USD/CAD Price Forecast: Bulls turn cautious ahead of US PCE Price Index, Canadian GDP

- USD/CAD retreats further from a multi-year peak, though bears lack conviction.

- The divergent Fed-BoC policy outlook acts as a tailwind for the currency pair.

- Bearish Oil prices undermine the Loonie and also contribute to limiting losses.

- Traders now look to the US PCE data and Canadian GDP for a fresh impetus.

The USD/CAD pair extends the previous day's retracement slide from the 1.4600 neighborhood, or the highest level since March 2020, and attracts some follow-through selling on Friday. The intraday fall is sponsored by a modest US Dollar (USD) downtick and drags spot prices to the 1.4430 area during the first half of the European session, though any meaningful depreciating move seems elusive.

A generally positive tone around the equity markets fails to assist the safe-haven Greenback to capitalize on this week's recovery from over a one-month low. That said, the Federal Reserve's (Fed) hawkish pause earlier this week, along with expectations that US President Donald Trump's protectionist policies would boost inflation, triggers a modest bounce in the US Treasury bond yields and should support the USD. In fact, the US central bank held interest rates steady at the end of a two-day meeting on Wednesday and signaled that there would be no rush to lower borrowing costs until inflation and jobs data made it appropriate.

Adding to this, Fed Chair Jerome Powell downplayed expectations for future rate cuts during the post-meeting press conference and said that politics would not affect the central bank's interest-rate calls. Powell's remarks reaffirmed the notion that rates will remain higher for longer amid caution over the Trump administration's policies. This marks a big divergence in comparison to the Bank of Canada's (BoC) dovish move to cut interest rates for the sixth time in a row since June and announced an end to its quantitative tightening program. This might continue to weigh on the Canadian Dollar (CAD) and cap the USD/CAD pair.

Meanwhile, Trump reiterated his threat to impose 25% tariffs on Mexico and Canada – the top two US trade partners. Adding to this, a fresh leg down in Crude Oil prices is seen undermining the commodity-linked Loonie and contributing to limiting the downside for the USD/CAD pair. The market focus now shifts to the release of the US Personal Consumption Expenditure (PCE) Price Index, which is the Fed's primary inflation measure and will play a key role in influencing the USD demand in the near term. Apart from this, the Canadian monthly GDP print and Oil price dynamics will provide some impetus to the USD/CAD pair.

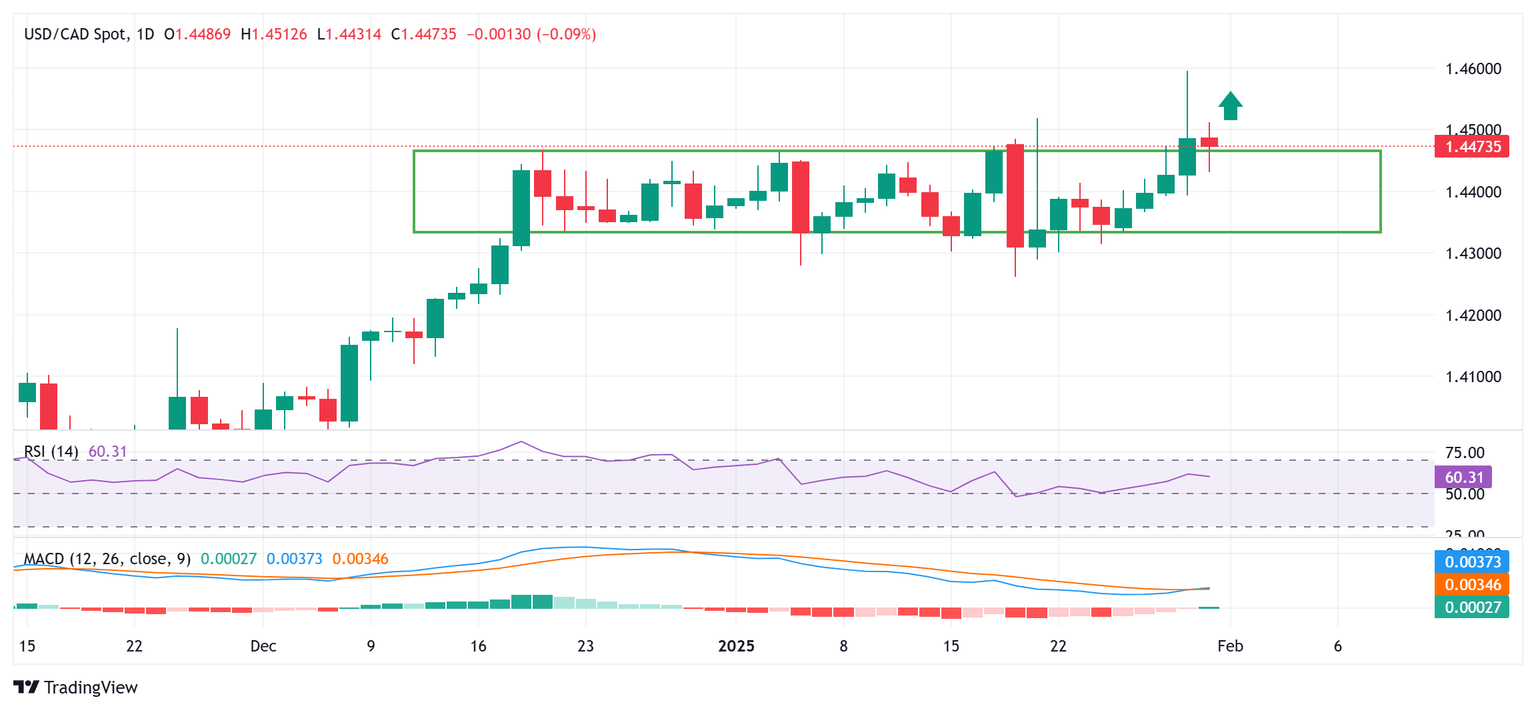

USD/CAD daily chart

Technical Outlook

From a technical perspective, the overnight breakout through over a one-month-old trading range was seen as a key trigger for bullish traders. Moreover, oscillators on the daily chart are holding comfortably in positive territory and are still away from being in the overbought zone. This, in turn, suggests that the path of least resistance for the USD/CAD pair is to the upside. That said, the intraday failure to find acceptance above the 1.4500 psychological mark warrants some caution.

Nevertheless, any subsequent slide is likely to find decent support near the 1.4400-round figure. A convincing break below the said handle could pave the way for a decline towards the 1.4330 horizontal zone en route to the 1.4300 mark. Some follow-through selling will suggest that the USD/CAD pair has topped out in the near term and set the stage for a meaningful corrective fall.

On the flip side, a sustained strength beyond the 1.4500 round figure will reaffirm the near-term positive bias and allow the USD/CAD pair to make a fresh attempt to conquer the 1.4600 mark. The momentum could extend further towards the March 2020 swing high, around the 1.4665-1.4670 region en route to the 1.4700 neighborhood, or January 2016 peak.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.