USD/CAD is reversing south [Video]

![USD/CAD is reversing south [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDCAD/canadian-dollars-57161236_XtraLarge.jpg)

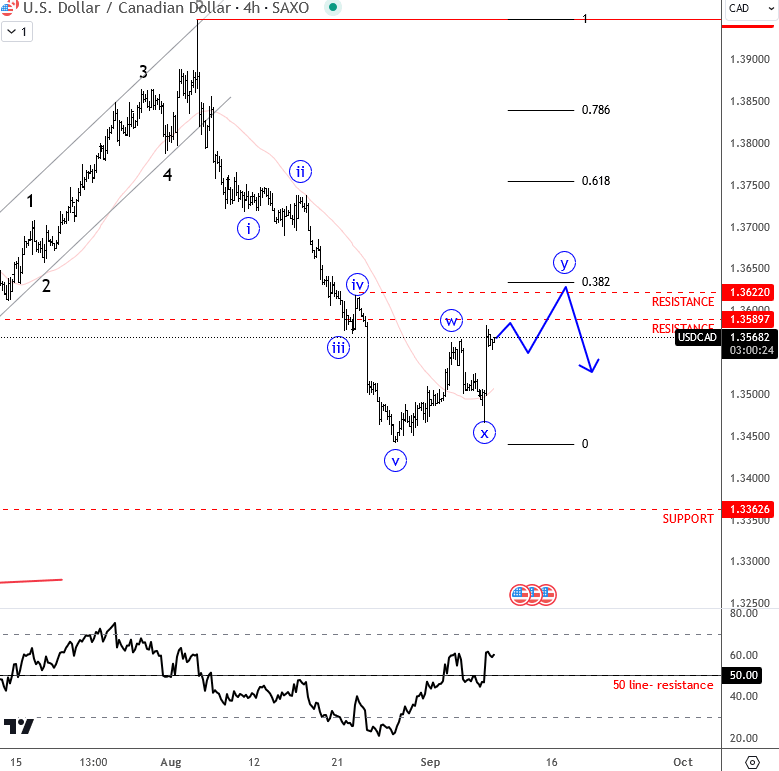

USDCAD is reversing south after an unsuccessful push above 2022 highs, so it appears that pair is back in the range. Currently, we see price coming down impulsively from the upper side of a big 2 year range. As such, more downside will be expected after current rally, which now looks like a higher degree correction as price makes a higher swing low on Friday, suggesting that rally is now a counter-trend, but will ideally stop at 1,36 resistance, or ideally close to 38.2% Fib, at 1.3620.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.