USD/CAD Outlook: Traders seem non-committed near 1.3200 ahead of Canadian CPI, US Retail Sales

- USD/CAD seesaws between tepid gains/minor losses through the first half of trading on Tuesday.

- An uptick in Oil prices underpins the Loonie and acts as a headwind amid renewed USD selling.

- Investors now look to the Canadian consumer inflation and US Retail Sales for a fresh impetus.

The USD/CAD pair struggles to gain any meaningful traction on Tuesday and oscillates in a narrow trading band, around the 1.3200 mark heading into the European session. A modest uptick in Crude Oil prices underpins the commodity-linked Loonie, which, along with the emergence of fresh selling around the US Dollar (USD), caps the upside for the major..

The possibility of more stimulus measures from China to support the fragile domestic economy lifts expectations for a strong fuel demand recovery in the world's largest importer. In fact, the National Development and Reform Commission (NDRC) - China's top economic planner - pledged that it would roll out policies to restore and expand consumption without delay as consumers' purchasing power remained weak. This helps offset the weaker incoming Chinese macro data and lends support to Oil prices. It is worth recalling that the National Bureau of Statistics of China reported on Monday that the economic growth decelerated substantially in the second quarter and Retail sales - a gauge of consumption - slowed sharply in June,

The US Dollar (USD), on the other hand, drifts back closer to its lowest level since April 2022 touched last Friday and continues to be weighed down by firming expectations that the Federal Reserve (Fed) will soon end its policy tightening cycle. Market participants seem convinced that the US central bank will keep interest rates steady after the highly-anticipated 25 bps lift-off at its upcoming policy meeting on July 25-26. This leads to a further decline in the US Treasury bond yields and continues to weigh on the Greenback. That said, persistent concerns over a global economic slowdown might limit losses for the safe-haven buck.

Investors, however, seem septic if the Fed will commit to a more dovish policy stance or stick to its forecast for a 50 bps rate hike this year. This might hold back traders from placing aggressive bearish bets around the USD and act as a tailwind for the USD/CAD pair ahead of Tuesday's key macro releases - the latest Canadian consumer inflation figures and the US monthly Retail Sales later during the early North American session. The US economic docket also features Industrial Production data, which, along with the US bond yields and the broader risk sentiment, will drive the USD demand and provide some impetus to the major. Apart from this, traders will further take cues from Oil price dynamics to grab short-term opportunities.

Technical Outlook

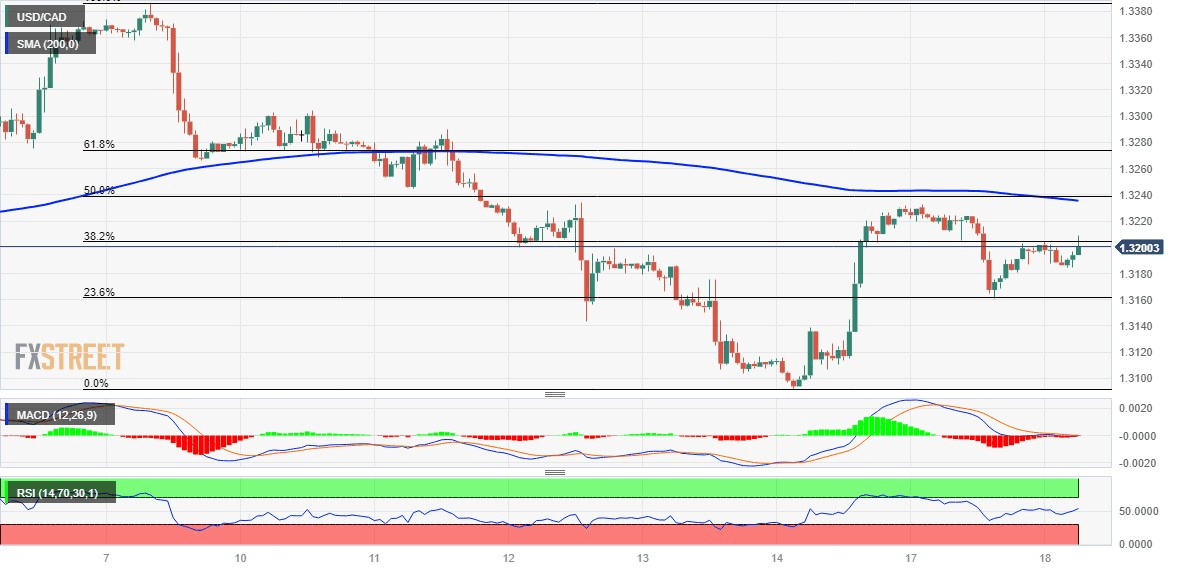

From a technical perspective, the overnight modest decline finds some support ahead of the 23.6% Fibonacci retracement level of the post-NFP rejection slide from the 50-day Simple Moving Average. The subsequent move up back above the 38.2% Fibo. level supports prospects for a further intraday appreciating move. Moreover, oscillators on hourly charts have just started gaining positive traction and validate the positive outlook. Hence, a move back towards testing the 1.3235 confluence, comprising the 200-hour SMA and the 50% Fibo. level, looks like a distinct possibility. Some follow-through buying should allow the USD/CAD pair to climb to the 1.3280-1.3285 region. This is closely followed by the 1.3300 mark, above which bulls might aim back to challenge the 50-day SMA resistance, currently pegged around the 1.3350 region.

On the flip side, the overnight swing low, around th 1.3160 area, nearing the 23.6% Fibo. level, might now protect the immediate downside, below which the USD/CAD pair could accelerate the slide back towards the 1.3100 mark. Acceptance below the said handle will be seen as a fresh trigger for bearish traders and drag spot prices towards the 1.3060 intermediate support en route to the 1.3000 psychological mark. The downward trajectory could get extended further towards the 1.2940-1.2935 support before the pair eventually drops to the 1.2900 round figure.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.