US Third Quarter GDP Preview: Must what goes down, come up?

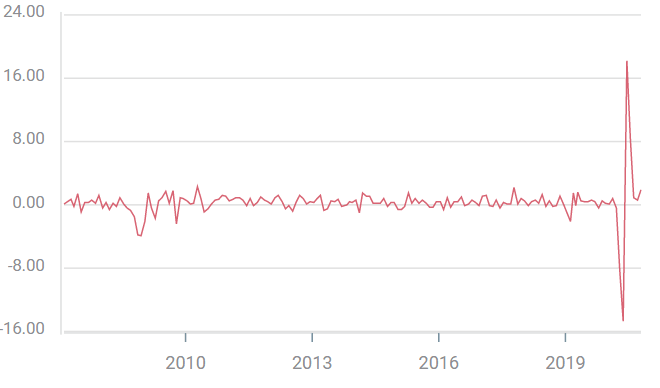

- US GDP growth forecast to set a record at 35% annualized.

- Atlanta Fed GDPNow estimate is 36.2%, its highest for Q3.

- New York Fed's Nowcast estimate is 13.75%.

- Market have priced a sharp increase in GDP.

American economic growth raced ahead in the third quarter after the pandemic lockdown in March and April caused the largest GDP drop in history.

Expansion is expected to reach an annual rate of 35% last quarter after it collapsed at 31.4% in April, May and June.

The closure of much of the US economy under government orders produced a catastrophic fall in employment, 22 million American lost their jobs in the shutdown months and through September just over 50% have returned to work. In the last two weeks of March over 10 million people filed for unemployment benefits and, seven months later on October 16 the weekly filing was still 767,000.

Retail Sales plunged 22.9% in the closure months, spending in the GDP component Control Group fell 9.2%. Durable Goods Orders for long-lasting consumer and business items plummeted 35% and Nondefense Capital Goods, the business investment proxy, dropped 7.9%.

Retail Sales

Pandemic recovery

Surprisingly, the recovery in Retail Sales, the Control Group and Durable Goods Orders has equalled or surpassed the declines suffered in the shutdowns despite the continuing high levels of unemployment and job losses.

Retail Sales have gained 30% in the five months through September. Including the shutdowns in March and April, the average is 1.01% over seven months. The Control Group receipts are 18.1% higher in the same five-month period with a 1.27% average. Either performance would credit a healthy consumer and labor market, in the midst of COVID-19 it is remarkable.

Durable Goods added 36.7% in the five months from May to September which gives just a 1.7% surplus for the total pandemic time from March or a 0.24% average increase. Nondefense Capital Goods, the business investment analog, is up 11.4% since April or a respectable 0.5% monthly rise over the seven-month period.

GDP Projections

Consumer spending is about 70% of US economic activity.

The rapid expected recovery in GDP in the third quarter has been driven by a quick return of consumer and business spending. The surprise has been the level and continuation of the consumer renaissance in the face of 7.9% unemployment and the much higher underemployment rate of 12.8%.

Jobless benefits from Washington and the states have helped to maintain consumption but with the next stimulus bill stalled in election politics, the ability of consumers to maintain these essentially normal levels of spending will come under strain if another relief program is not passed.

The Atlanta Fed's GDPNow model estimates that GDP expanded at 36.2% in the third quarter, and the New York Fed's Nowcast program has a much lower forecast at 13.75%. The consensus view from the Reuters Survey of economists is 35%.

Atlanta Fed GDPNow

Although a strong recovery in the third quarter is priced into the markets there is considerable range in many forecasts. The highly unusual economic events of the last seven months supply a vivid degree of uncertainty and markets are susceptible to any variation from the prediction.

Equities and the credit markets will respond in a linear fashion in either direction as GDP deviates from the forecast.

The dollar has been performing a limited safety role over the past several weeks, falling as perceived risk declines and climbing as risk rises. That dynamic should remain for US GDP. The stronger the US economy is in the third quarter the better for the globe and the less demand for the dollar safety trade. A weaker-than-expected GDP should prompt some modest immigration to the dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.