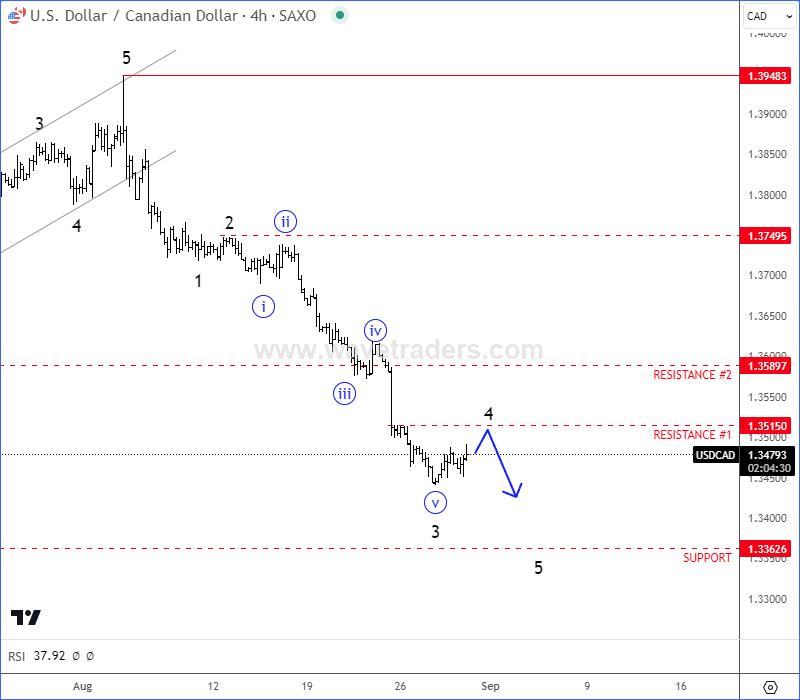

USD/CAD is falling in an impulsive five-wave cycle

USDCAD is coming down impulsively from the upper side of a big 2-year range, so be aware of more weakness, possibly still within a bearish extended five-wave drop, as the latest decline suggests that this is third wave. As such, more downside will be expected after the fourth wave rally. Resistance is at 1.3515 - 1.3590, from where we should be aware of a continuation lower towards 1.3360 strong support area.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.