US Thanksgiving Wrap: Consumers carry October, November starts to look dicey

- Initial Claims rise for the second week to 778,000.

- Durable Goods Orders, business spending better than forecast in October.

- Fed minutes suggest the FOMC will provide more guidance on bond program.

- Dollar loses ground as vaccine optimism plucks at the safety trade, US data is equivocal.

A triple dose of US data on Wednesday before the Thanksgiving holiday confirmed the strength of the consumer recovery even as employment problems again loom from the rising numbers of Covid-19 closures across the country.

American markets are closed on Thursday and with equities and bonds on an abbreviated session Friday, a long list of information descended on traders on Wednesday.

Durable Goods

Purchases of long-lasting consumer goods jumped in October. Durable Goods orders rose 1.3%, beating the 0.9% forecast and September's total was revised up to 2.1% from 1.9%.

Durable Goods Orders

In the eight months of the pandemic, including the lockdown months of March and April, sales of these more expensive items averaged 0.40% a month. In the eight months from June 2019 to January 2020 the monthly gain was 0.26%.

Durable Orders ex-Transportation climbed 1.3%, more than three times the 0.4% estimate and the prior month almost doubled to 1.5% from 0.8%. These purchases averaged 0.54% in the pandemic and just 0.03% from June last year to January.

Finally, the business spending proxy, Nondefense Capital Goods Orders ex Aircraft added 0.7% in October on a 0.5% prediction and nearly doubled the September gain to 1.9% from 1%. Here also the pandemic increase of 0.64% a month was much stronger than the 0.35% in the eight months to January 2020.

The contrast between the two eight-month periods is striking. From June 2019 to January 2020 the unemployment rate was 3.6%. Durable Goods Orders averaged 0.26% a month and business spending was 0.35%. From March through October this year the mid-point of unemployment was 9.6% yet goods orders averaged 0.40% and business investment was 0.64%.

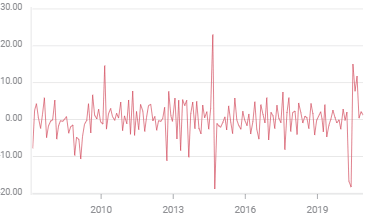

Initial Jobless Claims

Filings for unemployment benefits rose for the second week in a row, 67,000 in total, climbing to 778,000 on November 20 from 748,000 and 711,000 in the prior releases.

Two consecutive increases have happened only once before since claims peaked at 6.867 million in the third week of March. From July 10 to July 24 claims jumped 127,000 from 1.308 million to 1.435 million. Two weeks later they had fallen to 971,000 only to rise to 1.104 million on August 14.

Initial Jobless Claims

Two weeks are not conclusive, but the suspicion is that the newly orders closures of restaurants and other service businesses in several states have laid off enough workers to reverse the direction of the unemployment rolls.

FOMC minutes

The edited minutes of the November 4-5 Federal Open Market Committee meeting confirmed the Fed's commitment to the $120 billion in bond and asset-backed purchases each month that are keeping market rates near their historical lows.

The minutes averred that though the exit may be a long way off, it is on the minds of the governors. “Most” Federal Reserve officials, meaning governors and staff, wanted to provide more guidance to investors about the continuing bond-buying program, specifically what are the economic conditions for the purchases to end.

Thus far the statements issued with the FOMC meetings have only said that purchases will continue “over the comings months. “

Personal income, spending and PCE inflation

In other data Personal Income, a wider measure of household income that the Average Hourly Earnings figures associated with Nonfarm Payrolls, unexpectedly fell 0.7% in October missing its flat forecast. Personal Spending was slightly better than predicted at 0.5% on a 0.4% projection.

Core Personal Consumption Expenditures, the Fed's preferred, though now somewhat obsolete inflation gauge, was flat in October as predicted and the annual rate was 1.4% as predicted.

Conclusion and the dollar

Consumer spending has been the mainspring of the US recovery since the lockdowns ended. There is no reason, based on the performance of households over the past six months to assume that the modest number of new closures, which in most cases are far less stringent than in the spring , will have a damaging effect on consumption or the economy.

The dollar dropped in all the major pairs on Wednesday but the amount and the levels traversed were small and well traveled. No new ground was broken.

The EUR/USD moved to the top of its four-month range just over 1.1900 and the USD/JPY barely stirred from the middle of the descending channel that has ordered trading since April.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.