USD/CAD rally pauses: Awaiting next correction

The USD/CAD pair ended its continuous upward trend on Friday, 26 June 2024, settling around 1.3813, signalling a potential shift towards correction.

The Bank of Canada decided to lower the interest rate from 4.75% p.a. to 4.50% p.a. at its meeting this week. Overall, the tone of the Canadian regulator's remarks has changed. The Bank of Canada expects the economy to grow by 1.2% this year versus the previous forecast of 1.5%. Expectations for 2025 and 2026 were adjusted to 2.1% and 2.4% from 2.2% and 1.9%.

Inflation forecasts were also changed. By the end of 2024, the overall consumer price index is expected to fall to 2.6%. Inflation will be 2.4% in 2025 and 2.0% in 2026.

The Bank of Canada is confident that the state of the economy is well positioned for inflation to return to target even if economic activity improves slightly in the second half of this year.

Since 11 July, the CAD has been falling almost nonstop in tandem with the USD. It has only started to correct now that it has reached a three-month low.

USD/CAD technical analysis

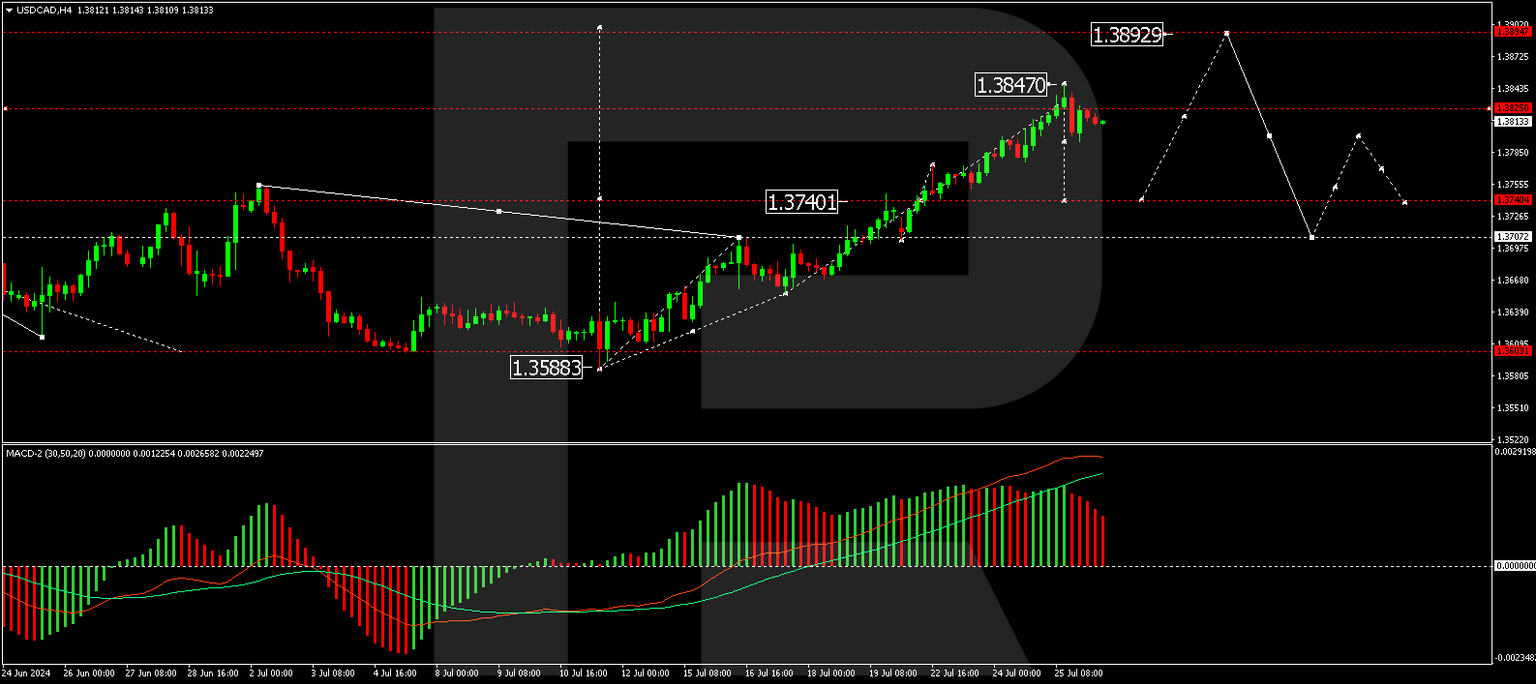

On the H4 chart of USD/CAD, the market has formed a consolidation range around 1.3740 and worked off the local target of the growth wave at 1.3847 in an upward movement. Today, we expect a new consolidation range to form at the current highs. In case of a downside exit, we will consider the probability of correction to 1.3740 (test from above). In case of an upward exit, we will consider the likelihood of the trend's continuation to 1.3892. Technically, this scenario is confirmed by the MACD indicator. Its signal line is at the maximum and is preparing for a decline.

On the USD/CAD H1 chart, the market made a downward impulse to the level of 1.3795 and a correction to the level of 1.3825. The market has practically marked the boundaries of the consolidation range. We expect the exit from this range down to the level of 1.3790. If this level is breached, we will consider the correction wave development to continue to 1.3763. The target is local. Technically, this scenario is confirmed by the Stochastic oscillator. Its signal line is under the mark of 50 and is directed strictly downwards to the level of 20.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.