US Retail Sales November Preview: The Fed looks to the consumer

- Retail Sales forecast to cool to 0.8% from 1.7%.

- Control Group expected to fall by half to 0.8%.

- Federal Reserve set to accelerate the bond taper.

- Strong Retail Sales support the dollar and Treasury yields.

American consumers are expected to add a second month in November to the start of the best holiday shopping season in two decades.

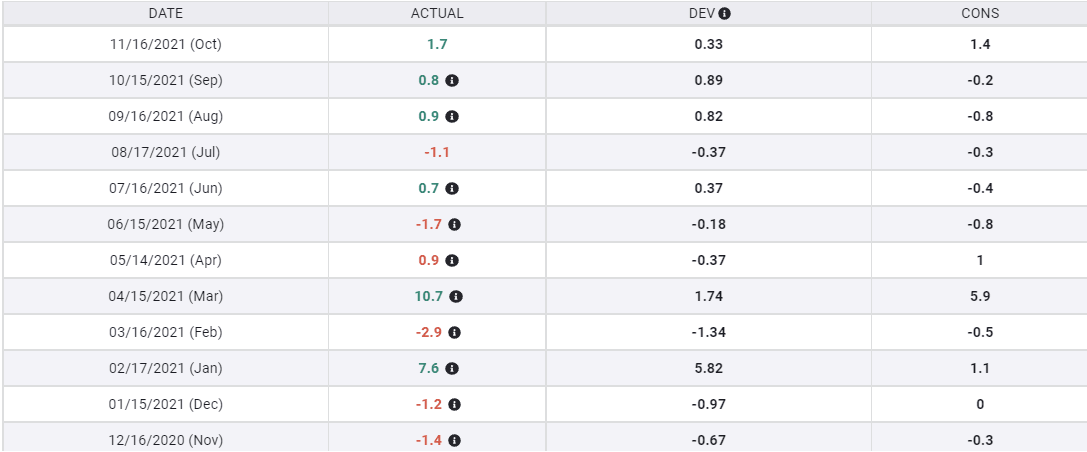

Retail Sales are forecast to rise 0.8% after climbing 1.7% in October, the strongest monthly gain since the pandemic stipend fueled 7.6% jump in March. Sales ex-autos are predicted to add 1% in November following the 1.7% gain in October. The Retail Sales Control Group, which mimics the consumption portion of Gross Domestic Product (GDP), is projected to increase 0.8%, half of its September result.

Retail Sales

Holiday sales, October, November and December are the financial backbone of many retail stores. Consumer spending is 70% of US economic activity.

One origin of the term ‘Black Friday’ for the day after Thanksgiving, the traditional start of the Christmas shopping season, is reputed to be in the accounting convention of writing profits in black ink and losses in red. That Friday is the first day many stores are profitable, having covered their costs in the previous 11 months. Accurate terminology or not, it is true that many retail operations depend on the Christmas season for most if not all of their profits.

The Fed, inflation and economic growth

The success of this year’s season is important for another less prosaic reason--consumer driven economic growth.

The Federal Reserve is set to double its bond taper to $30 billion at Wednesday’s meeting. This would conclude the bond program in the middle of March clearing the way for a hike in the fed funds rate as early as that month.

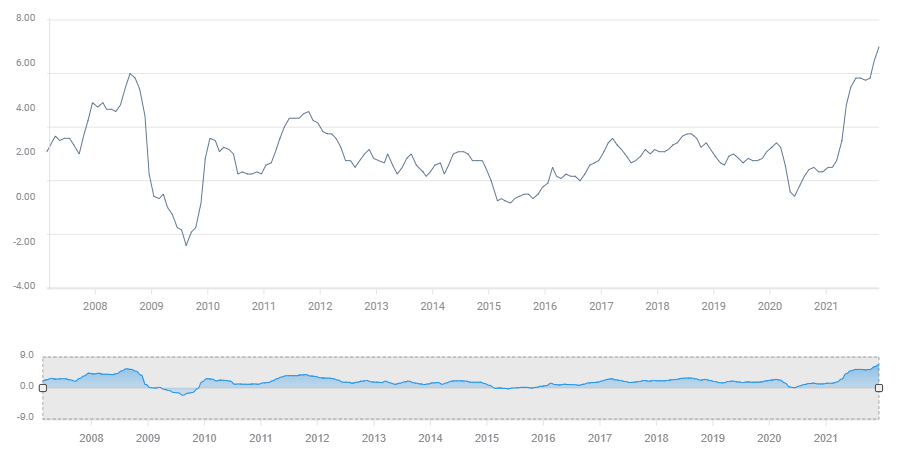

Fed policy has fallen drastically behind the inflation curve. The Consumer Price Index (CPI) jumped 6.8% (YoY) in November, the highest annual rate in 39 years. The Producer Price Index (PPI), a measure of production costs, soared to 9.6% in November, the highest on record, and a guarantor of higher consumer prices in the months ahead.

CPI

FXStreet

If the Fed decides to begin increasing the base rate to choke off inflation, it runs the risk of inhibiting economic growth. The stronger the retail sector is the better for the Fed’s policy reversal.

Consumer Confidence

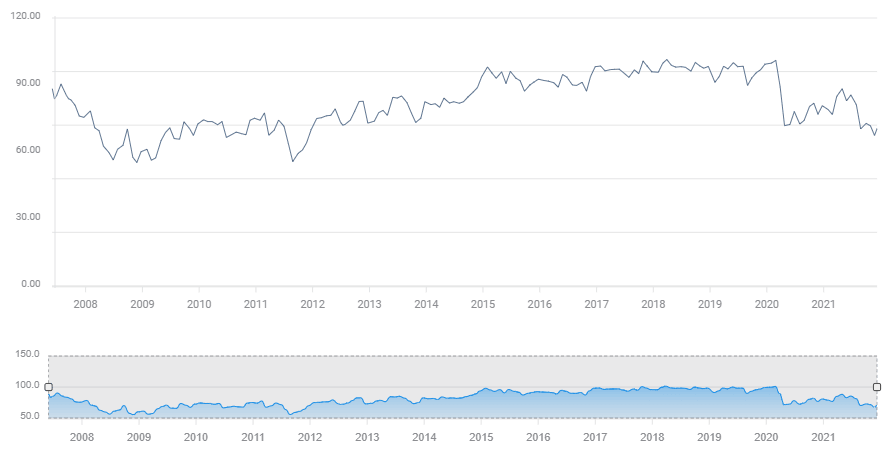

For the past six months, a disgruntled US consumer has not stopped spending despite confidence levels normally associated with recessions and their aftermath.

The Michigan Consumer Sentiment Index plunged to 70.3 in August and has averaged 70.5 for the past half year. It is expected to slip further to 69 when the December score is released two days before Christmas.

Michigan Consumer Sentiment

Conclusion

Retail Sales arrive the morning of the Fed meeting and will be interpreted in the glare of the bank’s monetary policy and anticipated shift to a tightening stance. A healthy and expanding consumer sector is the best enabler of Fed policy intentions.

Because the Federal Open Market Committee (FOMC) announcement is less than six hours later, the sales figures are not likely to excite trading. Markets will want to see what the governors do before committing to action, but the complexion of sales could add or detract from the market reaction to the expected taper. A good retail report will provide confidence that the economy can tolerate higher rates and a weak report bringing that idea into question.

Higher retail sales support the dollar and Treasury yields, and will help to mitigate equity response to rising interest rates.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.