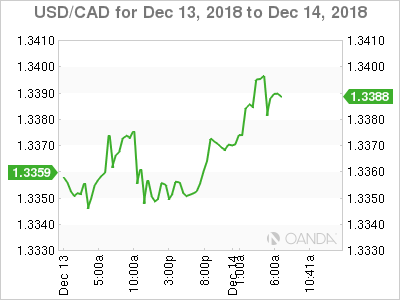

The Canadian dollar has ticked lower in the Friday session. Currently, USD/CAD is trading at 1.3389, up 0.24% on the day. On the release front, there are no Canadian events. In the U.S, the spotlight is on consumer spending. Retail sales and core retail sales are expected to drop sharply, with forecasts of 0.2% and 0.1%, respectively.

It has been a rough few weeks for the Canadian dollar. The currency has been under pressure since mid-November, losing 1.1 percent during the time. Weaker oil prices and a cooling U.S. economy have hampered Canada’s economy, and the BoC responded last week by remaining on the sidelines and maintaining interest rates.

In the U.S, weak inflation levels are another sign that the economy is slowing down. CPI dropped to 0.0% in November, down from 0.3% a month earlier. This marked the lowest level since May. Core CPI remained pegged at 0.2 percent. The weak readings can be attributed to falling oil prices, which has led to a sharp decline in gasoline prices. On an annualized basis, inflation gained 2.2 percent in November, down from 2.5 percent in October. With the U.S. economy showing signs of slowing down, and the global trade war taking a bite out of the global economy, inflation could continue to head lower as we head into 2019. This has led to a reassessment at the Federal Reserve of monetary policy. Earlier in the year, the Fed was sending messages that it would raise rates three or four times next year. This has been drastically scaled back, with some analysts predicting only one rate hike in 2019.

USD/CAD Fundamentals

Friday (December 14)

-

8:30 US Core Retail Sales. Estimate 0.2%

-

8:30 US Retail Sales. Estimate 0.1%

-

9:15 US Capacity Utilization Rate. Actual 78.6%

-

9:15 US Industrial Production. Estimate 0.3%

-

9:45 US Flash Manufacturing PMI. Estimate 55.1

-

9:45 US Flash Services PMI. Estimate 54.7

-

10:00 US Business Inventories. Estimate 0.6%

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3198 | 1.3292 | 1.3383 | 1.3461 | 1.3552 | 1.3696 |

USD/CAD posted small gains in Asian trade and this trend has continued in the European session

-

1.3383 was tested earlier in support and is a weak line

1.3461 is the next resistance line

Current range: 1.3383 to 1.3461

Further levels in both directions:

-

Below: 1.3383, 1.3292, 1.3198 and 1.3099

-

Above: 1.3461, 1.3552 and 1.3696

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD stays in daily range slightly below 1.0900

EUR/USD continues to move up and down in a narrow band slightly below 1.0900 in the second half of the day on Monday. The modest improvement seen in risk mood makes it difficult for the US Dollar to find demand and helps the pair stay in range.

GBP/USD treads water above 1.2900 amid risk recovery

GBP/USD is keeping its range play intact above 1.2900 in the American session on Monday. The positive shift seen in risk sentiment doesn't allow the US Dollar to gather strength and helps the pair hold its ground ahead of this week's key data releases.

Gold extends slide below $2,400

Gold stays under persistent bearish pressure after breaking below the key $2,400 level and trades at its lowest level in over a week below $2,390. In the absence of fundamental drivers, technical developments seem to be causing XAU/USD to stretch lower.

Crypto Today: Bitcoin is less than 10% away from all-time high as Ethereum ETF approval anticipation brews

Bitcoin trades around $68,000 early on Monday, less than 10% away from its all-time high of $73,777 on Binance. Ethereum ETF anticipation brews among traders and Ether investment products see inflow of over $45 million in the past week.

Election volatility and tech earnings take centre stage

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

The US Dollar managed to end the week higher as Trump Trades ensued. Safe-havens CHF and JPY were also higher while activity currencies such as NOK and NZD underperformed.