USD/CAD bears could remain in control

-

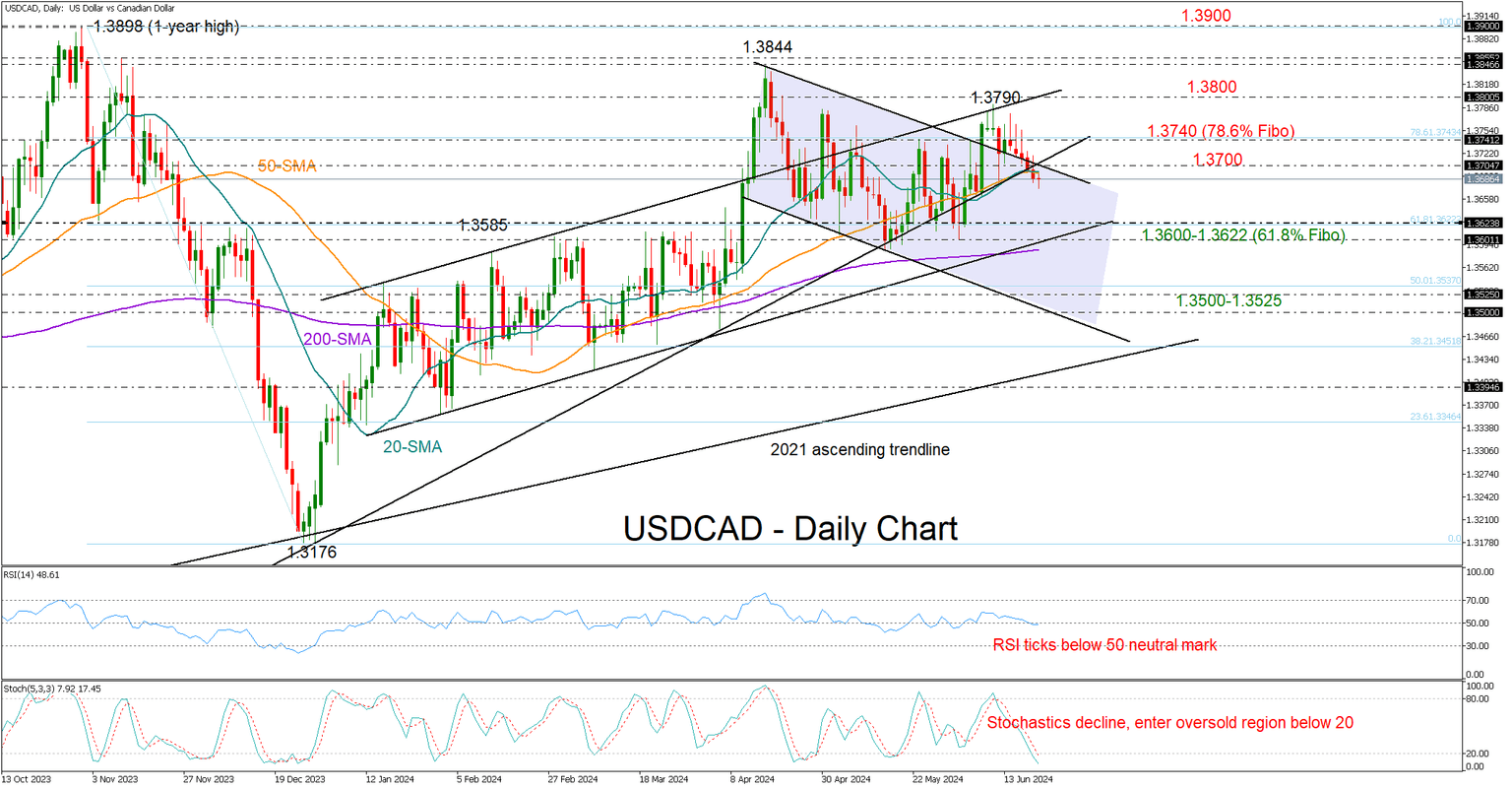

USDCAD eases below 1.3700; could attract new sellers in short-term.

-

Next support could emerge within 1.3600-1.3622 territory.

-

US S&P Global PMIs, Canadian retail sales on the agenda.

USDCAD has been tiptoeing to the downside for five consecutive trading days, increasing speculation that some stability could soon occur.

The technical picture, however, suggests that the bears have more to accomplish. Thursday’s close below the 20- and 50-day simple moving averages (SMAs) and the drop back into the short-term falling channel could raise fresh selling interest in the coming session. Meanwhile, the RSI has ticked below its 50 neutral mark and the stochastic oscillator, although within the oversold region, has yet to bottom out, both signaling more downside ahead.

If the bearish scenario plays out, the pair could seek support somewhere between the 61.8% Fibonacci retracement of the October-December 2023 downtrend at 1.3622 and the lower band of the broad bullish channel at 1.3600. Note that the 200-day SMA is within the neighborhood and a step below it could trigger a new decline towards 1.3500-1.3525.

Alternatively, a bounce above 1.3700 may not excite traders unless the price stretches successfully above the 78.6% Fibonacci mark of 1.3740. If that happens, attention will shift to the 1.3800 level, where the upper boundary of the bullish channel is located. Another victory there could lift the pair up to the 2024 top of 1.3844, while higher, the 2023 peak of 1.3900 could be the next resistance.

Overall, USDCAD remains exposed to more selling in the short-term picture. Unless the pair returns above 1.3700, the bears could next head for the 1.3600-1.3622 region.

Author

Christina joined the XM investment research department in May 2017. She holds a master degree in Economics and Business from the Erasmus University Rotterdam with a specialization in International economics.