USD/CAD Weekly Forecast: The rarefied air above 1.3000

- USD/CAD closes the week at par, after 18-month high trade at 1.3077.

- Risk aversion preference for US dollar abates on Friday as equities rebound.

- WTI falls 10.2% on Monday and Tuesday, recovers 9% by Friday.

- FXStreet Forecast Poll expects another attempt at 1.3000 to end in failure.

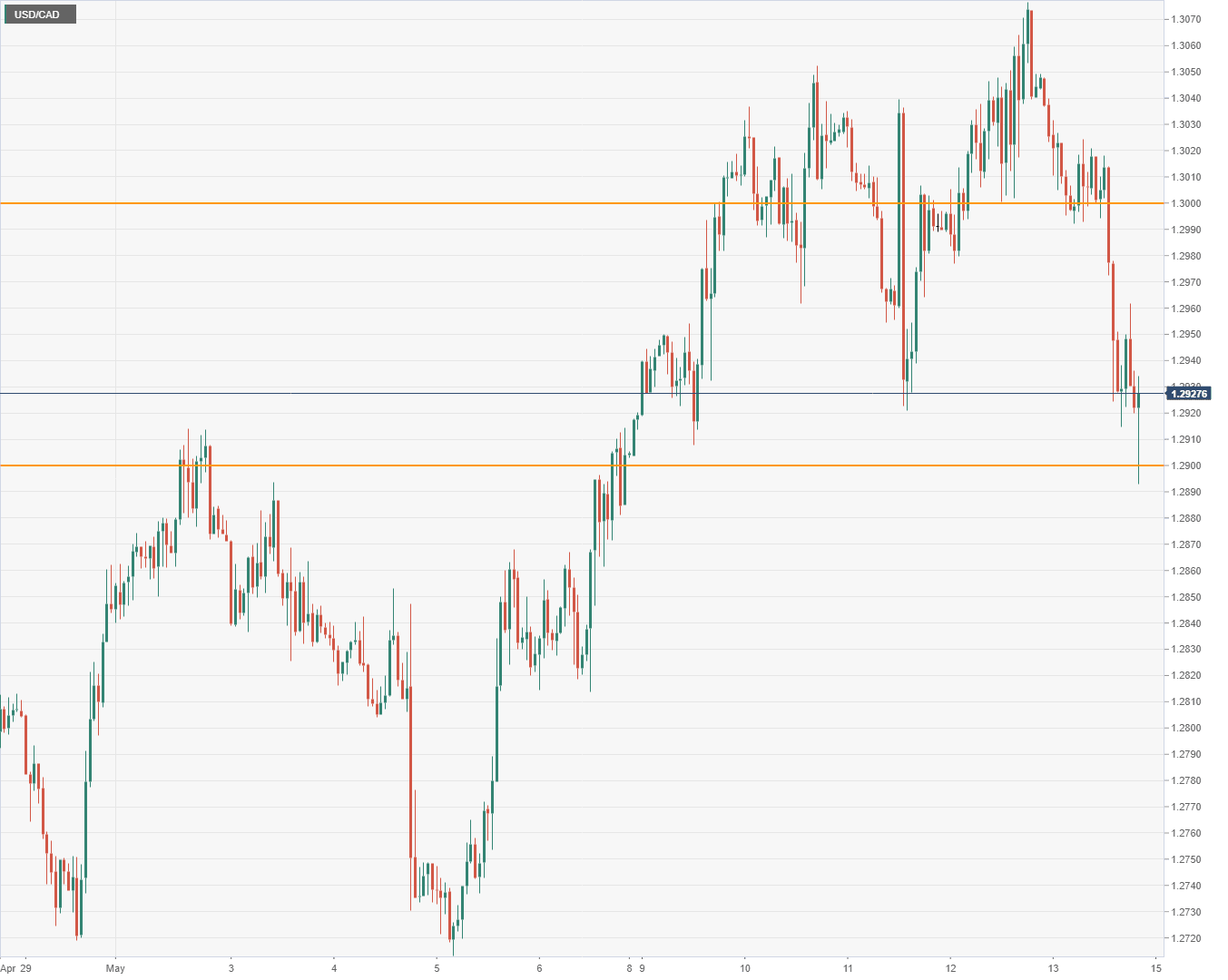

The USD/CAD surrendered its perch above 1.3000 this week almost as quickly as it landed. Dollar Canada closed at 1.3010 on Monday, its first finish above 1.3000 in 18 months. Two days later the pair dropped as low as 1.2921 before recovering to 1.2991. Thursday’s equity losses brought risk-averse traders back to the US currency giving the USD/CAD its highest close since November 23, 2020 at 1.3044. The hourlies below show the action.

Friday’s massive rebound in US stock averages, the Dow rose 1.47%, the S&P 500 2.39% and the NASDAQ rocketed 3.82%, downed risk assets and the USD/CAD plunged more than a figure finishing at 1.2928, nearly at par with the week’s open at 1.2906. Dollar Canada’s end of the week losses came despite a surge in US Treasury yields that added 11 basis points to the 10-year at 2.928% and 6.6 points to the 2-year return at 2.588%.

After falling 10.2% from Monday’s open at $109.55 to $98.41 on Tuesday, West Texas Intermediate (WTI) ratcheted higher in the latter part of the week. By Friday, WTI had clawed back all but 1% of its losses, finishing at $108.43, adding its bit to the loonie recovery.

The Dollar Index pulled back on Friday from its nearly two-decade high at 105.00 closing at 104.47.

Despite the modest reversal of the US dollar safety trade on Friday market direction is highly unsettled. Equities remain dramatically lower on the year. The S&P 500 finished Friday off 15.6%, the Dow 11.4% and the NASDAQ 24.5%.

The war in Ukraine and its attendant vault in commodity prices, China’s drastic lockdowns and soaring inflation and food prices have sent investors fleeing to the safety of the US dollar and assets over the past several weeks.

For equities, the risks that have shaved trillions in value from stocks have been twofold. The anticipated drag on the US economy from the Federal Reserve’s rate program and the threat to consumer spending from rampant price increases.

April's US CPI at 8.3% overall and core at 6.2% were slightly lower than the March figures but higher than the forecasts. Combined with producer prices at 11%, inflation is looking more and more as a long-term phenomenon, keeping market focus on the Federal Reserve’s aggressive rate policy.

The Michigan Consumer Sentiment Index dropped to 59.1 in April, well below the 64.0 forecast and the weakest reading since August 201. It was the second poorest score since the financial crisis.

Thus far, US consumer spending has not taken its cue from weakening sentiment. Retail Sales have averaged a healthy 0.95% for the six months through March. Personal Consumption Expenditures (PCE) from the Bureau of Economic Analysis (BEA) have measured 0.92% for the same period.

Those excellent results are somewhat deceptive as both figures include price increases in their calculations. Real PCE, also issued by the BEA, but corrected for inflation, shows a very different story. The six-month average is 0.17%, over 80% less than the unadjusted number.

If the US consumer falters in the second quarter, a recession as traditionally defined, becomes possible and perhaps likely.

There were no Canadian data releases of note.

Technical factors played a major role in the USD/CAD gyrations this week. Last Friday’s clear of 1.2900 with a close at 1.2904 was followed by Monday's jump above 1.3000. Three days of dithering around 1.3000 ended on Friday with a more than 100 point drop back through it and 1.2900.

In the past 18 months, the USD/CAD has been able to sustain pricing above 1.2900 for only very brief periods. This week’s foray to 1.3000 was the first visit since November 2020. The figure between 1.2900 and 1.3000 has been sparsely traded, which makes price actionin that area much more volatile.

USD/CAD outlook

In general, US Treasury rates have had limited impact on the USD/CAD because Canadian sovereign and commercial rates have moved in tandem with their American cousins. The base rate for the Fed and the Bank of Canada is 1.0%.

Safety considerations generated by the equity collapse have been the chief motivation for the rush to the US dollar over the past three weeks. Friday’s rebound in US averages is not a trend reversal as the market's inflation, interest rate and economic growth concerns have not vanished.

Technical support for the USD/CAD is moderate down to 1.2850 and strong below 1.2800. Resistance is largely non-existent above 1.2900 but equally absent is support when the USD/CAD moves higher.

With the balanced central bank policies, the external factors of WTI prices and equity developments have the most impact on USD/CAD levels.

If equity selling resumes the USD/CAD will likely move higher, but the volatility of the last two weeks in stocks has made the bar for currency action quite high. If equities have a relatively calm week the USD/CAD will drift lower, but plentiful support should retard movement. If there is a strong equity rally, the prospects for the loonie improve appreciably.

Oil prices have been restrained for the past month by the stalemate in Ukraine. This week’s range was nearly identical to the prior week and provided little guidance to currency traders.

Canadian CPI is expected to moderate slightly in April but with the Bank of Canada policy set it will have minimal market impact.

Retail Sales for April in the US are expected to exhibit continued moderate growth. Any sign of weakness will undermine equities and tend to the safety dollar trade. Existing Home Sales, 90% of the US market, were already down 11.5% in March from the November recent high as mortgage rates have climbed, a further drop is expected for April.

The outlook for the USD/CAD is modestly lower with caveats for developments in the equity and energy markets.

Canada statistics May 9–May 13

US statistics May 9–May 13

Canada statistics May 16–May 20

FXStreet

US statistics May 16–May 20

USD/CAD technical outlook

Despite the pullback to 1.2927 on Friday the MACD (Moving Average Convergence Divergence) is still in positive territory. The turn in the price line on Thursday should be watched for a cross of the signal line, a likely event if the pair continues south early in the week. The Relative Strength Index (RSI) changed direction toward neutral on Thursday. Volatility remains high in the Average True Range (ATR) with the USD/CAD level above 1.2900.

Resistance: 1.2940, 1.2990, 1.3000, 1.3025, 1.3045

Support: 1.2900, 1.2840, 1.2820, 1.2800

Moving Averages: 21-day 1.2804, 50-day 1.2695, 100-day-1.2689, 200-day 1.2652

FXStreet Forecast Poll

The FXStreet Forecast Poll predicts a failed breakout above 1.3000.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637880823022968988.png&w=1536&q=95)

-637880833396968524.png&w=1536&q=95)

-637880838187653107.png&w=1536&q=95)

-637880843224681191.png&w=1536&q=95)