US Third Quarter GDP Preview: A most uncertain estimate

- GDP forecast to dip sharply to 2.5% in the third quarter.

- Growth in the first quarter was 6.4%, in the second 6.7%.

- Supply-chain, labor market and pandemic problems complicate predictions.

- Federal Reserve to stay the taper course regardless of GDP.

Economic growth in the US appears to have slowed dramatically in the third quarter as labor and supply constraints and lingering pandemic problems hampered operations at firms nationwide. The novelty of more than 10 million unfilled jobs and more than 5 million unemployed, unprecedented government spending, Covid and vaccine fears and a quickly evolving economy have left analysts uncertain about how much damage may have been inflicted on gross domestic product (GDP).

The US government’s first assessment of economic activity will be issued by the Commerce Department on Thursday with the consensus estimate for a 2.5% annualized rate. That contrasts with the 6.7% pace in the second quarter and 6.4% in the first. The range of projections from the Reuters survey is unusually wide from 0.6% up to 5.2%.

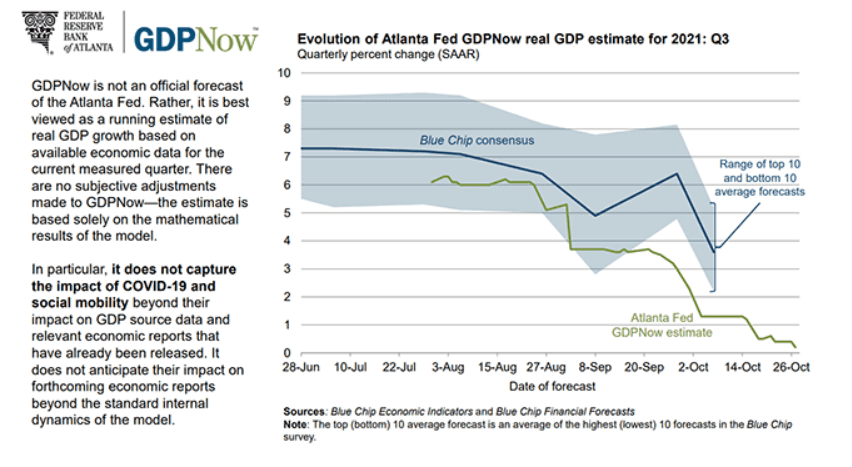

Some estimates of growth have declined steadily as the quarter has advanced.

Economists at the Atlanta Fed track GDP with their widely followed GDPNow model that incorporates statistics as they are released. This forecast began third quarter estimates on July 30 at 6.1%. By September 28 the projection had fallen to 3.0% and two weeks later it had dropped to 0.5%. The October 27 release after Durable Goods Orders brought GDPNow to 0.2%..

The St. Louis Federal Reserve, the proprietor of the widely used FRED economic database, compiles a Real GDP Nowcast that has the third quarter growth running at 6.85%.

Consumption

The figures from the consumer side of the economy are mixed.

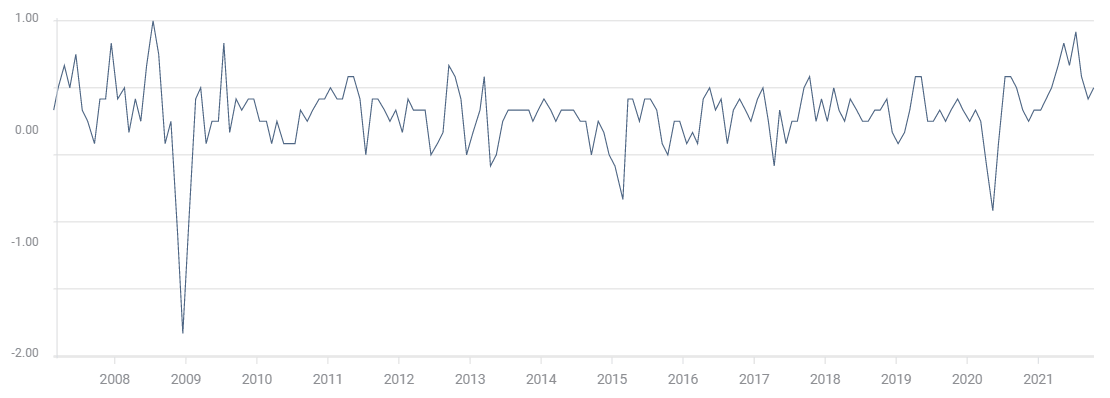

Retail Sales rose in the third quarter but modestly, averaging a 0.17% gain, up from a 0.03% monthly loss in the second quarter.

Retail Sales

FXStreet

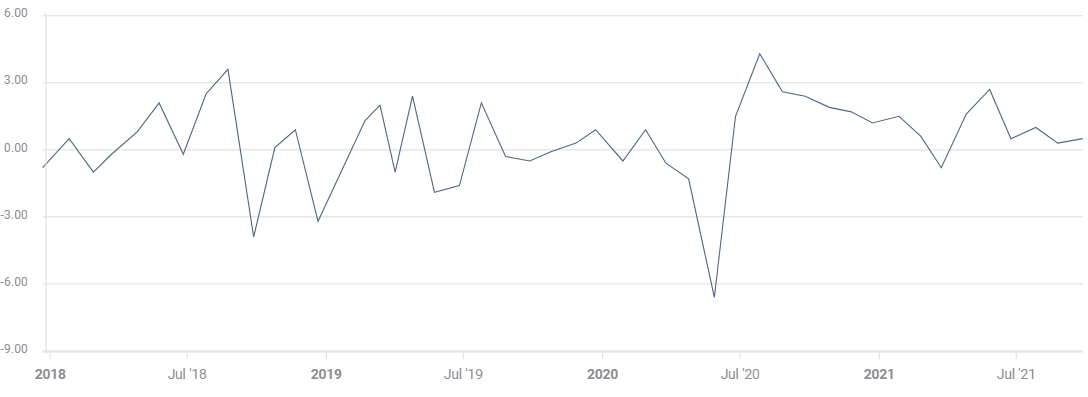

Personal Spending averaged a healthy 0.63% increase in the second quarter. This dropped to 0.35% in the two months of the third quarter which have been reported. September's spending numbers will be issued by the Department of Commerce this Friday, with the consensus estimate for 0.50%.

Personal Spending

FXStreet

But a good portion if not all of the spending increases in July, August and September were due to inflation which averaged 0.40% a month. Prices were even more volatile in the second quarter climbing an average 0.77% a month.

CPI (MoM)

FXStreet

A further complication comes from automobile sales. Vehicle production has been curtailed by the semiconductor shortage with the purchases of light cars and trucks down 21% in the third quarter. Dealer stocks have fallen but with the chip shortage it is uncertain whether the car makers were able to to raise production in the third quarter.

Business spending and inventories

The Durable Goods category Nondefense Capital Goods Orders ex Aircraft is often used as a proxy for business spending. These orders averaged 1.4% a month in the second quarter. In July, August and September that dropped average to 0.53%.

Nondefense Capital Goods Orders

Inventories are used by economists to estimate future production, on the logic that purchases from stockpiles or dealer lots will have to be replaced by manufacturers, guaranteeing a certain level of output. In the government’s calculation a drop in inventories becomes an addition to GDP, but the amount is difficult to compute beforehand.

Business spending appears to have slipped by almost two-thirds from the second quarter to the third, and if that is accurate will compromise GDP.

Trade deficit

In government accounting the trade deficit subtracts from GDP and a surplus adds to it. The US has not had a monthly trade surplus in over a generation so it is not a matter of an absolute value but the variation.

The deficit for goods and services averaged $71.1 billion in the second quarter. In the two reported months of the third the average was $71.8 billion, a 1% increase. September’s deficit is expected to increase to $74.1 billion when it is reported on November 4, as the recovering US economy draws in more goods and services. If that is correct it would bring the quarterly average to $72.6 billion, a 2.1% jump and enough to lower GDP.

Conclusion

The biggest questions for markets are how long will the supply and labor shortages last and will they improve from here or are there deeper problems ahead.

What will be the impact of the trillions of dollars of new spending proposed, but by no means certain, from the Biden administration as it encounters an overheating and unbalanced economy?

Third quarter GDP will be an first exercise in assessing the extent of the economic impact. The wide range of the forecasts for GDP describes just how unusual the situation is and how ill-equipped analysts are to judge without historical guidelines.

We can recall the initial estimates for the labor market last spring around the lockdowns when the collapse and recovery forecasts were in error by factors not percentages. This is not to question economists’ methods but only to point out the difficulty of statistical guesses in new and changing circumstances.

Third quarter GDP is likely an afterthought for the Federal Reserve and its expected taper commencement next Wednesday. Nonetheless, a better than expected reading will support Treasury rates and the dollar and give credence to the idea that the US economy may yet exhibit its traditional resilence. While a worse than anticipated GDP result will change little.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.