US S&P Global PMIs Preview: Dollar set to rise on a slip in the services sector

- S&P Global's Services PMI may decline, missing estimates for a third consecutive time.

- Investors fear a recession more than fresh rate hikes from the Federal Reserve.

- A weak read would trigger safe-haven flows toward the US Dollar.

Sell in May and go away? This market adage could be realized if the influential S&P Global Services Purchasing Managers' Index dips as I expect. The reading has broken a winning streak of six beats and missed estimates in the two most recent releases. Another weak data could come now – but for the US Dollar, a potential miss could be a boon.

Here is a preview of S&P Global's preliminary Purchasing Managers' Indexes (PMIs) for May, due on Tuesday, May 23.

Why S&P Global's PMIs matter for the US Dollar and what to expect

While ISM's (Institute for Supply Management) PMIs hold the highest prestige, the ones published by S&P Global (formerly Markit) have an advantage – their preliminary version is out before the end of the month. In addition, the upcoming publication is the first significant release for the week, meaning more impact on already sensitive markets.

The focus is on the services sector, which accounts for roughly 70% of the world's largest economy. Economists expect the Services PMI to stand pat at 53.6 points in May, reflecting decent growth – every figure above 50 represents expansion. They may be too optimistic.

First, the mood has worsened due to the ongoing debt crisis debacle in Washington. Purchasing managers cannot fully ignore the news and remain optimistic. Secondly, there are signs of a slowdown in the US economy, seen in retail sales, producer prices and jobless claims.

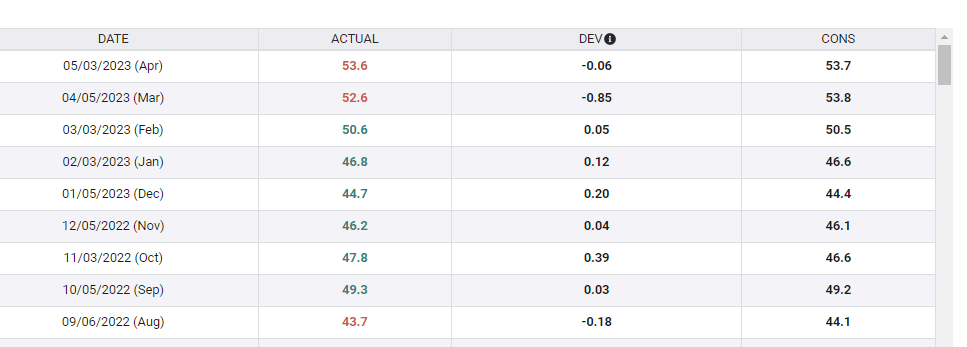

Third, the S&P Global Services PMI seemed to have lost momentum against economists' expectations..

Source: FXStreet

All in all, a miss is more likely than a beat.

Expected market reaction to the S&P Global PMI release

This time, the release comes as investors are following the debt crisis debacle in Washington. At the time of writing, there is fresh optimism, but the fluctuations in the saga mean markets are jittery. If pessimism returns, a weak data release would only add fuel to the fire – weigh on stocks and push the safe-haven US Dollar up.

Yet, even if headlines from Washington remain upbeat around the publication, there is room for a risk-off reaction in markets. Why? Investors are worried about a recession, and every poor release adds to worries. If the US sneezes, the world catches a cold – sending funds to the safety of the US Dollar.

What about rate hikes? The Federal Reserve (Fed) has all but announced the end of its tightening cycle. While some hawks at the bank remain open to yet another increase of borrowing costs, Fed Chair Jerome Powell seemed to signal that the bar is high for another move.

Final thoughts

Traders often overlook S&P Global's PMIs – but their early release makes them impactful. The current backdrop points to a miss and an opportunity for US Dollar strength and stock market weakness.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.