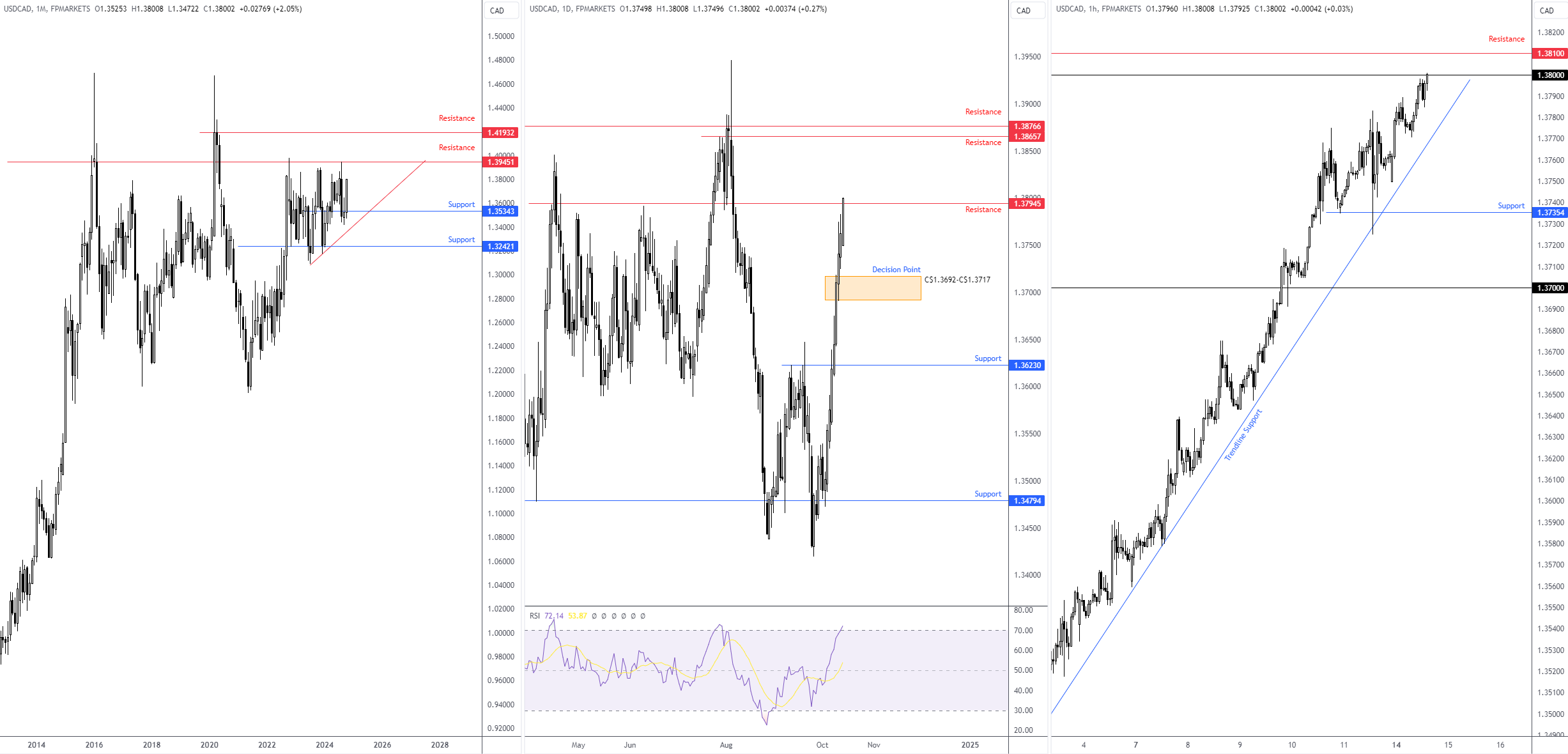

Month to date, the USD/CAD currency pair (US dollar versus the Canadian dollar) is up 2.0% and testing monthly highs.

Monthly price action suggests further upside ahead

The monthly timeframe exhibits scope to explore higher terrain until reaching resistance at C$1.3945, following a rebound from a support zone around C$1.3534. Technically, the pair has been hampered by said resistance since October 2022. However, sellers have been largely unwilling to commit, thus suggesting an eventual breakout to the upside and shining light on another layer of resistance at C$1.4193.

Daily resistance could hinder buying

Meanwhile, price action on the daily timeframe shows the unit testing the mettle of resistance coming in at C$1.3795. Beneath here, a decision point area is seen at C$1.3692-C$1.3717, while a break above current resistance could have the currency pair knocking on the door of a resistance zone between C$1.3877 and C$1.3866. Although the monthly timeframe suggests a break above daily resistance is likely, the daily chart’s Relative Strength Index (RSI) has recorded overbought conditions.

Shorter-term flow on the H1 timeframe, as you can see, has been working closely with picture-perfect trendline support since the beginning of October (extended from the low of C$1.3472). As of writing, buyers and sellers are squaring off just south of C$1.38 (the figure) and neighbouring resistance at C$1.3810; note also that upside momentum has slowed since last Thursday.

H1 structure is key

While monthly flows suggest further outperformance, the daily timeframe’s resistance at C$1.3795 (and the RSI indicating overbought conditions) may concern buyers. To help determine short-term direction, H1 trendline support and C$1.38 will be key levels to watch.

A noteworthy break above the big figure (and C$1.3810 resistance) would imply bullish strength (in line with monthly flow), and continuation moves toward at least H1 resistance from C$1.3848. At the same time, defending H1 resistance and prompting a breakout below the H1 trendline support indicates daily resistance may invite profit-taking and a possible dip to at least H1 support from C$1.3735 or C$1.37 (the figure).

This material on this website is intended for illustrative purposes and general information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP Markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for Difference (CFDs) are derivatives and can be risky; losses can exceed your initial payment and you must be able to meet all margin calls as soon as they are made. When trading CFDs you do not own or have any rights to the CFDs underlying assets.

FP Markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative. A Product Disclosure Statement for each of the financial products is available from FP Markets can be obtained either from this website or on request from our offices and should be considered before entering into transactions with us. First Prudential Markets Pty Ltd (ABN 16 112 600 281, AFS Licence No. 286354).

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.