USD/CAD Price Forecast: Bulls need to wait for strength beyond 200-day SMA/1.3600

- USD/CAD stands firm near a two-week high amid a modest USD strength.

- Bullish Crude Oil prices underpin the Loonie and cap gains for the pair.

- Traders now look to this week’s key releases before placing directional bets.

The USD/CAD pair attracts buyers for the fourth straight day on Monday and trades just below the 1.3600 mark, or over a two-week high during the early European session. The uptick is sponsored by a bullish US Dollar (USD), which stands tall near a seven-week high amid expectations for a less aggressive policy easing by the Federal Reserve (Fed). Against the backdrop of Fed Chair Jerome Powell's relatively hawkish remarks last week, the upbeat US employment details released on Friday forced investors to further scale back their bets for an oversized interest rate cut at the November FOMC meeting.

In fact, the headline NFP print showed that the economy added 254K jobs in September, surpassing even the most optimistic estimates, while the Unemployment Rate slipped to 4.1% from 4.2% in the previous month. Additional details of the report indicated that there were 72K more jobs added in July and August than previously reported, pointing to a still resilient labor market and that the economy is in a much better shape. Furthermore, higher-than-expected growth in the Average Hourly Earnings revived inflation fears and backed the view that the Fed will not need to cut interest rates sharply.

In contrast, the markets have been pricing in the possibility of a larger, 50 basis points (bps) interest rate cut by the Bank of Canada (BoC) amid signs of economic weakness. This, in turn, is seen undermining the Canadian Dollar (CAD) and lending additional support to the USD/CAD pair. Meanwhile, concerns about supply disruptions from the Middle East keep Crude Oil prices elevated near a five-week top, which could offer some support to the commodity-linked Loonie and act as a headwind for the currency pair. Traders might also prefer to wait on the sidelines ahead of this week's key releases.

The minutes of the September FOMC policy meeting will be published on Wednesday, ahead of the latest US consumer inflation figures on Thursday. Apart from this, the US Producer Price Index (PPI) Index on Friday will be looked upon for cues about the Fed's rate-cut path and drive the USD demand. Investors will also confront the release of Canadian monthly employment details on Friday, which, along with Oil price dynamics, should provide meaningful impetus to the USD/CAD pair. Nevertheless, the fundamental backdrop supports prospects for a further near-term appreciating move for spot prices.

Technical Outlook

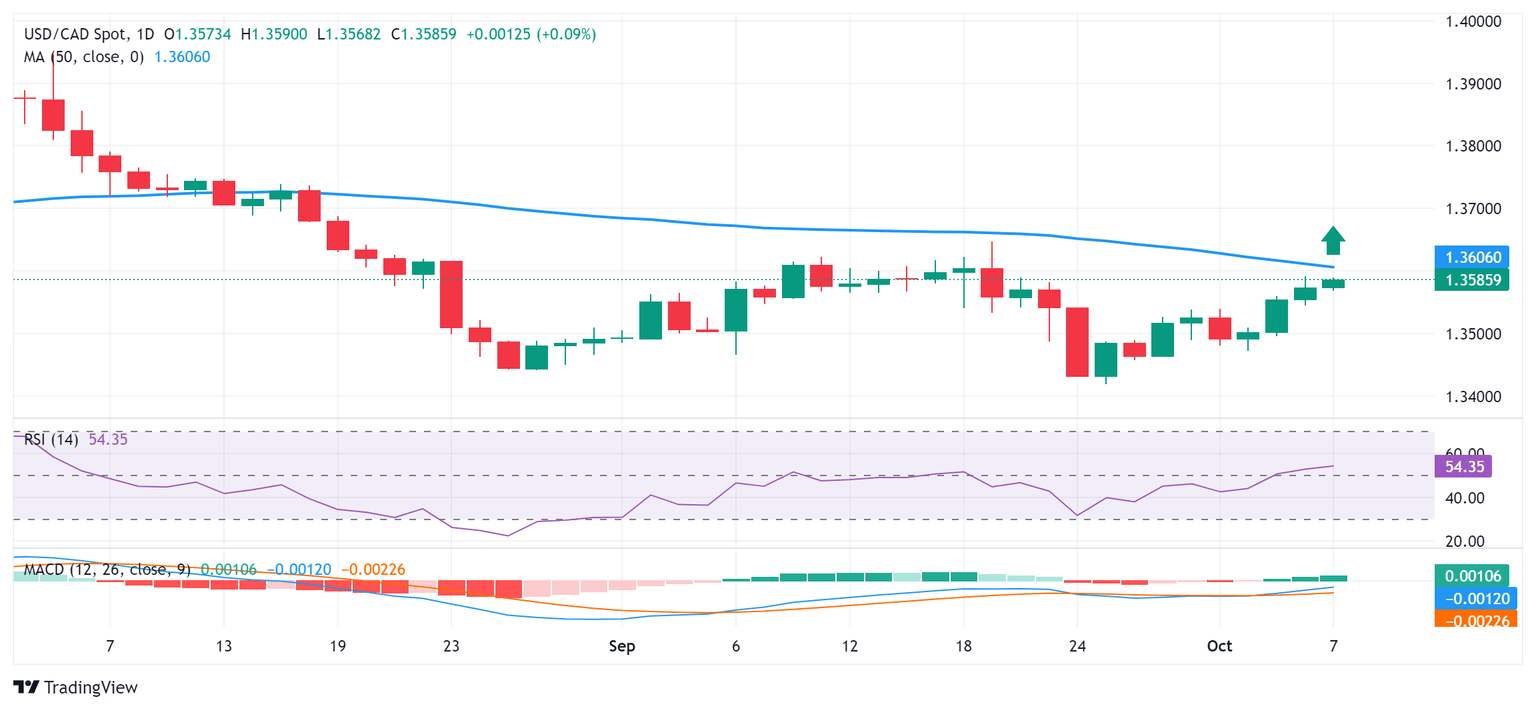

From a technical perspective, bulls need to wait for sustained strength and acceptance above the 200-day Simple Moving Average (SMA) hurdle, currently pegged near the 1.3600 mark, before placing fresh bets. Given that oscillators on the daily chart have just started gaining positive traction, the USD/CAD pair might then climb beyond the 1.3615-1.3620 supply zone and test the September swing high, around the 1.3645-1.3650 region. The subsequent move-up should allow spot prices to aim back to reclaim the 1.3700 round figure.

On the flip side, Friday’s swing low, around the 1.3540 area, now seems to protect the immediate downside ahead of the 1.3500 psychological mark. Some follow-through selling below the 1.3475-1.3470 area would expose the multi-month low, around the 1.3420 region. The latter is closely followed by the 1.3400 round figure, which if broken decisively should pave the way for the resumption of the recent well-established downtrend witnessed over the past two months or so.

USD/CAD daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.