USD/CAD Weekly Forecast: Adjusting the volatile balance

- USD/CAD falls 1.4% despite rising US Treasury yields.

- WTI closes at its highest level since July 13.

- Canadian Federal election leaves no trace on markets.

- FXStreet Forecast Poll is uniformly bearish out to one quarter.

The Canadian Dollar had its best week in a month, gaining 1.4% against its US counterpart as risk-aversion from China’s Evergrande Group moderated and crude oil closed at its strongest level in two months. The loonie run came despite rising US Treasury rates after the Federal Reserve meeting on Wednesday and Monday’s status quo Canadian federal elections.

Dollar Canada, the market term for the USD/CAD, had its only positive day on Monday, opening at 1.2763 and rising to 1.2826 by the close. Thursday’s breach of support at 1.2765 provoked the largest move with the USD/CAD losing more than a figue and ending at 1.2656.

China’s heavily indebted Evergrande Group missed an interest payment on Thursday but is not in technical default for 30 days. The mainland's second largest real estate developer is suffering from Beijing’s recent change in policy that now says, “Housing is for living in, not for speculation,” after years of using the construction sector to boost GDP. Real estate and associated industries account for about 15% of China's economic activity, and 70% of urban wealth is stored in highly speculative housing prices.

West Texas Intermediate (WTI), the North American pricing standard, rose 2.9% on the week, concluding at its highest point since July 15. The energy sector contributes about 10% to Canada’s GDP and has a strong influence on the Canadian dollar.

American Treasury rates rose sharply on Thursday and Friday following the Federal Open Market Committee (FOMC) on Wednesday. Federal Reserve Chair Jerome Powell again touted a reduction in the $120 billion of monthly bond purchases, saying that most FOMC members agreed that the conditions for a taper had been met. The bank’s Projections Materials forecasts moved the inaugural fed funds rate increase into 2022 for the first time since the pandemic began last March.

The 10-year Treasury yield added 14 basis points to close at 1.453%, its best level since July 1.

Canada’s federal elections on Monday resulted in Prime Minister Justin Trudeau winning his second minority term in a row, and third overall, and had no market impact – the re-election being exactly in line with predictions.

Retail Sales for Canada were better than expected in July but still negative and showing the drag of provincial restrictions.

In the US, stocks recovered from Monday’s China-inspired sell-off, returning to last week’s level by Friday. Existing Home Sales, 90% of the US market, performed as expected in August, and Initial Jobless Claims rose for the second week in a row, though neither affected markets.

USD/CAD outlook

The USD/CAD has been range bound between 1.2500 and 1.2700 for the better part of three months with three almost identical short-lived upside attempts and one even briefer dip. Fundamentally, the balance between the recovering energy sector’s support of the Canadian dollar and the expected ascent of US Treasury rates has faced off to neutral.

American Treasury rates have the greater potential, but the Fed’s taper coyness has, so far, kept US rates from a concerted move higher. At Friday's close of 1.453% the 10-year Treasury yield was 29 basis points below the March 31 close of 1.746%.

The retreat of Evergrande risk in the second half of the week gives the USD/CAD a weak downward cast. There are multiple support levels between here and the bottom of the range and no compelling reason for a determined sell-off.

One caveat would be a steady rise in US Treasury rates. The likely take-off point for speculative impact on the US dollar would be 1.57% in the 10-year yield.

US 10-year Treasury yield

CNBC

Next week Canada releases GDP figures. Growth has been a weak link in the otherwise good Canadian data, especially in comparison to the US economy. The second quarter contraction was the chief reason for the pause in the Bank of Canada’s taper.

US data in the week ahead begins with Durable Goods Orders for August, essentially a restatement of the Retail Sales figures. An important exception is Nondefense Capital Goods Orders, a much followed proxy for business investment. The manufacturing Purchasing Managers’ Index will shed insight on whether the factory sector is surmounting labor and material shortages and price inflation.

Canada statistics September 20–September 24

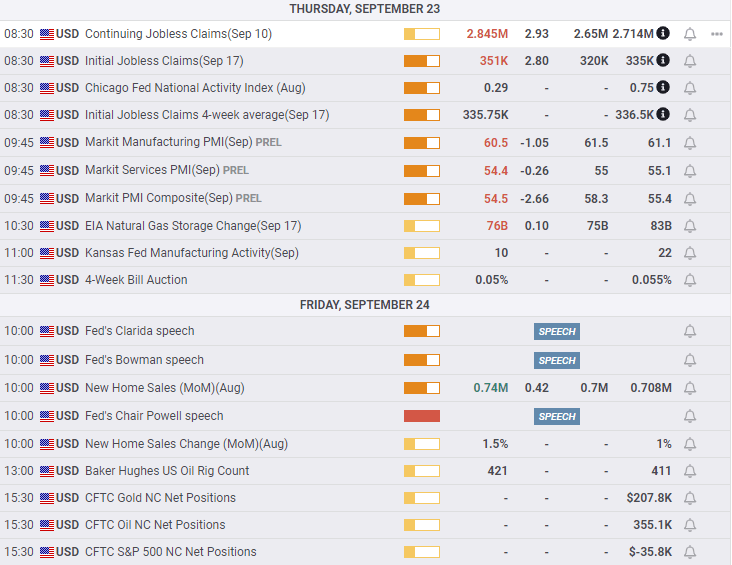

US statistics September 20–September 24

FXStreet

Canada statistics September 27–October 1

FXStreet

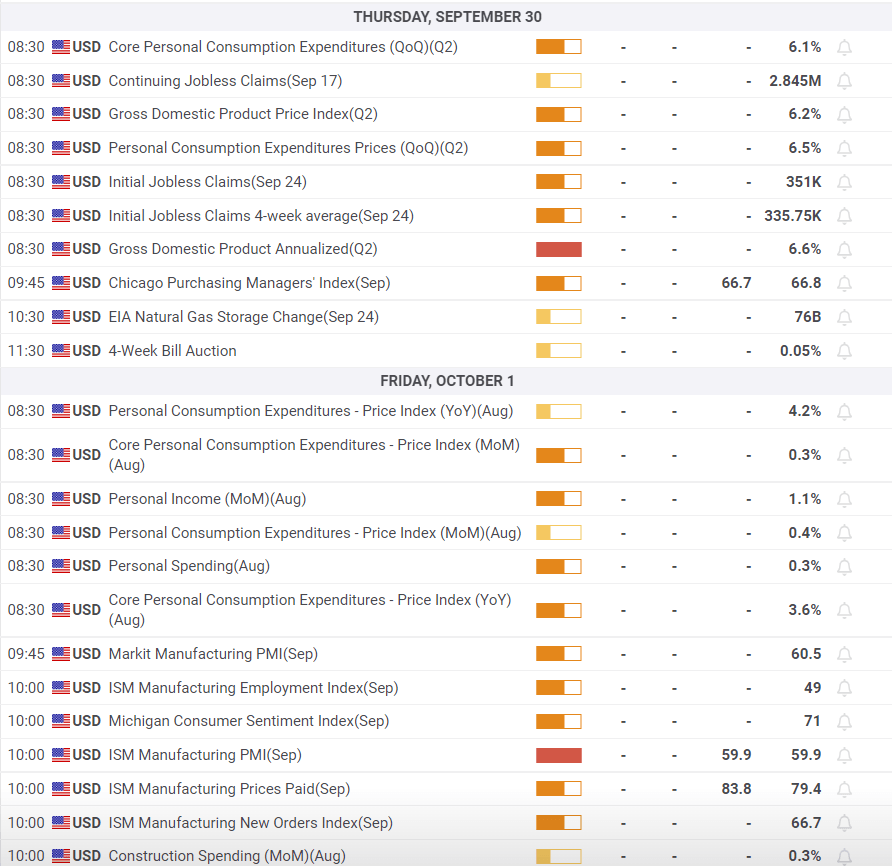

US statistics September 27–October 1

USD/CAD technical outlook

Momentum indicators have retreated on the USD/CAD reversal. The MACD (Moving Average Convergence Divergence) ended the week just negative and the Relative Strength Index (RSI) dropped to neutral. The True Range fell from its highest reading in a month. None of the three are overtly negative despite their change in direction.

The 21-day moving average (MA) at 1.2662, is very weak resistance just above the 1.2652 Friday close. If the USD/CAD moves above that level, especially above 1.2700, it will become much more substantial support. The 50-day MA at 1.2619 backs support at 1.2625 as does the 200-day MA at 1.2524 for the line at 1.2525.

Support lines are far more plentiful and well-documented with price action and, in the absence of a major fundamental development, a substantial impediment to a USD/CAD decline.

Resistance: 1.2662 (21 MA), 1.2700, 1.2765, 1.2825, 1.2865

Support: 1.2625, 1.2619 (50 MA), 1.2600, 1.2560, 1.2525, 1.2524 (200 MA), 1.2445

FXStreet Forecast Poll

The FXStreet Forecast Poll bearish sentiment seems a bit overstated, given the support structure of the USD/CAD.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.