- The Canadian Dollar had a turbulent week with rising trade tensions and jobs data.

- A light Canadian calendar leaves the limelight to trade

- The technical picture remains indecisive after the recent swings.

This was the week: trade wars, wild reaction to the jobs report

The imposition of steel and aluminum tariffs by the US on Canada already raised the tension and hurt the Canadian Dollar. Top Economic Adviser at the White House Larry Kudlow, aggravated the situation by suggesting that Trump may opt for bilateral agreements with Canada and Mexico rather than the trilateral NAFTA deal. Trump's tirade of tweets against Canada exacerbated the situation.

Canada's jobs report triggered a whipsaw action in the USD/CAD. For the second consecutive month, Canada lost jobs: 7,500 in May after 1,100 in April. The loonie initially dropped but found a significant silver lining: wage growth jumped to 3.9% YoY, far above expectations. The Canadian Dollar is reacting more and more to wages rather jobs.

Bank of Canada Stephen Poloz did not rock the boat with the Financial System Review and the disappointing Ivey PMI, which came out at 62.5, was good enough to be shrugged off. Canada's trade balance deficit shrank to -1.9 billion, better than expected.

In the US, the ISM Non-Manufacturing PMI exceeded expectations with 58.6 points ahead of the Fed.

All in all, trade and the jobs report dominated the scene.

Canadian events: Light calendar leaves eyes on trade

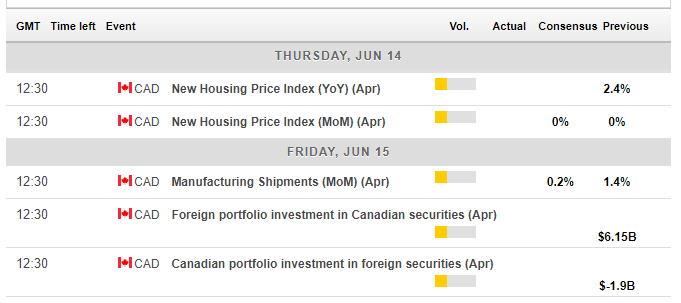

Markets could continue digesting the Canadian jobs report early in the week as the first noteworthy indicators are published only on Thursday. The New Housing Price Index showed an annual gain of 2.4% in March. The housing sector remains sensitive. On Friday, Manufacturing Shipments are likely to show a modest increase in April after a robust rise of 1.4% in March. Foreign investments may also be of interest.

The light economic calendar leaves the focus on the primary market mover: NAFTA. The acrimonious tones may wane initially as Trump will be focused on the historic Summit with Trump. Yet every day that passes by gets us closer to the Mexican elections. The leading candidate, Andres Manuel Lopez Obrador, may have a tougher approach, adding onto Trump's combative one.

Any headlines related to NAFTA negotiations or the tariffs on steel and aluminum could have a significant impact on the Canadian Dollar. Canada is very much dependent on trade with the US and uncertainty weighs on the economy and could deter the Bank of Canada from raising rates in its July meeting.

Here is the Canadian calendar for this week.

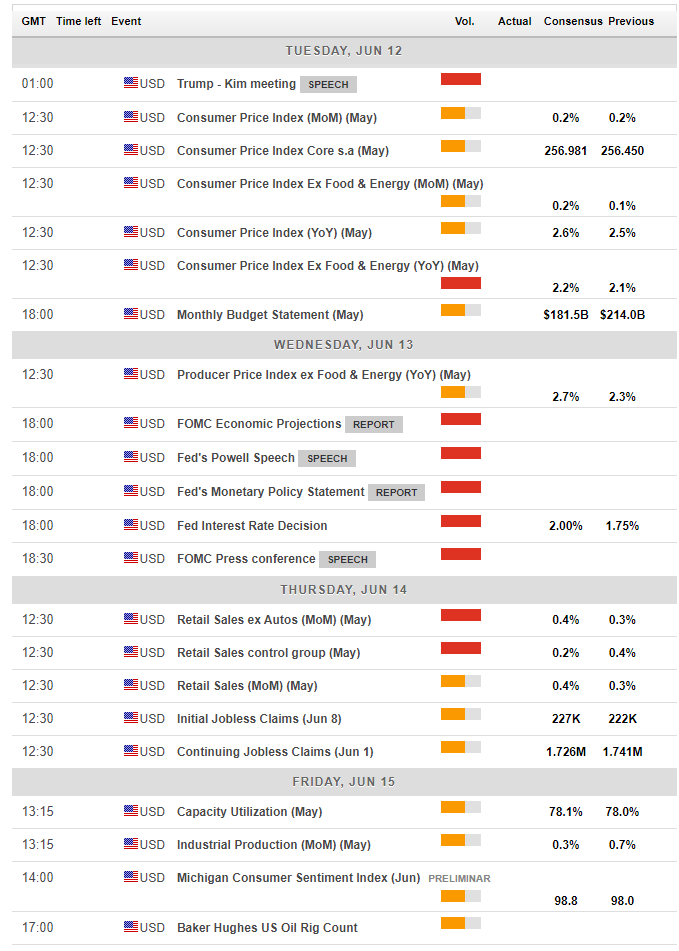

US events: Trump-Kim Summit, the Fed, and two top-tier figures

The historic Summit between North Korean Leader Kim Jong-un and President Donald Trump will have indirect implications for the Canadian Dollar. As a risk currency, the loonie will rise on a successful Summit that will advance the peace process, and it may fall on failure or an abrupt breakup of talks.

The inflation report on Tuesday is expected to show an acceleration in Core CPI to 2.2% in May. Such a move would lift the US Dollar and could tilt the Fed towards a more hawkish tone. A deceleration in prices may have the opposite effect.

The focus then shifts to the Federal Reserve, which is set to raise interest rates, but may hint that the next move is due only in December. The dot-plot and other forecasts will be closely watched, as well as Fed Chair Jerome Powell's press conference. The FOMC may opt for removing the phrase about maintaining accommodative monetary policy, a move that may perk up the greenback.

One last top-tier event awaits the Retail Sales report. The all-important Control Group stood at 0.4% last time an may see a slower growth rate. The headline number is projected to show a faster growth rate.

Industrial Production and the Consumer Sentiment on Friday may also have some influence if they move in the same direction.

Here are the critical American events from the forex calendar:

USD/CAD Technical Analysis - Bullish Bias

The pair enjoys upside Momentum, the rise above 50, indicating further gains, and the pair trades well above both the 50-day Simple Moving Average and the 200-day one.

The psychological level of 1.3000 level remains a battleground. 1.3050 capped the pair several times in May and served as support back in March. 1.3125 was the peak seen in mid-March. Further above, 1.3180 carries some weight due to a past role, and 1.3320 looms overhead.

1.2930 capped the pair early in May and provided some support in early June. 1.2860 was a swing low on June 6th and also held the pair down in late April. 1.2810 was a low point on May 31st. Further down, the 1.2730-1.2750 region served as a cushion in mid-May.

Where next for USD/CAD?

US President Trump's growing isolationist stance has the worst impact on Canada which is dependent on commerce with the US, and the C$ is not reflecting the full brunt of the shift in policy. Also, the recent loss of jobs is bad news despite the rise in inflation. So is the weak GDP reported in the previous week. The BOC may refrain from raising rates as the Fed continues its hikes. All in all, we could see another down week for the loonie, another up week for the USD/CAD.

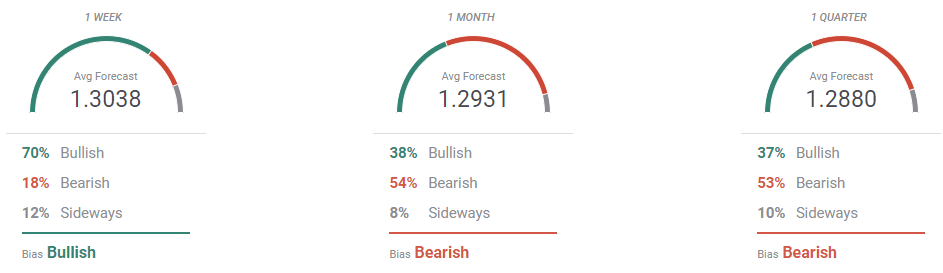

The FXStreet Forecast Poll shows a bullish bias in the short term, similar to the views expressed here.

More: 5 critical events in 50 hectic hours - everything you need to know

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-636640640346150899.png)