- USD/CAD rallies to its highest level since April 2020 in reaction to Trump’s tariff threats.

- The overnight fall in Crude Oil prices undermines the Loonie and further boosts the pair.

- Rising US bond yields revive the USD demand and favor bulls ahead of FOMC minutes.

The USD/CAD pair catches aggressive bids and spikes to the 1.4175-1.4180 region on Tuesday in reaction to US President-elect Donald Trump's tariff threats. In a post on Truth Social, Trump pledged to impose a 25% tariff on all products coming into the US from Mexico and Canada, and an additional 10% tariff on goods from China. Such a move would end a regional free trade agreement and trigger trade wars, which, in turn, weigh heavily on the Canadian Dollar (CAD).

Meanwhile, reports that Israel and the Lebanon-based Hezbollah militant group are on the cusp of a ceasefire deal led to the overnight decline in Crude Oil prices. This overshadows the optimism over reduced bets for a bigger rate cut by the Bank of Canada (BoC) in December and turns out to be another factor undermining the commodity-linked Loonie. Apart from this, the emergence of some US Dollar (USD) buying provides an additional boost to the USD/CAD pair.

Scott Bessent's nomination as the US Treasury secretary provided a short-lived respite to US bond investors amid expectations for a less dovish Federal Reserve (Fed). In fact, market players now seem convinced that US President-elect Donald Trump’s expansionary policies will reignite inflation and force the Fed to cut interest rates slowly. This, in turn, triggers a fresh leg up in the US Treasury bond yields and assists the USD to fill Monday's bearish weekly gains.

That said, the underlying bullish sentiment across the global financial markets holds back traders from placing aggressive bullish bets around the safe-haven buck. Furthermore, a modest uptick in Oil prices helps limit losses for the Canadian Dollar (CAD) and prompts some intraday profit-taking around the USD/CAD pair. Investors now look to the FOMC minutes for cues about the future rate-cut path, which will drive the USD and provide meaningful impetus.

Tuesday's US economic docket also features the release of the Conference Board's Consumer Confidence Index, New Home Sales data and the Richmond Manufacturing Index. The focus will then shift to the release of the revised US Q3 GDP print on Wednesday and the US Personal Consumption Expenditure (PCE) Price Index on Friday. The crucial data will play a key role in influencing the USD price dynamics and determining the near-term trajectory for the USD/CAD pair.

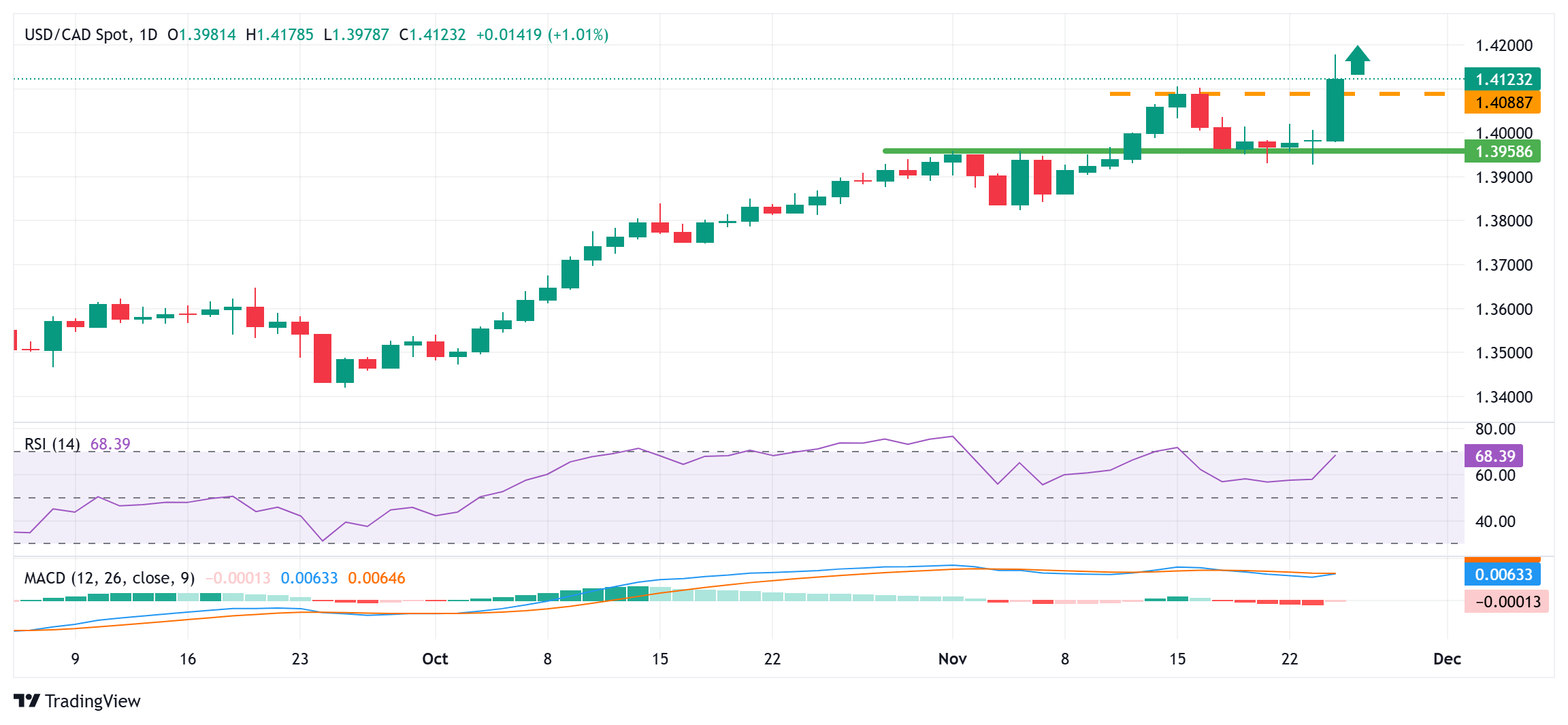

Technical Outlook

From a technical perspective, an intraday breakout and acceptance above the 1.4100 mark favors bullish traders. Moreover, oscillators on the daily chart are holding comfortably in positive territory and suggest that the path of least resistance for the USD/CAD pair is to the upside. Hence, any further pullback might still be seen as a buying opportunity and remain limited near the 1.4055 area, which should now act as a strong near-term base.

On the flip side, the multi-year peak, around the 1.4175-1.4180 region, now seems to act as an immediate hurdle. Some follow-through buying, leading to a subsequent strength beyond the 1.4200 mark, will be seen as a fresh trigger for bullish trades. The USD/CAD pair might then aim to test the April 2020 swing high, around the 1.4300 mark, with some intermediate hurdle near the 1.4265 region.

USD/CAD daily chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD turns positive to retake 1.0500, as focus shifts to Fed Minutes

EUR/USD is trading close to 1.0500 in Tuesday's European trading, erasing lsses to trade in the green. The US Dollar reverses President-elect Trump’s tariff threats-led gains, allowing the pair to stage a modest recovery heading into the release of the Fed Minutes later in the day.

GBP/USD extends recovery toward 1.2600 ahead of BoE's Pill, Fed Minutes

GBP/USD extends the recovery toward 1.2600 in the European session on Tuesday, following a slump to the 1.2500 area in Asian trading. The pair finds footing amid a retreat in the US Dollar as markets look past Trump tariff threats, bracing for BoE Pill's speech and Fed Minutes.

Gold price defends $2,600 ahead of FOMC minutes; not out of the woods yet

Gold price retains its negative bias for the second straight day and trades just above a one-week low during the first half of the European session on Tuesday. The growing conviction that Donald Trump's expansionary policies will reignite inflation and limit the scope for the Fed to cut interest rates further triggers a fresh leg up in the US Treasury bond yields.

Trump shakes up markets again with “day one” tariff threats against CA, MX, CN

Pres-elect Trump reprised the ability from his first term to change the course of markets with a single post – this time from his Truth Social network; Threatening 25% tariffs "on Day One" against Mexico and Canada, and an additional 10% against China.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.