USD/CAD Weekly Forecast: Ukraine reorders market outlook

- Thursday’s US CPI volatility leaves USD/CAD higher.

- Russian threat to Ukraine aids the US dollar on Friday.

- Federal Reserve rate intentions complicated by inflation, Russia.

- FXStreet Forecast Poll predicts near-term gains for USD/CAD.

The volatility around the US inflation report on Thursday and the sharply higher Treasury rates gave the US dollar its largest boost this week, with reported Russian threats to Ukraine adding a fillip on Friday. Even so the USD/CAD finished at 1.2745, below its Monday open at 1.2754.

Consumer inflation in the US jumped to 7.5% in January, a four-decade record, sending equity and bond prices plummeting and raising the breadth of the Treasury yield curve. The return on the 10-year Treasury soared 24 basis points on the day, closing at 2.035%, the first finish above 2% since July 2019. All Treasuries except the 30-year ended the day with yields above where they were in March 2020 before the start of the pandemic.

Treasury yields retreated on Friday afternoon as reports circulated that the UK had advised citizens to leave Ukraine and was evacuating embassy staff from Kyiv. Biden administration officials told the Public Broadcasting System (PBS) that the US expected a Russian invasion of Ukraine next week.

The yield on the 10-year US Treasury fell 11 basis points to 1.918% as bonds rallied on safety concerns. The Canadian equivalent yield fell 7 points to 1.871% after the Russian news.

Even with Friday’s retreat the yield spread between the US 1-year Treasury and its Canadian counterpart, Canada does not have a 2-year note, has narrowed substantially this year. At the close on December 31, the US 1-year was paying 0.389% and the Canadian 0.780%, for a Canadian advantage of 39 basis points. At Friday’s conclusion the US note was returning 1.037% and Canada’s was yielding 1.19%, an advantage of 15 basis points.

Equities tumbled after the various Russian reports.The Dow ended down 1.43%, 503.53 points at 34,738.06. The NASDAQ lost 2.78%, 394.49 points to 13,791.15 and the S&P 500 dropped 85.44 points, 1.90% to 4,418.64.

The greenback’s late gains on Thursday were also aided by comments from St Louis Federal Reserve President James Bullard, a well-known inflation hawk. He said that the bank should raise the fed funds rate 100 basis points by July. This would entail at least one 0.5% increase over the three FOMC meetings on March 16, May 4 and June 15.

Before Thursday’s CPI data, market debate had centered on whether the Fed would hike 0.5% at the March 16 meeting. The general opinion was that it would not.

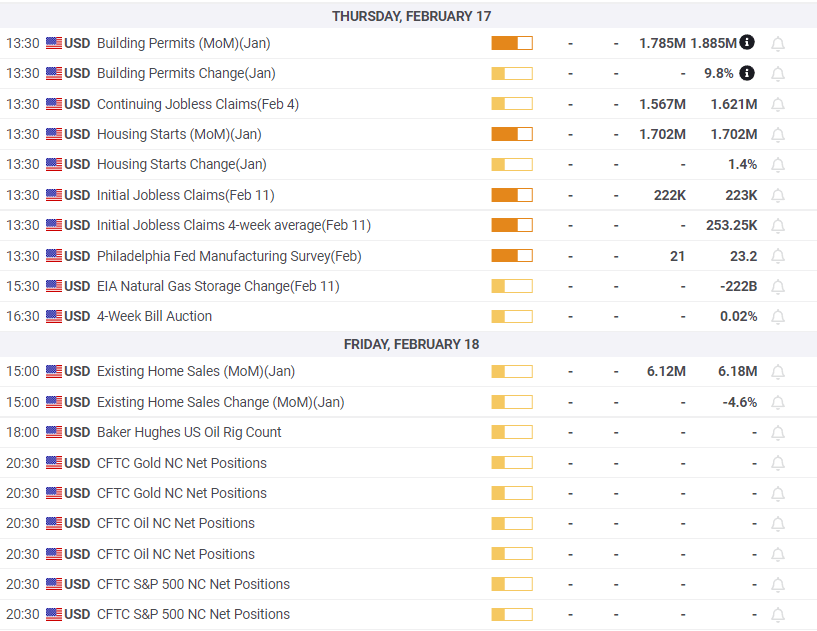

On Wednesday evening, the probability of a 0.5% increase next month was rated by the Chicago Mercantile Exchange (CME) FedWatch Tool, which uses fed futures to compute the odds, at 24%.

CME

Immediately after the inflation figures on Thursday the probability had risen to 92.8%.

The odds dropped back to 44.3% at the close on Friday.

Federal Reserve Chair Jerome Powell has stated the bank will begin to reduce its $9 trillion balance sheet, acquired over the past decade, after bond buying ceases in March. Until Thursday the assumption had been that the bank would wait a month or more after termination before beginning a portfolio reduction.

A passive roll-off, where the Fed does not reinvest the proceeds of maturing securities, has been expected for several months. If Mr. Powell announces the date at the March FOMC meeting, it will not be a surprise. It’s advent and composition will be the main topic of reporters’ questions. A much more aggressive choice would be active sales. This would send a powerful rate signal to credit markets, ensuring much higher Treasury and commercial rates.

For the moment, a stronger Fed response seems obviated by the threat to global and US growth posed by a Russian invasion of Ukraine. While the diplomatic responses and sanctions might vary from country to country, a near guarantee is that oil and energy prices would rocket higher.

The 3.6% jump in West Texas Intermediate (WTI) price on Friday is a direct result of the Ukrainian situation. Were a conflict to start, the euro would be particularly vulnerable. Germany, the united currency's largest economy, gets about 30% of its energy from Russia, all of which would be under threat.

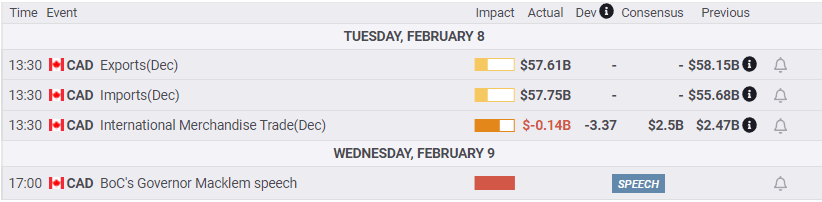

Canadian data this week was limited to December imports and exports and had no market impact.

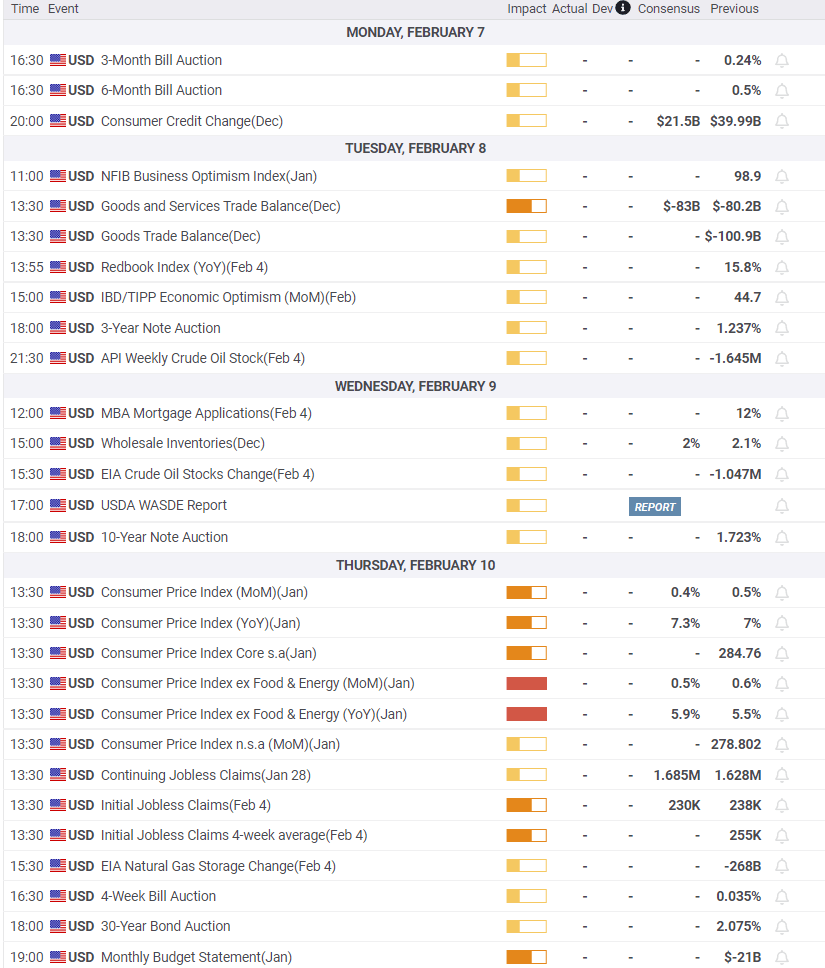

In the US, jobless claims fell to 223,000 in the February 4 week, the fourth decline in a row and the lowest total in five weeks.

The Michigan Consumer Sentiment Index for February dropped unexpectedly to 61.7, its lowest score in over a decade, from 67.2 and underlines the risk to the US economy should consumers pull back on spending. It had been forecast to rise to 67.5.

USD/CAD Outlook

The USD/CAD will be subject to the countervailing forces of rising US interest rates, potentially higher crude prices and a US dollar safety trade, if Ukraine ignites.

Much depends on what Vladimir Putin in Moscow decides. If Russia does begin a military operation, WTI will soar, at least initially, taking the loonie with it, and the USD/CAD lower. Alternative oil producers in OPEC, Nigeria, Indonesia and elsewhere are not in a position, nor would they be inclined, to ramp up production to replace Russian crude. China would benefit as it would be Russia’s main client and gain pricing power. Shale producers in the US have been crippled by the Biden administration’s energy policies which would have to be credibly reversed, to bring production back to 2019 and 2020 levels.

A Russian invasion of Ukraine, even if limited to the eastern Donbass region, would dominate politics and financial markets. Treasury rates would fall as markets sought the safety of US bonds. The chance of the Fed instituting a more aggressive rate program during a Russian invasion of Ukraine is nil.

There are many unknowns in the outlook for the USD/CAD in the event of a Russian invasion. The strength of the safety trade to the US dollar depends on the goals and violence of an invasion and on the Western response. Initially the surprise would play to US assets, the dollar, Treasuries and the USD/CAD. The longer view would be ordered by developments in the oil market and the political and military situation in Ukraine.

With these possibilities hanging over the USD/CAD, traders should expect a neutral aspect while the politics of the former Soviet and Tsarist Empires play out.

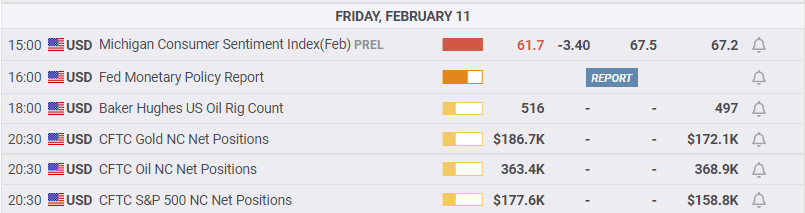

Canadian inflation in January is expected to trail the US but move higher. Retail Sales for December are forecast to improve.

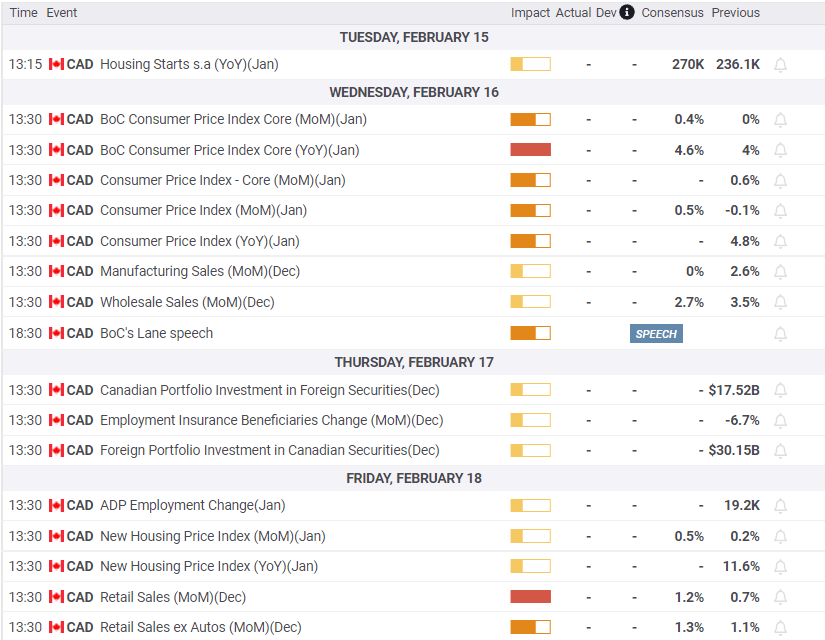

Retail Sales are the most relevant US data. Sales were stagnant in the fourth quarter. If the expected 1.6% increase does not occur, concerns for the US economy will spread to the all-important consumer sector. Weak sales could lower Treasury rates and Fed rate hike prospects.

Canada statistics February 7–February 11

FXStreet

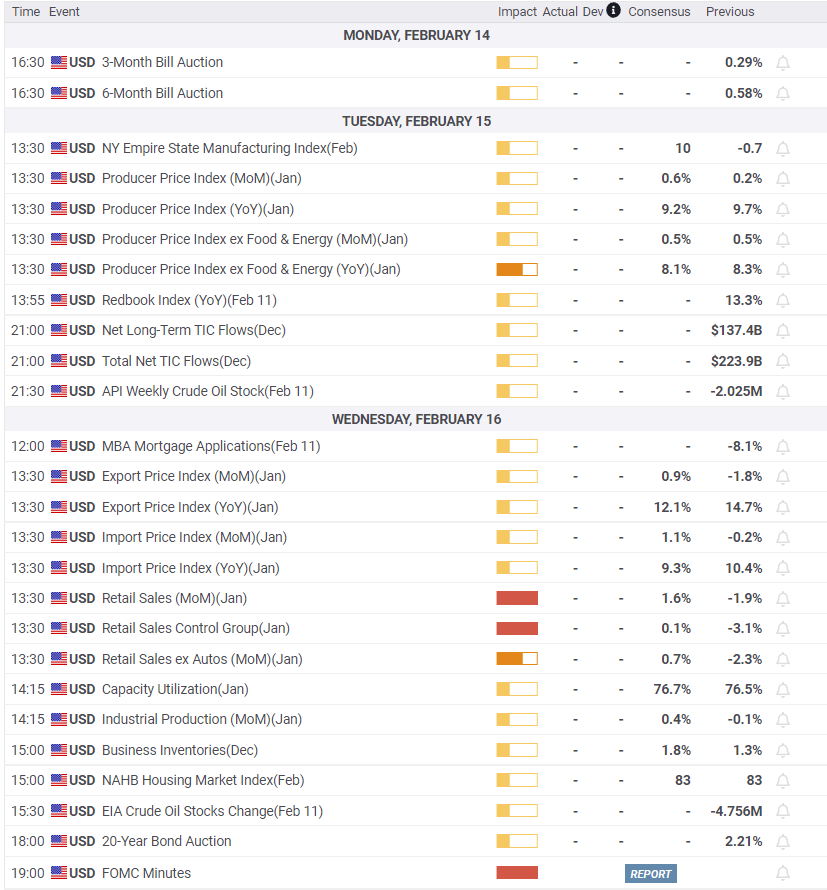

US statistics February 7–February 11

FXStreet

Canada statistics February 14–February 18

FXStreet

US statistics February 14–February 18

FXStreet

USDCAD technical outlook

Movement in the last 12 USD/CAD sessions have largely restricted to a 1.2650–1.2750 range. The MACD (Moving Average Convergence Divergence) has lapsed to near neutrality, as has the Relative Strength Index (RSI). This should in no way diminish the potential for movement, but political threats in the Ukraine have not yet had a major or sustained impact on currency markets. The waning MACD divergence does show diminished upward momentum. Average True Range (ATR) had flat volatility from Wednesday on, but as with the other indicators, this is not predictive in the current situation.

The 50-day moving average (MA) at 1.2707 has been above the 21-day MA for almost one month. The rebound of the USD/CAD from 1.2500 and its stability abound 1.2700 was well predicted. Monday's turn higher in the 21-day MA and Wednesday's increased slope were indicative of good support at 1.2670. Three of the moving averages, 21-day, 50-day and 100-day coincide with support lines, giving the USD/CAD technical structure beneath additional strength.

Resistance: 1.2775, 1.2800, 1.2840, 1.2855, 1.2915, 1.2940

Support; 1.2725, 12700 (50-day MA 1.2707), 1.2679, 1.2650 (21-day MA 1.2651), 1.2625 (100-day MA 1.2623)

FXStreet Forecast Poll

The FXStreet Forecast Poll is slightly bullish in the near term but negative thereafter, irrespective of the threat from Ukraine.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637802215836126517.png&w=1536&q=95)