USD/CAD Weekly Forecast: Oil prices and US payrolls in the dock

- USD/CAD pulls back 1.4% from two-month peak.

- WTI closes at $73.77, highest since October 2018.

- OPEC and Nonfarm Payrolls will set the week's agenda.

- FXStreet Forecast Poll foresees technical weakness.

The USD/CAD retreated from its two-month high, closing for the week at 1.2293 about half-way between the six-year low of June 2 at 1.2035 and last Friday’s close at 1.2463. Crude oil prices, which rose in four of five sessions, provided the main energy to the Canadian dollar side of the ledger.

West Texas Intermediate (WTI) gained 3.8% on the week, opening at $71.06 and concluding at $73.77. It was the highest daily close for the North American oil pricing standard since October 18, 2018. The oil complex accounts for about 11% of Canadian economic activity and is probably the most important day-to-day factor in loonie pricing.

The June 11 breach of the USD/CAD channel that originated in the March 2020 panic was reinforced by the results of the 15-16 Federal Open Market Committee meeting (FOMC). The updated US economic assessment with higher projections for growth and inflation brought a potential rate hike into 2023 instead of at some indeterminate date beyond.

That Fed reassessment gave the US dollar its largest and most widespread gains since late March.

Treasury returns have switched places since the Fed meeting, flattening the yield curve. The 10-year has added 3 basis points from its open on June 16 at 1.499% to 1.524% on Friday. Its high was 1.764% on March 31.

US 10-year Treasury yield

CNBC

The 2-year, which for more than a year has been restrained by the Fed’s bond purchases, has added 10 points to 0.268%.

US 2-year Treasury yield

CNBC

April Retail Sales were the only major Canadian data release. At -5.7%, they were worse than forecast but had no market impact.

In the US, housing sales remained strong. Durable Goods orders were less than expected in May, but April’s results were revised sharply higher, as were that month's Retail Sales figures. Nondefense Capital Goods, the business spending proxy, were less than projected, but the main problem seems to be product and material shortages left over from the lockdowns. Inflation in the PCE numbers produced no surprises.

Federal Reserve Chair Jerome Powell’s Congressional testimony before the House Select Committee on the Coronavirus Crisis repeated the outline from the Fed meeting. The US recovery is strengthening, perhaps a bit more than the Fed had expected, and inflation is a temporary phenomenon.

USD/CAD outlook

The week’s decline in the USD/CAD is more a consolidation than a change in outlook, though it demonstrated yet again the oil-based potential of the Canadian dollar. Crude prices will likely rise further as the global recovery gathers strength, especially with the crippling of the US swing producers in the shale fields.

American Treasury rates should continue higher giving the dollar support. Gains in the USD/CAD tend to be mitigated by oil price increases.

OPEC’s meeting next week will keep the focus on petroleum pricing. The main topic will be easing production quotas for August.

The immediate prognosis for the USD/CAD is mixed. Treasury rates and US inflation suggest a higher trajectory, as does the possibility of stop-loss buying around important levels – the next is 1.2500. Tilting against this scenario is the prospect of higher crude oil prices.

However, oil prices are close to their seven-year high of $76.06 from October 3, 2018. The very rapid and extreme price increases over the last year argue for caution in anticipating gains.

American Nonfarm Payrolls on Friday will dominate markets. A small increase to 675,000 is forecast, but with unemployment claims back over 400,000 for the last two weeks, the risk is on the downside. A weak number will damage the dollar. The manufacturing Purchasing Managers' Index for June from the Institute for Supply Management will be noted but will not move markets.

Canada statistics June 21–June 25

FXStreet

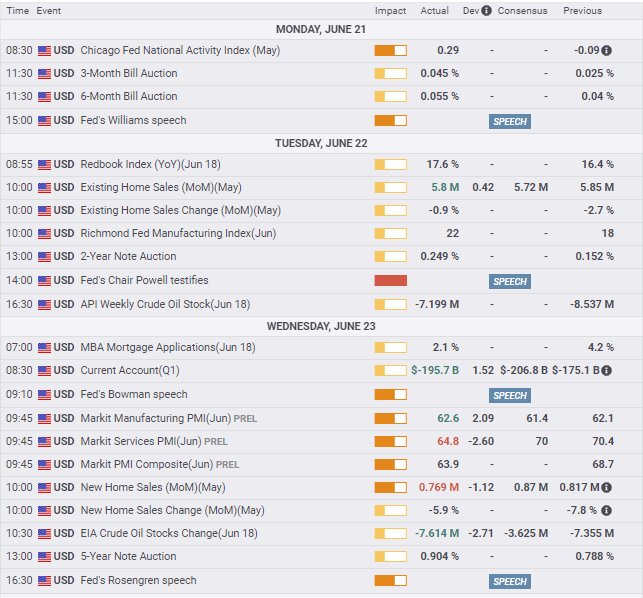

US statistics June 21–June 25

FXStreet

Canada statistics June 28–July 2

FXStreet

US statistics June 28–July 2

USD/CAD technical outlook

Buying momentum in the USD/CAD has dropped sharply as given in the Relative Strength Index (RSI) and True Range indicators. The MACD is still a buy, though of diminished intensity. The 21-day moving average (MA) turned higher two weeks ago and at 1.2190 is part of support at that level. The 100-day MA at 1.2404 is aligned with resistance at 1.2400. Reentry to the descending channel is not out of the question if oil prices jump or NFP is weak. The upper border is about 1.2125.

Support and resistance lines are balanced with recent and intensive trading giving heft.

Resistance: 1.2329, 1.2369, 1.2499, 1.2500

Support: 1.2270, 1.2190, 1.2130, 1.2035

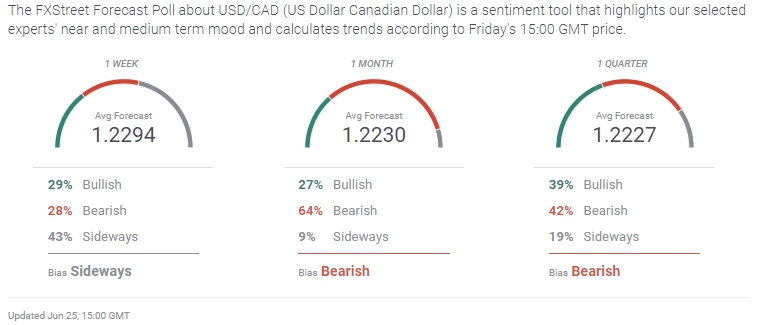

FXStreet Forecast Poll

The FXStreet Forecast Poll accounts for the weak follow on the June 11 channel break as a determinate technical factor. Unless countered soon by better fundamentals for the USD/CAD, the odds of technical decline rise accordingly.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.