USD/CAD Elliott Wave technical analysis [Video]

![USD/CAD Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/USDCAD/background-of-canadian-fifty-and-hundred-dollar-bills-2910964_XtraLarge.jpg)

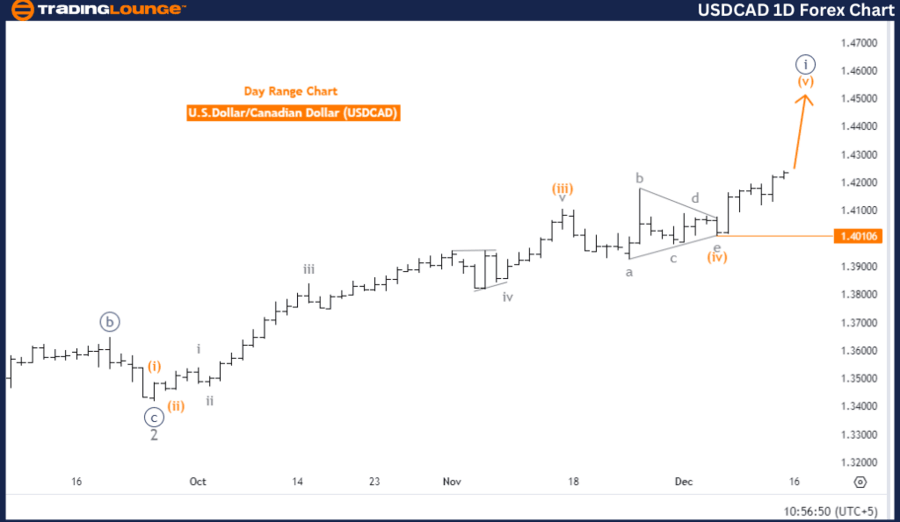

USD/CAD Elliott Wave technical analysis

-

Function: Bullish Trend.

-

Mode: Impulsive.

-

Structure: Orange Wave 5.

-

Position: Navy Blue Wave 1.

-

Direction for next lower degrees: Navy Blue Wave 2.

Details

- Current Status:

- Orange wave 4 appears completed.

- Orange wave 5 of navy blue wave 1 is in progress.

- Invalidation Level: 1.40106 (A drop below this level invalidates the current Elliott Wave structure).

Analysis overview

The USDCAD daily chart indicates a bullish trend, based on Elliott Wave analysis. The chart's current mode is impulsive, reflecting robust upward momentum within the wave structure.

Key highlights

-

Wave progression:

-

Orange wave 5 is developing within the broader navy blue wave 1 structure.

-

Completion of orange wave 4 has paved the way for sustained upward movement in orange wave 5.

-

-

Final phase:

- Orange wave 5 marks the final phase of navy blue wave 1, typically associated with strong bullish sentiment.

-

Upcoming corrective phase:

- The next phase is expected to be navy blue wave 2, signaling a potential corrective retracement in the larger impulsive sequence.

Key considerations

-

Bullish sentiment:

Orange wave 5 is actively driving prices higher, underlining a bullish bias. -

Potential reassessment:

If prices drop below the invalid level of 1.40106, it will require revisiting the Elliott Wave structure.

Strategic implications for traders

-

Capitalizing on the trend:

Traders and analysts can align their strategies with this phase of the uptrend, leveraging the bullish momentum of orange wave 5. -

Preparing for corrective wave 2:

Awareness of the impending navy blue wave 2 correction can help in managing risk effectively. -

Close observation:

Monitoring price action and wave progression will be essential for successfully navigating this bullish trend.

This analysis underscores a clear bullish trajectory for USDCAD on the daily chart. Traders should remain alert to price levels and wave developments to optimize their strategies during this phase.

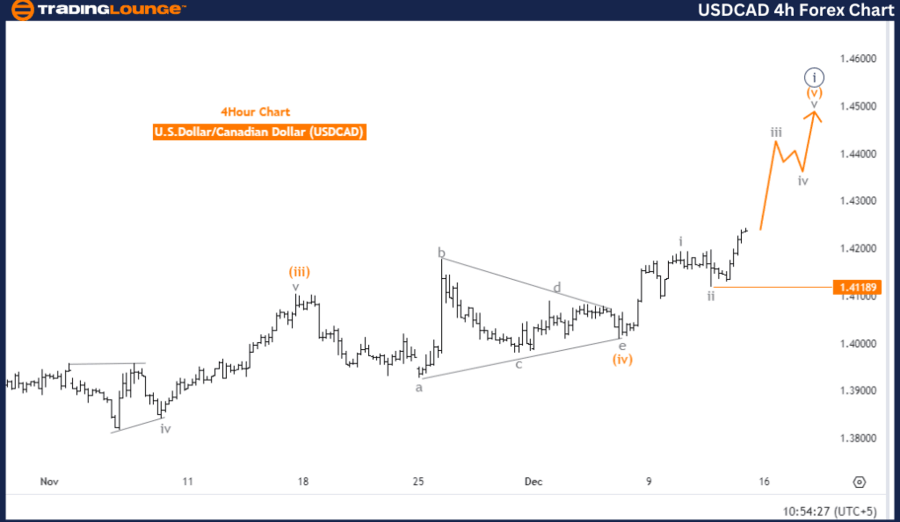

USD/CAD Elliott Wave technical analysis

-

Function: Bullish Trend.

-

Mode: Impulsive.

-

Structure: Gray Wave 3.

-

Position: Orange Wave 5.

-

Direction for next lower degrees: Gray Wave 4.

Details

- Current Status:

- Gray wave 2 appears completed.

- Gray wave 3 is in progress, with the market positioned in orange wave 5.

- Invalidation Level: 1.41189 (A drop below this level invalidates the current Elliott Wave structure).

Analysis overview

The USDCAD 4-hour chart reveals a bullish trend based on Elliott Wave analysis. The impulsive mode indicates strong upward momentum within gray wave 3, which is the centerpiece of the ongoing uptrend.

Key highlights:

-

Wave progression:

- Gray wave 2 is likely complete, initiating the active phase of gray wave 3.

- The market is currently in orange wave 5, marking the final stage of gray wave 3.

-

Upward momentum:

- Gray wave 3 is often characterized by robust and sustained price increases, reflecting strong bullish sentiment.

-

Upcoming correction:

- After the completion of gray wave 3, the next expected phase is gray wave 4, signaling a potential corrective phase within the larger impulsive wave sequence.

Key considerations

-

Bullish sentiment:

The ongoing gray wave 3 phase aligns with a strong upward trajectory, suggesting further price advances. -

Potential reassessment:

A drop below the invalid level of 1.41189 would negate the current Elliott Wave structure and require reevaluation.

Strategic implications for traders

-

Capitalizing on the trend:

The sustained bullish movement in gray wave 3 provides opportunities for traders to align with the uptrend. -

Preparing for gray wave 4:

Awareness of the potential corrective phase following gray wave 3 will help in managing risk and planning exits. -

Monitoring sub-waves:

Tracking the progression of orange wave 5 and key price levels is crucial for effective market navigation.

This analysis highlights the strength of the USDCAD uptrend on the 4-hour chart, offering actionable insights for traders to adapt their strategies to the prevailing bullish dynamics.

USD/CAD Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.