USD/CHF calling the rally after Elliott Wave double three pattern

In this technical article we’re going to take a look at the Elliott Wave charts charts of USDCHF Forex pair published in members area of the website. Our members know USDHCF recently made a clear three-wave correction. The pull back completed as Elliott Wave Double Three pattern and made rally toward new highs as expected. In this discussion, we’ll break down the Elliott Wave pattern and forecast.

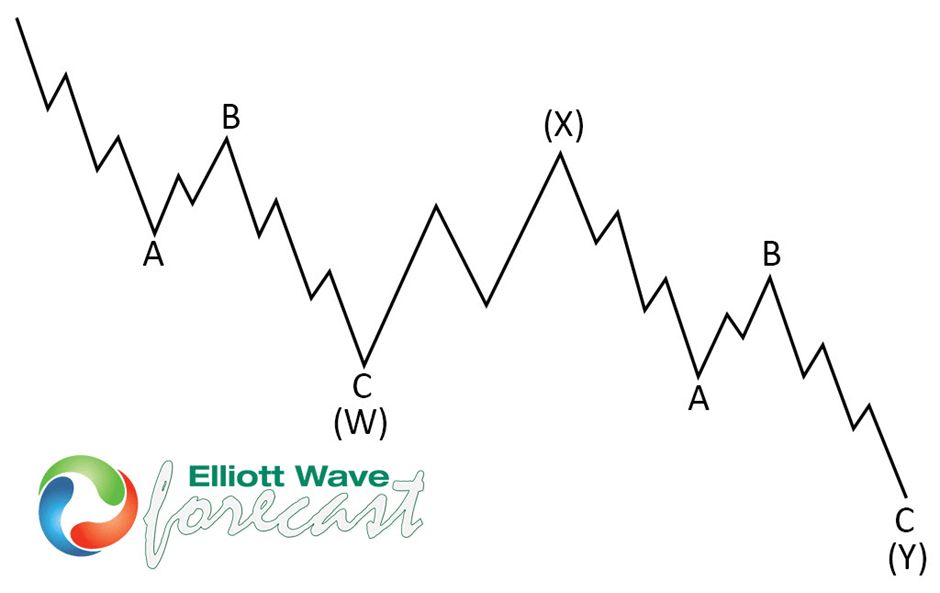

Elliott Wave double three pattern

Double three is the common pattern in the market , also known as 7 swing structure. It’s a reliable pattern which is giving us good trading entries with clearly defined invalidation levels.

The picture below presents what Elliott Wave Double Three pattern looks like. It has (W),(X),(Y) labeling and 3,3,3 inner structure, which means all of these 3 legs are corrective sequences. Each (W) and (Y) are made of 3 swings , they’re having A,B,C structure in lower degree, or alternatively they can have W,X,Y labeling.

USD/CHF Elliott Wave one hour chart 11.20.2024

USDCHF is showing higher high sequences in the cycle from the September 6th low , suggesting further strength ahead. The structure of this pullback shows clear 7 swings – Double Three Pattern. The first leg, shows a clear 3-wave structure a,b,c red, followed by a 3-wave bounce in (x) blue. We can also count 3 swings in (y) blue leg. We advise against selling $USDCHF and instead favor the long side. While the price stays above ((iv)) black low, we expect to see further rally toward new highs.

USD/CHF Elliott Wave one hour chart 11.24.2024

USDCHF found buyers as expected. The forex pair has reacted strongly and eventually we got a break toward new highs. Now, intraday pull backs should ideally keep finding buyers as far as 0.8783 pivot holds.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com