- Stability expected in April Retail Sales at 0.7%.

- Consumer spending is 70% of US economic activity.

- Federal Reserve policy may depend on the US consumer.

- Equities, Treasury yields and the dollar could respond to sales.

Markets are watching the Federal Reserve, the governors are watching the US consumer.

Retail Sales are forecast to climb 0.7% in April, up from 0.5% in March. Sales ex-Autos are expected to rise 0.3% after adding 1.1% in March and the Control Group is projected to increase 0.7% in April following a gain of 0.5% in March.

The Consumer Economy: Real spending

The health of the US economy depends on consumers. With 70% of GDP tied to consumption, those millions of daily individual and household decisions are the most important economic variables. If consumers begin to hold back, then business spending, investment and the economy soon follows.

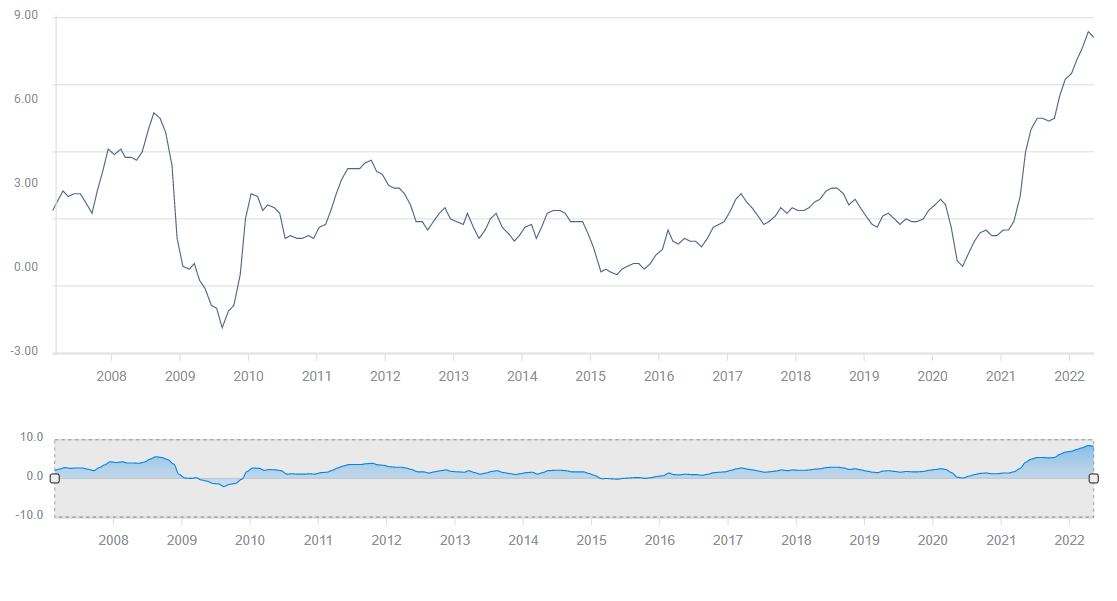

Consumer spending has been relatively stable over the past six months. Despite annual inflation that has jumped from 6.8% in November to 8.3% in April and averaged 7.7%, Retail Sales have increased 0.95% a month for the past half-year. Personal Consumption Expenditures (PCE) , a somewhat wider measure of consumption from the Bureau of Economic Analysis, have recorded 0.92% in average gains.

CPI

Those excellent results are misleading.The sales figures from the Census Bureau and the PCE numbers from the BEA are sales volume measures, calculated from price and items sold.

If for instance, the number of cars purchased is unchanged from one month to the next but the price per car rises 10%, the sales or PCE number will be 10% higher. The amount of activity represented by the sales numbers has not altered but the data gives the appearance of economic growth.

When inflation is low the discrepancy between nominal sales figures and numbers corrected for price increases, is minor and ignored by markets.

That is not an accurate approach when inflation reaches the level of the past year.

The BEA issues two PCE numbers. The first is the uncorrected for inflation, the second is real PCE, adjusted for price changes. The two series are very different. Regular PCE, as above, averaged 0.92% from November to April. Real PCE increased just 0.17% per month. The six-month real average is 82% less than the unadjusted number.

Retail Sales and the Consumer Price Index CPI do not track the same basket of goods so correction of one with the other is just a rough calculation. For the half-year through April, CPI averaged a 0.7% increase and sales rose 0.95% per month. The 0.25% result is 74% less than the original number, a figure close enough to the difference between the PCE and real PCE numbers to give it validity.

American households continue to spend, but the real economic impact is far less than the headline PCE and sales numbers portray.

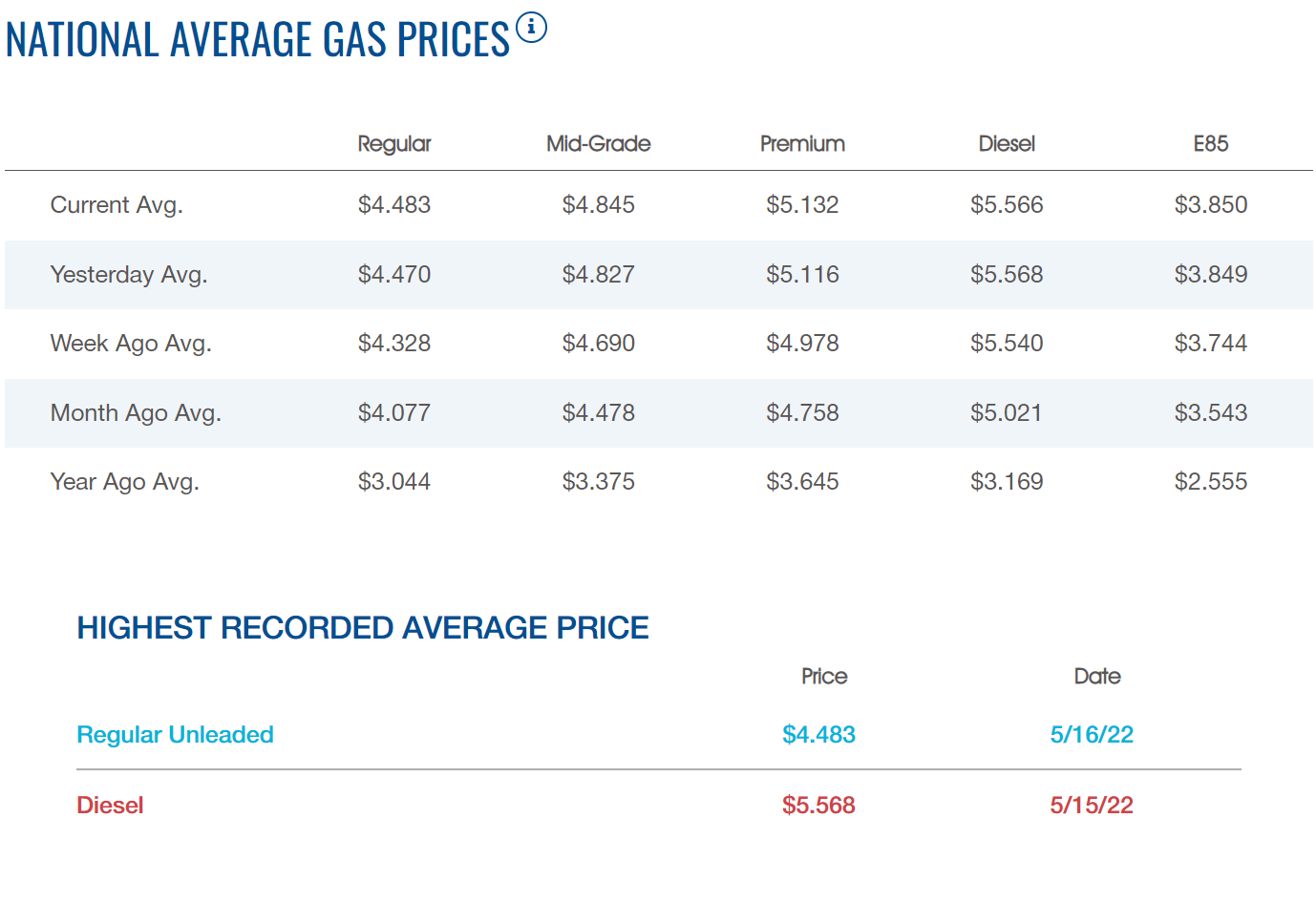

Were US consumers to curtail purchases just a small amount, a very realistic possibility given that prices have been soaring for a year and gasoline, that most American of necessities, has hit an all-time record five days running to May 16, overall consumption could easily contract. Second quarter GDP is estimated by the Atlanta Fed at 1.8%. It would only take a month or two of negative consumer spending to push the quarter and the economy into an official recession for the first half of the year.

American Automobile Association

Federal Reserve

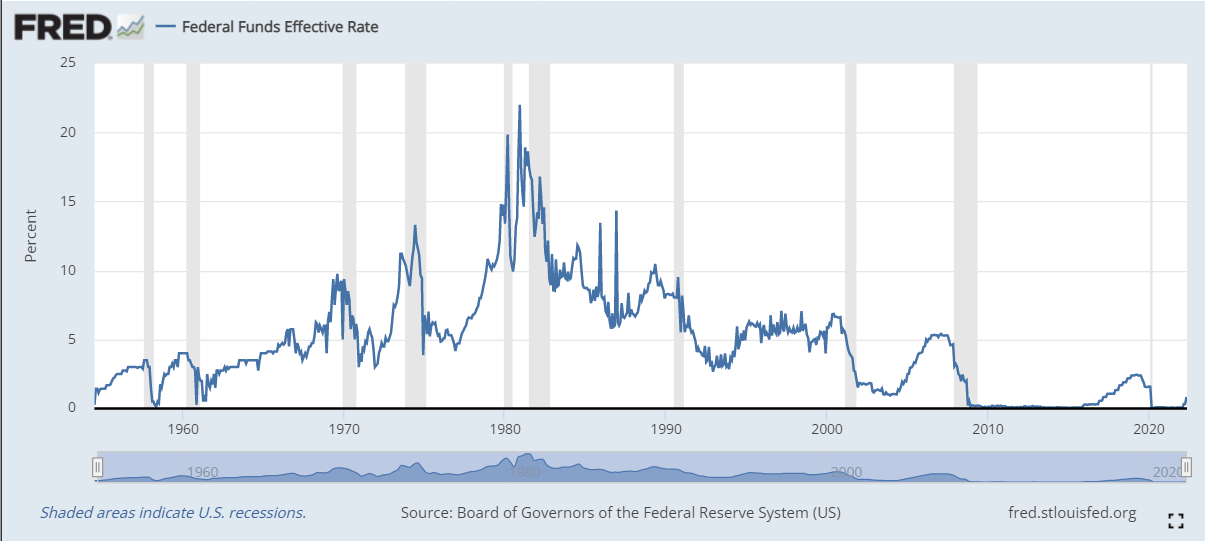

The Fed has deployed its traditional interest rate tools against inflation that Chair Jerome Powell said is “far too high.”

In the last two meetings, the governors have hiked 75 basis points and the Treasury market expects 200 more by the end of the year.

The unanswered question for the Federal Open Market Committee (FOMC) is the disposition of rate policy if the economy falls into recession. Mr.Powell alluded to the problem in his press conference after the May 4 meeting, noting that reducing inflation while maintaining economic growth is difficult. In US post-war history, a rising rate cycle from the Fed is almost always followed by a recession.

The economy contracted 1.4% in the first quarter, far worse than the 1.1% consensus forecast. Even if the import explanation for contraction is accepted, the Fed will be hard-pressed to continue raising rates if the economy is in recession after the second quarter.

That may be the most telling reason for markets to expect 50 basis point increases at the next two FOMC meetings on June 15 and July 27. Second quarter GDP will not be reported until July 28, the day after the Fed meeting.

The Fed has made it very clear that it intends to move quickly against inflation and the best way to accomplish that is to front load increases, getting as close to its rate goal before a possibly faltering economy blocks further action.

Treasury futures consider two 50 basis point hikes a near certainty. The odds of at least a 2.0% upper target after the July 27 FOMC are a remarkable 99.2%.

Three scenarios for Retail Sales

If April Retail Sales comes in close to estimates, from 0.6% to 0.8%, (0.7% consensus forecast) market reaction will be limited, as it usually is when important data arrives as expected. Equities, Treasury rates and the dollar are all suffering from recession fears, though for the greenback the result is higher from the safety trade. Sales at or close to its forecast will probably be enough to reassure markets that the consumer has not given up and the economy will continue to expand. Expect equities and Treasury rates to rise modestly and the dollar to drift lower.

If sales are stronger than 0.8%, confidence in the economy will be reinforced. Equity and Treasury yield gains will be more robust and the dollar should fall.

If sales are less than 0.6%, the prospects for consumer spending and the economy fall with weakening sales. Inflation was 0.3% in April, so the rough estimate for sales can be dropped by that amount. Equities, Treasury rates will fall, and the dollar will rise. The amount depends on the degree of the discrepancy.

Market reaction to a weak sales number will be more pronounced than an equally strong figure because a poor number supports the negative outlook for the US economy that has become current over the last two months.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Gold remains within striking distance of new record-high above $3,300

Gold clings to strong daily gains above $3,300 after setting a new all-time peak near $3,320 earlier in the day. Continued concerns over the escalating US-China trade tensions and a weakening Greenback, support the demand for the metal prior to Powell's speech.

EUR/USD remains consolidative around 1.1350 on firmer US Retail Sales

EUR/USD maintains its daily gains around the 1.1350 region on the back of the resumption of the bearish tone in the Greenback, which showed no reaction to the stronger-than-expected Retail Sales in March. Later in the day, investors are expected to closely follow Fed Chairman Powell’s comments on the economic outlook.

GBP/USD recedes from tops and revisits the 1.3250 zone

GBP/USD extends its positive streak on Wednesday, now coming under some selling pressure around the 1.3250 after earlier multi-month tops around the 1.3300 mark. The daily uptick comes on the back of the weaker US Dollar and easing inflationary pressure in the UK.

Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

Bitcoin price stabilizes around $83,500 on Wednesday after facing multiple rejections around the 200-day EMA. Bloomberg reports that China is open to trade talks with President Trump’s administration.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.