USD/CAD Weekly Forecast: What ails the USD/CAD?

- USD/CAD loses 4% in the three weeks since BOC bond cut on April 21.

- WTI little changed on the week but up 4.96% since April 21.

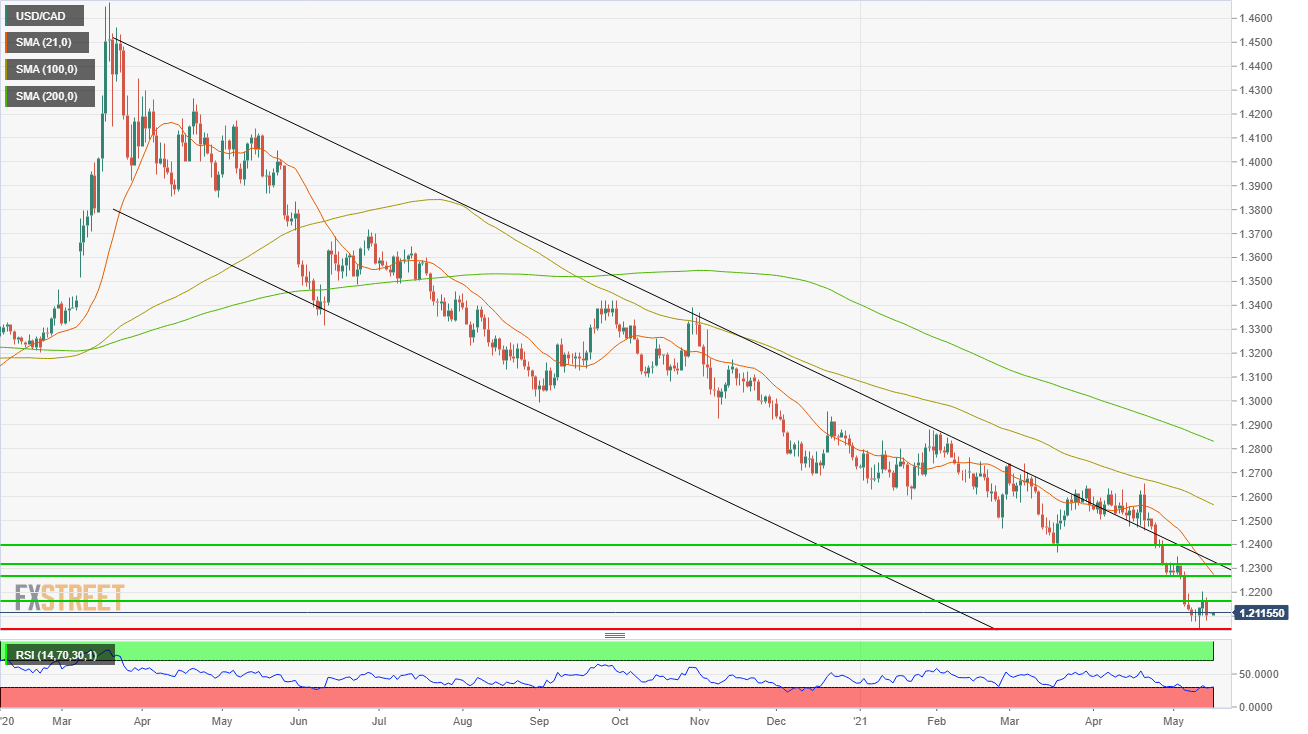

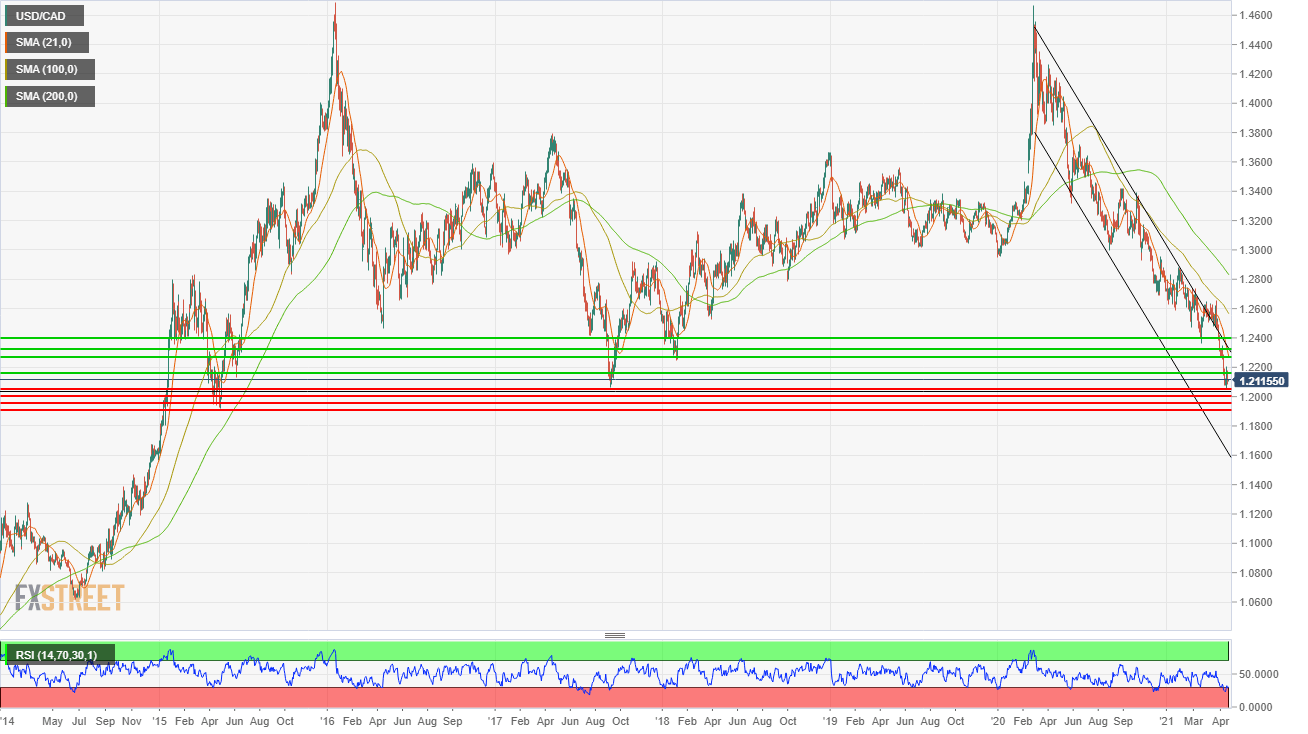

- USD/CAD has lowest close and trade since May 2015 this week.

- FXStreet Forecast Poll is optimistic for the USD/CAD in the medium term.

The USD/CAD fell to 1.2046 on Wednesday, its lowest trade in six years as the loonie remains the sole major currency that has moved higher throughout the pandemic. Its end for the week at 1.2105 was just points from Monday’s close at 1.2101, which was the best finish for the Canadian dollar since May 15, 2015.

On April 21 the Bank of Canada (BOC) reduced its quantitative easing purchases of government debt by 25% from C$4 billion a week to C$3 billion and since then the USD/CAD has fallen 4%.

Several factors have favored the Canadian dollar this year.

Commodity prices have risen 17.8% and that has been an asset for Ottawa's largely resource-based economy. Canada is a major exporter of crude oil, particularly to the United States, and West Texas Intermediate (WTI) prices are up 35.6% from their December 31 close.

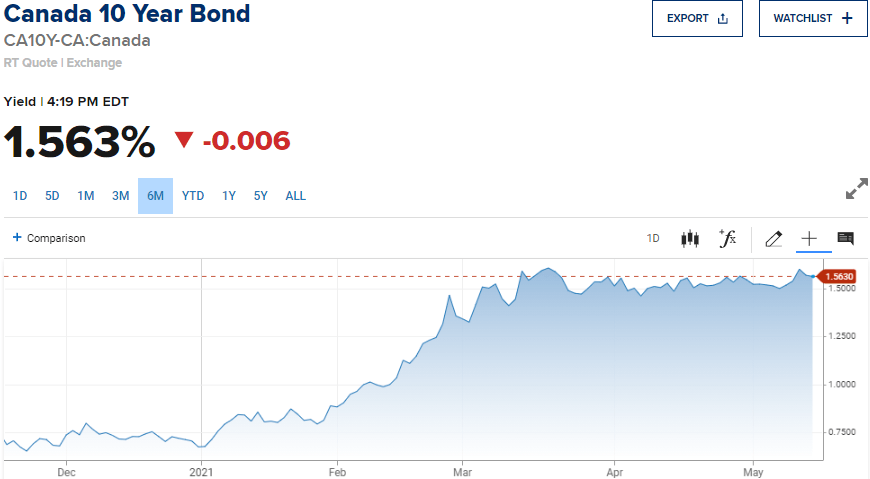

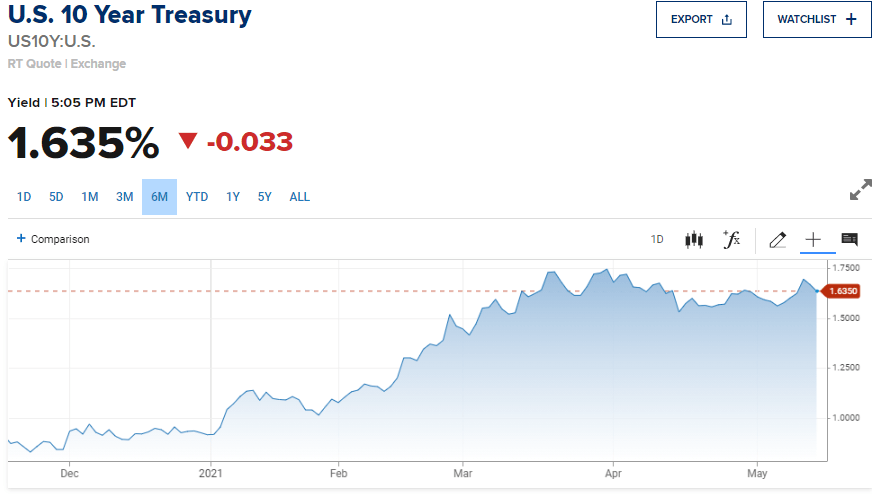

Yield increases on Canadian government debt have outpaced US Treasury gains this year. The Canadian 10-year bond has added 89 basis points to 1.563%, while the US 10-year Treasury has risen 72 basis points to 1.635%. The spread has moved slightly in the favor of the northern currency.

CNBC

The Canadian dollar is in the unique position among the major trading pairs in that it can directly benefit when the economy of its currency colleague, the United States, improves.

Even though Canada's vaccination rate and the reopening of its economy has trailed the US by a wide margin, it can profit from the US success.

American economic expansion surged 6.4% in the first quarter and is running at 10.5% in the second, according to the Atlanta Fed GDPNow model. Because the two economies are so closely tied, a good portion of that US growth reaches across the border to Canadian resource producers and manufacturing enterprises.

The vast Federal Reserve quantitative easing program of $120 billion a month also benefits the Canadian economy and the loonie through the relative simplicity of cross-border financing and its support for US activity.

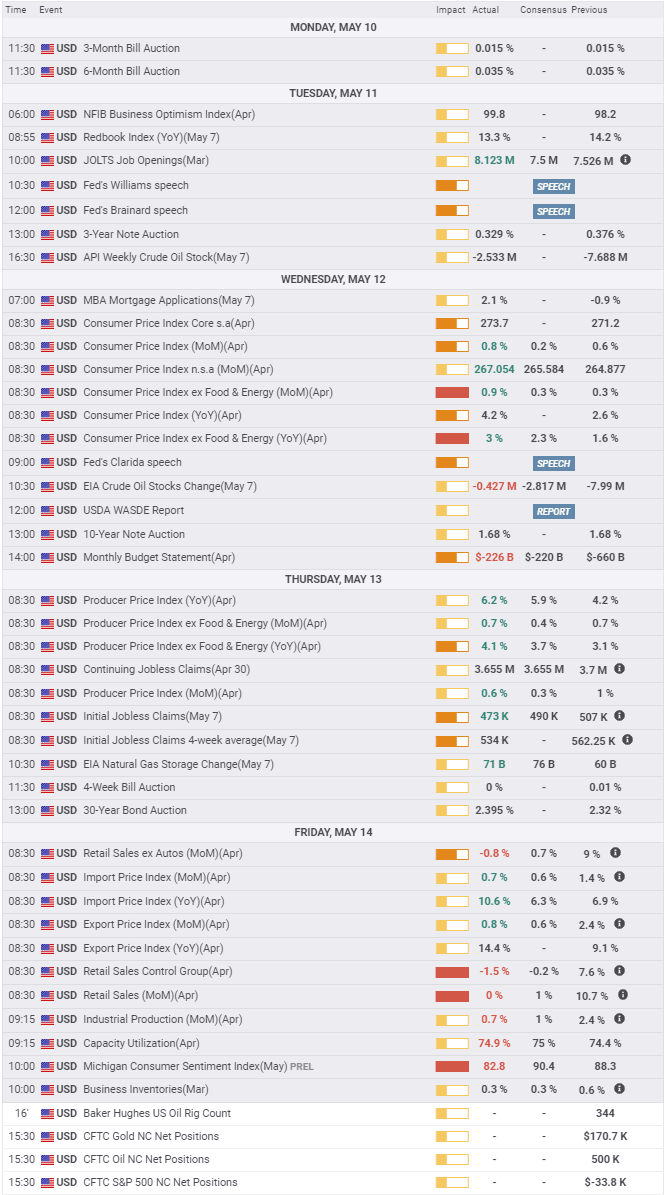

Statistics in the US both supported and sowed doubts about the Fed's easy money policy.

Consumer inflation has tripled in four months from 1.4% in January to 4.2% in April, and its impact is being felt across a wide range of goods.

Wages are rising as employers try to entice workers back to their jobs. Markets had anticipated a sharp increase in annual inflation as the base effects of last year’s lockdowns work through the data, but April's rate was 0.6% above the consensus forecast.

With commodity prices soaring and raw material and component shortages spreading, markets were suspicious that more than just statistical variation was at work. That suspicion has been confirmed.

Treasury rates rose sharply after the CPI release. The benchmark 10-year yield bolted 7 basis points from 1.625% to 1.695%, the 5-year and the 30-year added 6 points each to 0.864% and 2.415%, respectively.

Only the 2-year, pinned by the Federal Reserve’s bond purchases concentrated in the short end of the yield curve, moved less than a point from 0.163% to 0.167%.

Treasury rates gave back some of their gains by Friday, closing at 1.635%.

American Retail Sales for April on Friday were disappointing, coming in flat on expectations for a 1% increase, though March regained almost the difference as it was revised up to 10.7% from 9.8%. The Control Group slipped 1.5% in April. The forecast was for a 0.2% loss. March’s result was revised substantially higher to 7.6% from 6.9%.

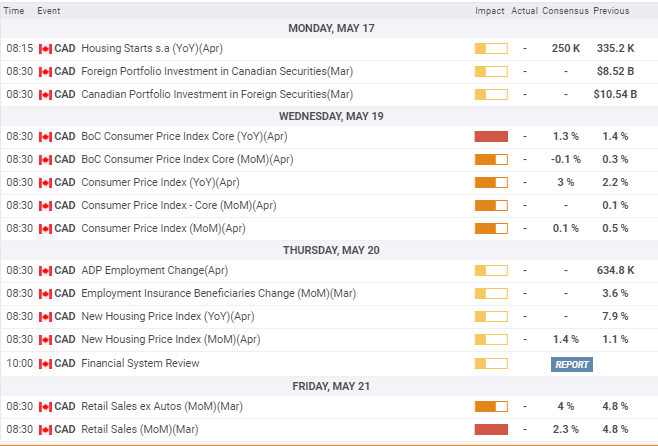

Canadian statistics were negligible on the week. Manufacturing Sales were as expected in March and Wholesale Sales were considerably stronger. Neither had market impact.

USD/CAD outlook

The trends that have bolstered the Canadian dollar this year remain intact. Canadian yields have closed the gap with Treasury rates.

At the beginning of the year, the spread between the comparative 10-year yields favored the US by 24 basis points. By May 14, that was down to 7 points.

Commodity prices remain strong, and the potential for WTI to rise is excellent once the European and global economies find their post-pandemic footings. The lagging Canadian economy will, as the year progresses, leave its provincial closures behind and add domestic growth to that spilling over the border from the United States.

The potential for Canada’s April inflation rate, expected to rise from 2.2% to 3%, to run hotter is high. When rising inflation is combined with the BOC’s already demonstrated hawkish intent, Canadian government rates could improve relative to US Treasury yields.

Technical considerations also favor continued loonie strength. The USD/CAD left all recent support levels in the past when it dropped below 1.2300. Current support references are from May 2015 and earlier and consequently weak.

Until one of the major fundamental trends mentioned above abate or reverse, the USD/CAD will continue to slide.

Canada statistics May 10–May 14

US statistics May 10–May 14

Canada statistics May 17–May 21

April inflation stands out in the week ahead. A stronger than forecast report will aid the Canadian dollar.

US statistics May 17–May 21

The US housing market with statistics in building permits and starts on Tuesday and Existing Home Sales on Friday should continue red-hot.The scarcity of new homes, especially of lower-cost inventory is a major component of asset price inflation.

USD/CAD technical outlook

The Relative Strength Index is oversold but cannot be considered a buy signal given the current fundamental outlook. The 21-day moving average (MA) at 1.2273 is a strong backer of resistance at 1.2270. The 100-day MA at 1.2566 and the 200-day MA at 1.2832 await fundamental trend revision.

The age of the support lines and the relatively thin formative trading make them weaker than their proximity to current levels might suggest. Resistance lines are recent but suffer the same sparse trading reinforcement. Neither set of lines will offer a major obstacle to a concerted move.

Resistance: 1.2170, 1.2270, 1.2320, 1.2400

Support: 1.2045, 1.2000, 1.1950, 1.1900

FXStreet Forecast Poll

The FXStreet Forecast Poll envisions a minor technical bounce in the one-month and one-quarter outlook, but such is dependent on a fundamental reversal in at least one of the trends bedeviling the USD/CAD.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.