USD/CAD Price Forecast: Short-term bullish breakout in play ahead of FOMC minutes

- USD/CAD gains positive traction for the sixth straight day amid a bullish USD.

- The overnight slump in Oil prices undermines the Loonie and remains supportive.

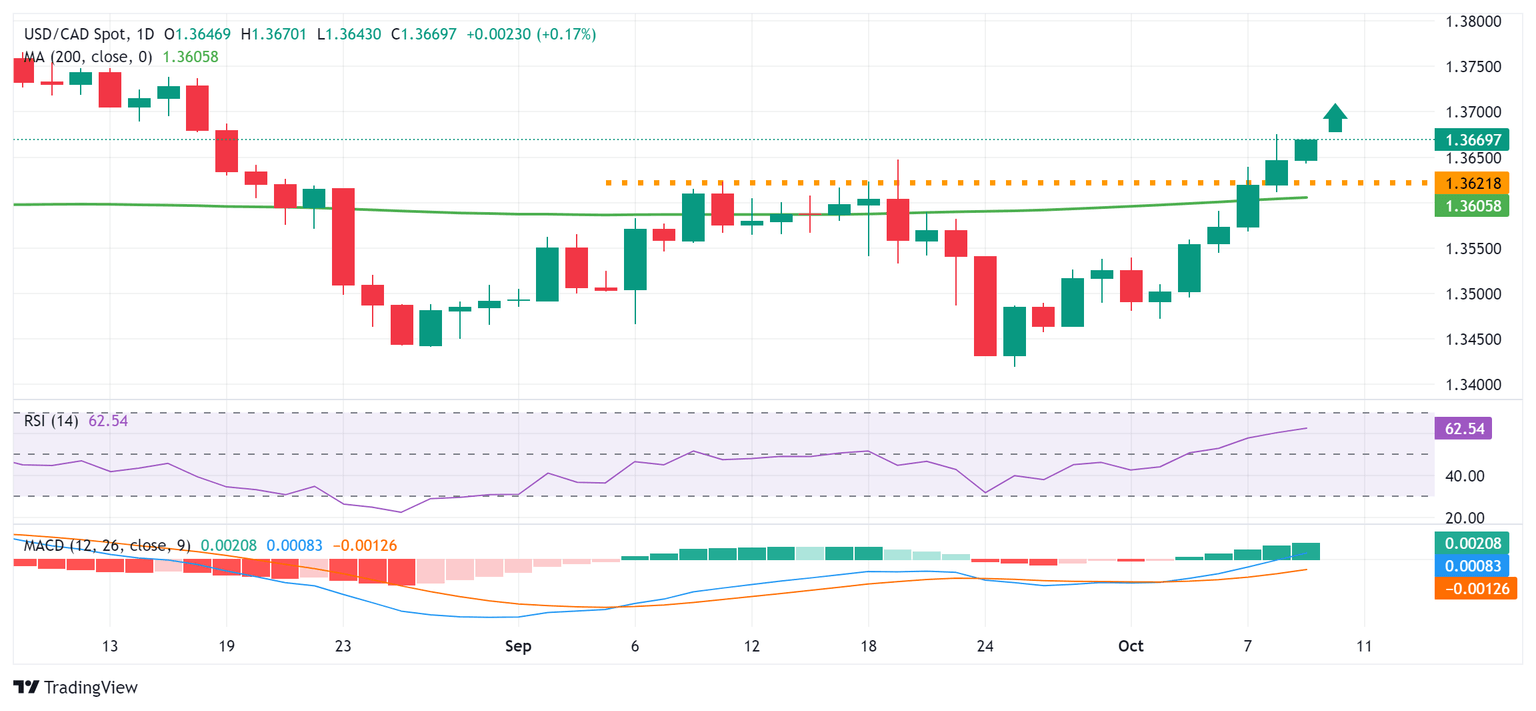

- Acceptance above the 200-day SMA favors bulls ahead of the FOMC minutes.

The USD/CAD pair attracts buyers for the sixth straight day on Wednesday and trades around the 1.3665 area during the early European session, just below its highest level since August 19 touched the previous day. Geopolitical risk premium decreased slightly amid news of a possible ceasefire between Lebanon's Hezbollah and Israel, which led to the overnight slump in Crude Oil prices. This, along with expectations for a larger interest rate cut by the Bank of Canada (BoC), undermines the commodity-linked Loonie and acts as a tailwind for the pair amid a modest US Dollar (USD) uptick.

Investors have been paring bets for a more aggressive policy easing by the Federal Reserve (Fed) amid signs of a still resilient US labor market and another oversized rate cut in November. This keeps the yield on the benchmark 10-year US government bond elevated above the 4% threshold and the USD Index (DXY), which tracks the Greenback against a basket of currencies, close to a seven-week high touched last Friday. Apart from this, a generally weaker tone around the equity markets offers support to the safe-haven buck and turns out to be another factor contributing to the USD/CAD pair's positive move.

The upward trajectory could further be attributed to some technical buying following this week's sustained breakout through a technically significant 200-day Simple Moving Average (SMA) resistance near the 1.3600 mark. Bulls, however, might refrain from placing aggressive bets and prefer to wait for the release of the FOMC meeting minutes later during the North American session. Investors this week will further confront the release of the US Consumer Price Index (CPI) and the US Producer Price Index (PPI), which will be looked upon for cues about the Fed's rate-cut path and influence the USD.

Apart from this, the Canadian monthly employment report on Friday will help in determining the next leg of a directional move for the USD/CAD pair. Nevertheless, the aforementioned fundamental backdrop, along with a bullish technical setup, suggests that the path of least resistance for spot prices remains to the upside. Hence, any corrective pullback could be seen as a buying opportunity and is more likely to remain cushioned.

Technical Outlook

From a technical perspective, the USD/CAD pair seems poised to prolong its recent upward trajectory witnessed over the past two weeks or so. The constructive outlook is reinforced by the fact that oscillators on the daily chart have been gaining positive traction and are still away from being in the overbought territory. Hence, a subsequent strength towards reclaiming the 1.3700 mark, en route to the 1.3725-1.3730 supply zone, looks like a distinct possibility. Some follow-through buying has the potential to lift spot prices beyond the 1.3760-1.3765 intermediate hurdle, towards reclaiming the 1.3800 round figure.

On the flip side, the 1.3625-1.3620 horizontal zone now seems to protect the immediate downside ahead of the 200-day SMA breakpoint, around the 1.3600 mark. Any further decline could be seen as a buying opportunity and remain limited near the 1.3545-1.3540 region. The latter should act as a key pivotal point, which if broken decisively will negate the positive outlook and expose the 1.3500 psychological mark. The USD/CAD pair could slide further to the 1.3465-1.3460 support before eventually dropping to the 1.3420 area, or the lowest level since March touched last month.

USD/CAD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.