With both the US and Canada set to release employment figures at 14:30 GMT, USD/CAD warrants a look.

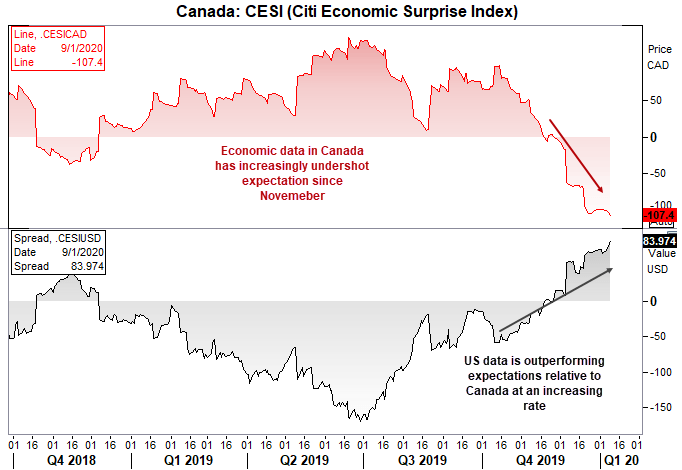

Data has generally undershot expectation for Canada since the end of November. Given BOC have a base rate of 1.75%, it appears to be only a matter of time before they’re forced to lower rates. Yet Poloz seems to think otherwise.

Despite dovish remarks from Assistant Governor Wilkinson in November, Governor Poloz refused to play along and has retained his neutral stance in the face of weak data, even as recently as yesterday’s ‘fireside’ talk. (Personally, I think ‘Poloz and friends’ would make a great title, but hey).

Citing ‘bad weather and strikes’ as a source for weak Q4 data, Poloz also thinks that business investment may be much stronger than originally anticipated. If so, then we’ll have to revise our expectations for BOC to cut, but it doesn’t change the fact that the US data is outperforming expectations relative to Canada. And this could place upside pressure on USD/CAD if this trend persists.

In last month’s employment report, Canadian unemployment rose to 5.9% (5.8% prior, 16-month high) and 71.2k lost making it the largest monthly drop since 2009. So for CAD’s perspective, this is what to watch out for:

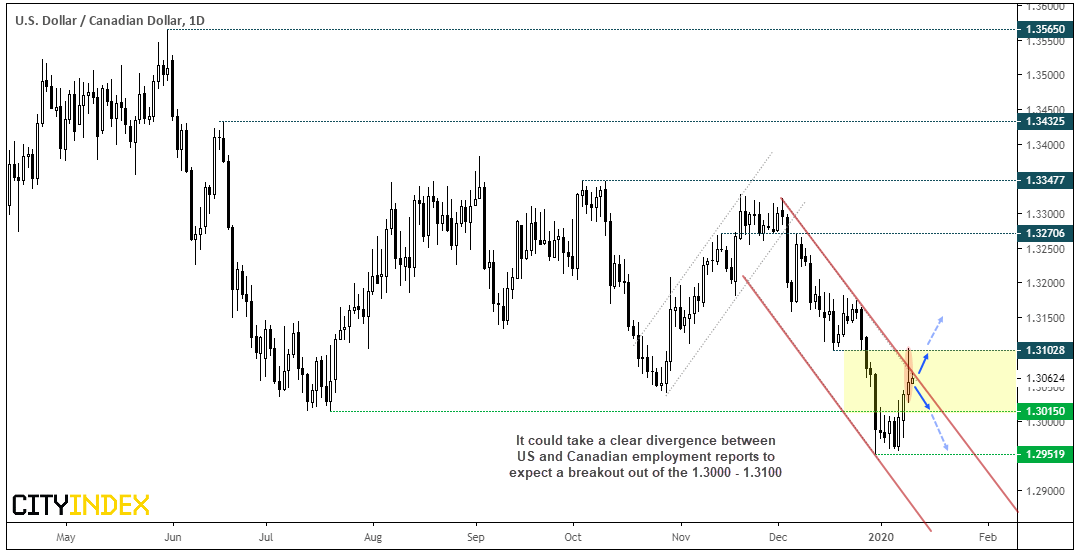

USD/CAD Bullish: If unemployment remains at or above 5.9% and we see another large decline in jobs, it suggests that November’s data was not an outlier and there could be worse to come. If this is coupled with an okay (or better) employment set from the US, we’d expect USD/CAD to break above 1.3103 with relative ease

USD/CAD bearish: However, expectations are for unemployment to revert to 5.8% and see +25k jobs added. We shouldn’t even need to see data exceeded expectations for this to be CAD positive (USD/CAD negative) as it suggests that November’s report was an outlier and that Poloz may be right to keep his neutral stance. Obviously, if this is coupled with stronger than expected data from Canada and weaker from the US, it only adds to the bearish case for USD/CAD.

USD/CAD Daily: Wednesday’s close above the 2019 low showed that mean reversion was underway, with yesterday’s high breaching the December trendline and testing 1.3103 resistance. However, the bearish hammer closed beneath the trendline and shows a hesitancy to move higher ahead of today’s employment line-up. Trading around mid-way between 1.3000 – 1.3100, we could find prices remains between this zone if reports from US and Canada are mixed. It will therefore likely take a clear divergence between the US and Canadian employment reports to see the 1.3015 – 1.3100 range be broken today.

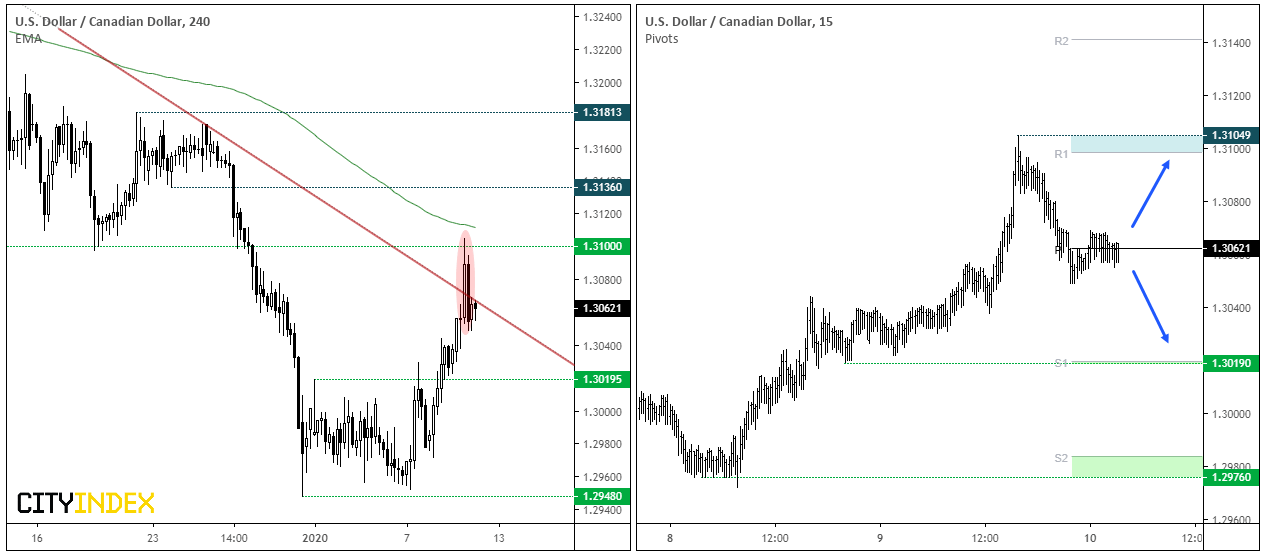

USD/CAD Intraday: A bearish engulfing candle / 2-bar reversal has formed on the 4-hour chart. The 1.3100 handle held and there’s also the 200-period eMA just above, so it could take a strong US beat and CA miss for these levels to break with conviction.

Switching to the 15-minute chart, it’s worth noting that prices remain anchored to the pivot point S1 and R1 sit on structural levels. This provides a clear range for intraday traders to consider trading within, with a relatively unobscured view.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD holds on to intraday gains after upbeat US data

EUR/USD remains in positive ground on Friday, as profit-taking hit the US Dollar ahead of the weekend. Still, Powell's hawkish shift and upbeat United States data keeps the Greenback on the bullish path.

GBP/USD pressured near weekly lows

GBP/USD failed to retain UK data-inspired gains and trades near its weekly low of 1.2629 heading into the weekend. The US Dollar resumes its advance after correcting extreme overbought conditions against major rivals.

Gold stabilizes after bouncing off 100-day moving average

Gold trades little changed on Friday, holding steady in the $2,560s after making a slight recovery from the two-month lows reached on the previous day. A stronger US Dollar continues to put pressure on Gold since it is mainly priced and traded in the US currency.

Bitcoin to 100k or pullback to 78k?

Bitcoin and Ethereum showed a modest recovery on Friday following Thursday's downturn, yet momentum indicators suggest continuing the decline as signs of bull exhaustion emerge. Ripple is approaching a key resistance level, with a potential rejection likely leading to a decline ahead.

Week ahead: Preliminary November PMIs to catch the market’s attention

With the dust from the US elections slowly settling down, the week is about to reach its end and we have a look at what next week’s calendar has in store for the markets. On the monetary front, a number of policymakers from various central banks are scheduled to speak.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.