USD/CAD Price Forecast: Bulls need to wait for sustained strength beyond 50-day SMA

- USD/CAD struggles to capitalize on its recent gains amid mixed fundamental cues.

- Rebounding US bond yields underpin the USD and act as a tailwind for the pair.

- An uptick in Oil prices benefits the Loonie amid reduced BoC rate cut bets and cap gains.

The USD/CAD pair retests a multi-week top on Thursday, though it lacks follow-through buying and trades in neutral territory, around the 1.4335 region during the early European session. The US Dollar (USD) builds on the overnight bounce from over a two-month low touched on Monday amid a pickup in the US Treasury bond yields. Apart from this, concerns about US President Donald Trump's tariff plans weigh on the Canadian Dollar (CAD) and act as a tailwind for the currency pair.

In fact, a White House official said on Wednesday that the March 4 deadline for Trump's announced 25% tariffs on Mexican and Canadian goods remained in effect "as of this moment". Furthermore, Trump ordered an investigation on copper imports to assess whether tariffs should be imposed due to national security concerns. Adding to this, Trump said that his administration will soon announce a 25% tariff on imports from the European Union and new "reciprocal" tariffs for each country.

However, the aforementioned factors, to a larger extent, are offset by reduced bets for another interest rate cut by the Bank of Canada (BoC) in March amid a slight acceleration in Canadian consumer inflation. This, along with a modest recovery in Crude Oil prices underpins the commodity-linked Loonie. Moreover, the USD bulls seem reluctant amid expectations that the Federal Reserve (Fed) will cut interest rates further this year. This contributes to capping gains for the USD/CAD pair.

Traders now look forward to Thursday's US economic docket – featuring the release of the Prelim Q4 GDP print, Durable Goods Orders, Pending Home Sales, and Weekly Initial Jobless Claims. Apart from this, speeches by influential FOMC members will drive the USD demand, which, along with Oil price dynamics, should provide some impetus to the USD/CAD pair. The focus, however, remains glued to the US Personal Consumption Expenditure (PCE) Price Index, due on Friday.

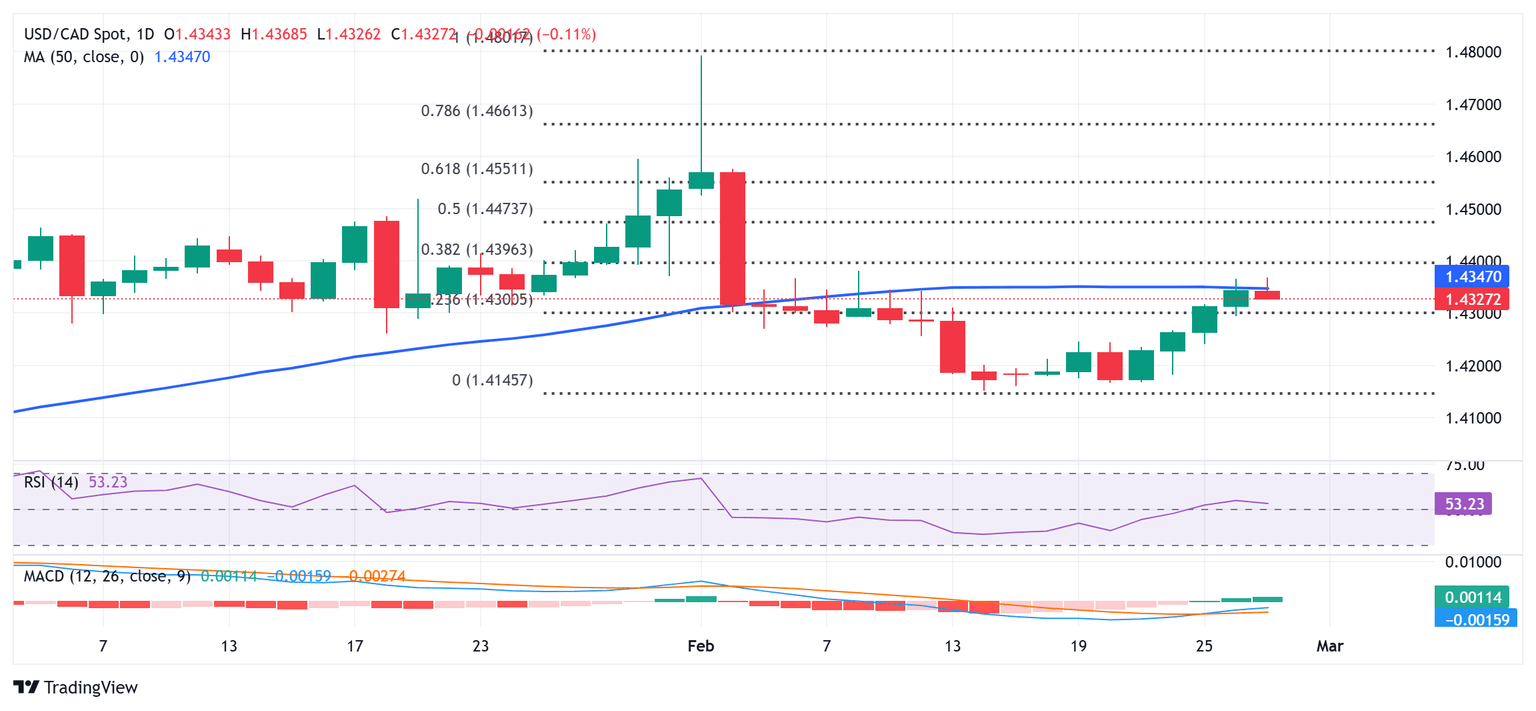

USD/CAD daily chart

Technical Outlook

From a technical perspective, the overnight sustained move and close above the 23.6% Fibonacci retracement level of the recent sharp pullback from a multi-year peak could be seen as a key trigger for bulls. Moreover, oscillators on the daily chart have just started gaining positive traction, suggesting that the path of least resistance for the USD/CAD pair is to the upside. That said, the lack of bullish conviction beyond the 50-day Simple Moving Average (SMA) warrants some caution.

Hence, it will be prudent to wait for some follow-through buying beyond the 1.4365-1.4370 region, or the overnight swing high, before positioning for any further appreciating move. The USD/CAD pair might then aim to reclaim the 1.4400 mark, which coincides with the 38.2% Fibo. level, and climb towards the 1.4470 area, or the 50% Fibo. level. The momentum could extend further beyond the 1.4500 psychological mark, towards the 61.8% Fibo. level around the 1.4545 zone.

On the flip side, the 1.4300 mark, or the 23.6% Fibo. level now seems to protect the immediate downside. A convincing break below could make the USD/CAD pair vulnerable to accelerate the fall towards the 1.4240 intermediate support en route to the 1.4200 mark and the 1.4150 region, or the lowest level since December 12 touched earlier this month. Some follow-through selling would be seen as a fresh trigger for bearish traders and pave the way for an extension of the monthly downtrend.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.