147/0.8901) which also marks the ceiling of the range of past three weeks, break of which would generate strong bullish signal on completion of a higher base at 0.8900 zone (June 16-22).

Technical studies on daily chart are improving, but 14-d momentum is still in negative territory, suggesting that the downside will remain vulnerable if 0.90 zone resists another attack.

Rising 10DMA (0.8961) offers solid support, which should keep the downside protected to maintain fresh bullish bias.

Res: 0.9016; 0.9053; 0.9080; 0.9110.

Sup: 0.8961; 0.8936; 0.8923; 0.8901.

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD drops toward 1.0850 as USD finds fresh buyers

EUR/USD inches lower to near 1.0850 in the European session on Monday. A renewed US Dollar uptick amid a slightly negative shift in risk sentiment and Trump trade optimism weigh on the pair. All eyes remain on the Fedspeak, in the absence of top-tier data releases.

GBP/USD falls below 1.3050 on resurgent US Dollar demand

GBP/USD falls back below 1.3050 in European trading on Monday, undermined by a modest USD strength. The fundamental backdrop supports prospects for a further depreciating mov, as markets remain risk-averse ahead of the upcoming Fedspeak.

Gold price sticks to gains near all-time peak, renewed USD buying caps gains

Gold price scales higher for the fifth straight day – also marking the seventh day of a positive move in the previous eight – and touches a fresh record high, around the $2,732-2,733 region on the first day of a new week.

Could BTC reach its all-time high of $73,777?

Bitcoin is approaching the resistance level of around $70,000. A firm close above this mark could trigger a rally to retest its all-time high. Ethereum is nearing its descending trendline, with a break and close above signaling a potential rally.

If at first you don’t succeed, keep trying, so the story goes in China

Asian stocks saw a solid lift today, riding the coattails of Wall Street’s rally, but a welcome spark came from China’s big banks slashing their benchmark lending rates. This move injected a fresh wave of optimism into markets, fueling the hope that China’s recent stimulus efforts might finally be gaining economic traction.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.