US Q1 GDP Preview: Eyes on inflation and FOMC as economic recovery gathers steam

- US economy is expected to grow by 6.1% in the first quarter.

- Investors are likely to focus on FOMC meeting and PCE Price Index data.

- US Treasury bond yields could continue to impact USD's valuation.

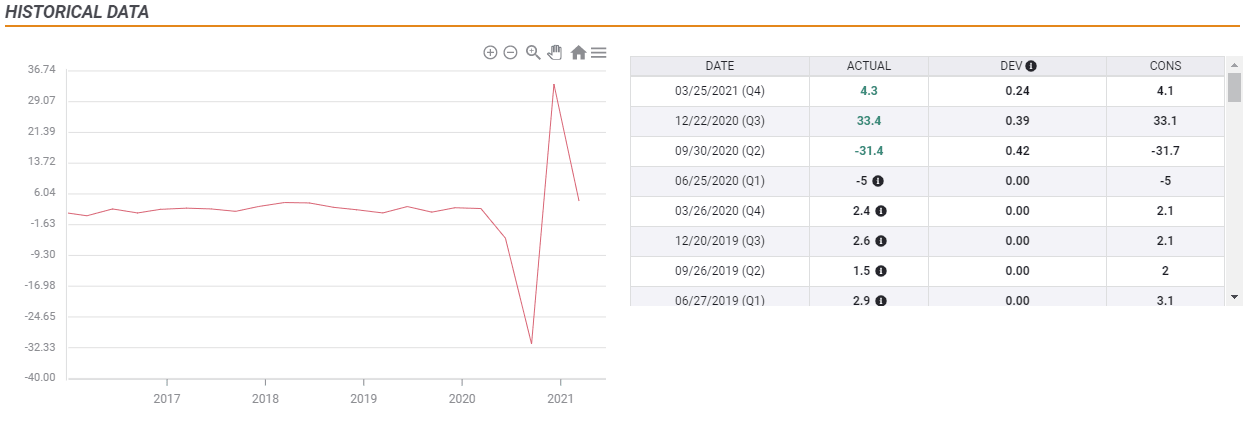

The US Bureau of Economic Analysis (BEA) will release its first estimate of the first quarter real Gross Domestic Product (GDP) growth on Thursday, which is expected to show the US economy continues to recover from the pandemic at a robust pace. Markets expect the economy to expand by 6.1% on a yearly basis after growing 4.3% in the fourth quarter of 2020, fueled by unprecedented monetary policy support and fiscal stimulus.

US Real GDP Annualized

In the final estimate of the Q4 GDP, “the increase in fourth-quarter GDP reflected both the continued economic recovery from the sharp declines earlier in the year and the ongoing impact of the COVID-19 pandemic, including new restrictions and closures that took effect in some areas of the United States,” the BEA noted. Since then, the US took additional steps to loosen restrictions and administered more than 200 million doses of coronavirus vaccines.

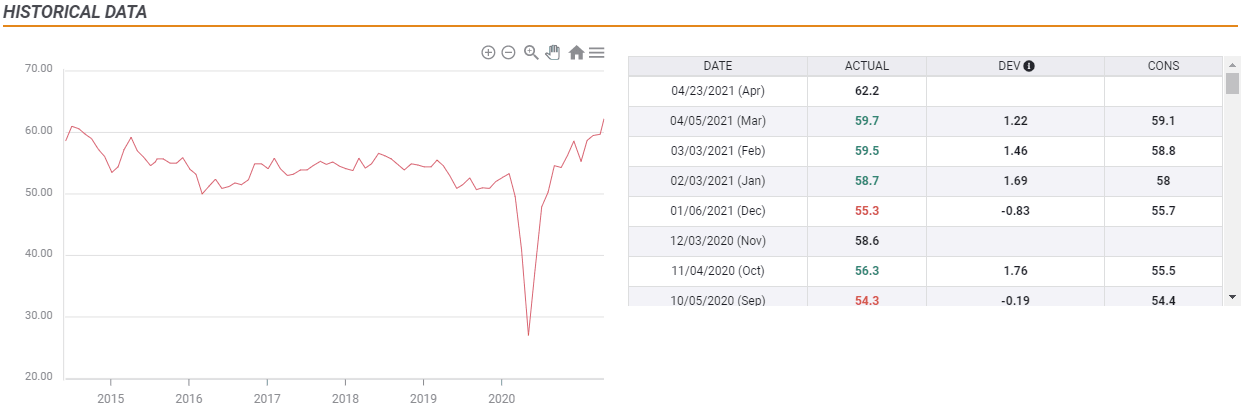

On a negative note, the severe weather conditions in February had a negative impact on the activity with Retail Sales, Durable Goods Orders, Personal Income and Personal Spending contracting during that period. Nevertheless, March readings confirmed that the slowdown in February was temporary. Furthermore, the business activity in the private sector expanded at its strongest pace on record with the IHS Markit’s Composite PMI rising to a series high of 62.2. Finally, the weekly Initial Jobless Claims data published by the US Department of Labor continued to decline steadily during the first quarter and fell to its lowest level since the beginning of the pandemic at 547,000 in the week ending April 17.

Markit Preliminary Composite PMI April

What will constitute an overheating economy?

In short, it’s not going to be a big surprise to see that the US economy continued to fire on all cylinders despite adverse weather conditions in the first quarter of 2021. Hence, the initial market reaction is likely to remain muted. Stock markets in the US have been pricing the brightening prospects of a strong economic rebound and all three main indexes of Wall Street renewed all-time highs toward the end of April.

The main concern for markets is the potential impact of this type of growth on price pressures. Although the Federal Reserve has been downplaying risks of overheating the economy, the latest regional manufacturing reports and the PMI publications revealed that supply constraints and the lack of low-wage labour were forcing producers to start transferring costs to clients.

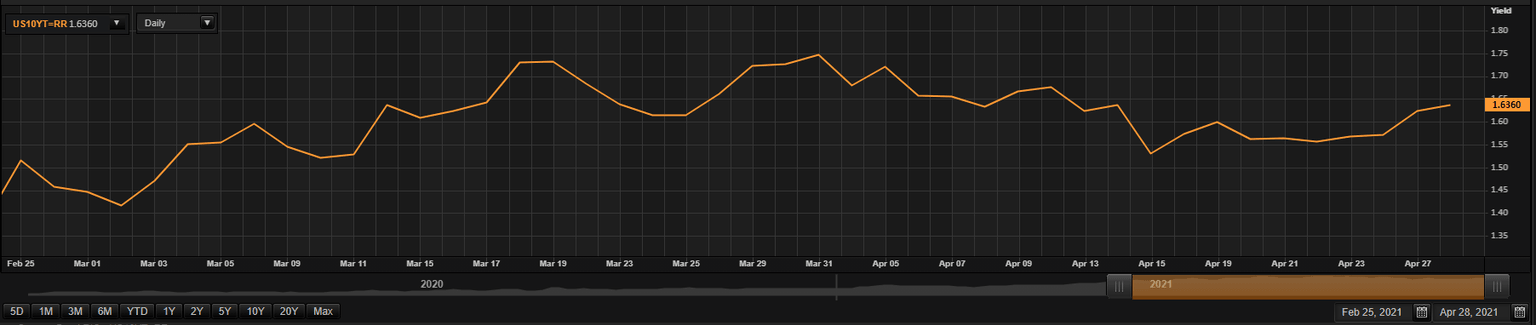

On Friday, the BEA will publish the Personal Consumption Expenditures (PCE) Price Index data, the Fed’s preferred gauge of inflation. On a yearly basis, the Core PCE Price Index, which excludes volatile food and energy prices, is expected to rise to 1.8% in March from 1.4% in February. A print closer to 2% could trigger a sharp increase in the US Treasury bond yields and provide a boost to the greenback ahead of the weekend. On the other hand, a softer-than-anticipated inflation reading is likely to make it difficult for the USD to find demand as it would suggest that the Fed still has more room before considering tapering.

Meanwhile, the US Federal Reserve will release its Monetary Policy Statement following the April meeting on Wednesday. Although the FOMC is not expected to make any changes to its policy settings, investors will look for fresh clues regarding the timing of tapering. FOMC Chairman Jerome Powell made it clear that they will communicate it clearly and well in advance when they decide it's time to start reducing asset purchases. However, an improved outlook and an optimistic tone in the statement language could be enough to lift T-bond yields and the USD.

US Federal Reserve Meeting April Preview: Buying time before the inevitable taper.

Major currency pairs to watch for

As mentioned above, the GDP data is unlikely to cause sharp fluctuations by itself as it will be published in between the FOMC's policy announcements and Friday's inflation figures. Even so, market participants will keep a close eye on the benchmark 10-year US Treasury bond yield, which was up nearly 5% on a weekly basis at the time of press.

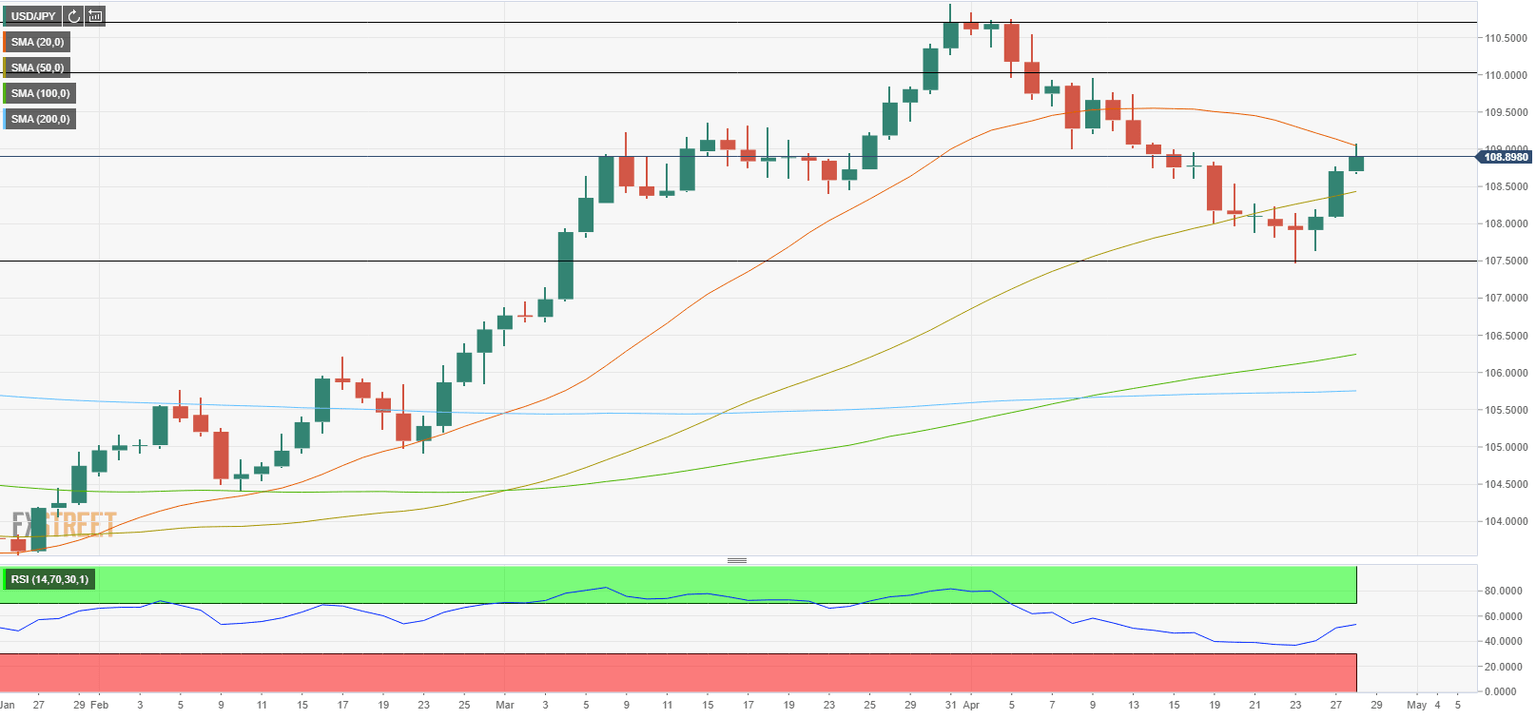

Generally, USD/JPY is one of the most sensitive pairs to movements in T-bond yields. A sharp upsurge in yields could open the door for additional gains toward 110.00. On the other hand, the three-week-long drop witnessed in April seems to have found support around 107.50, punctuating the significance of this level if the pair turns south in the second half of the week.

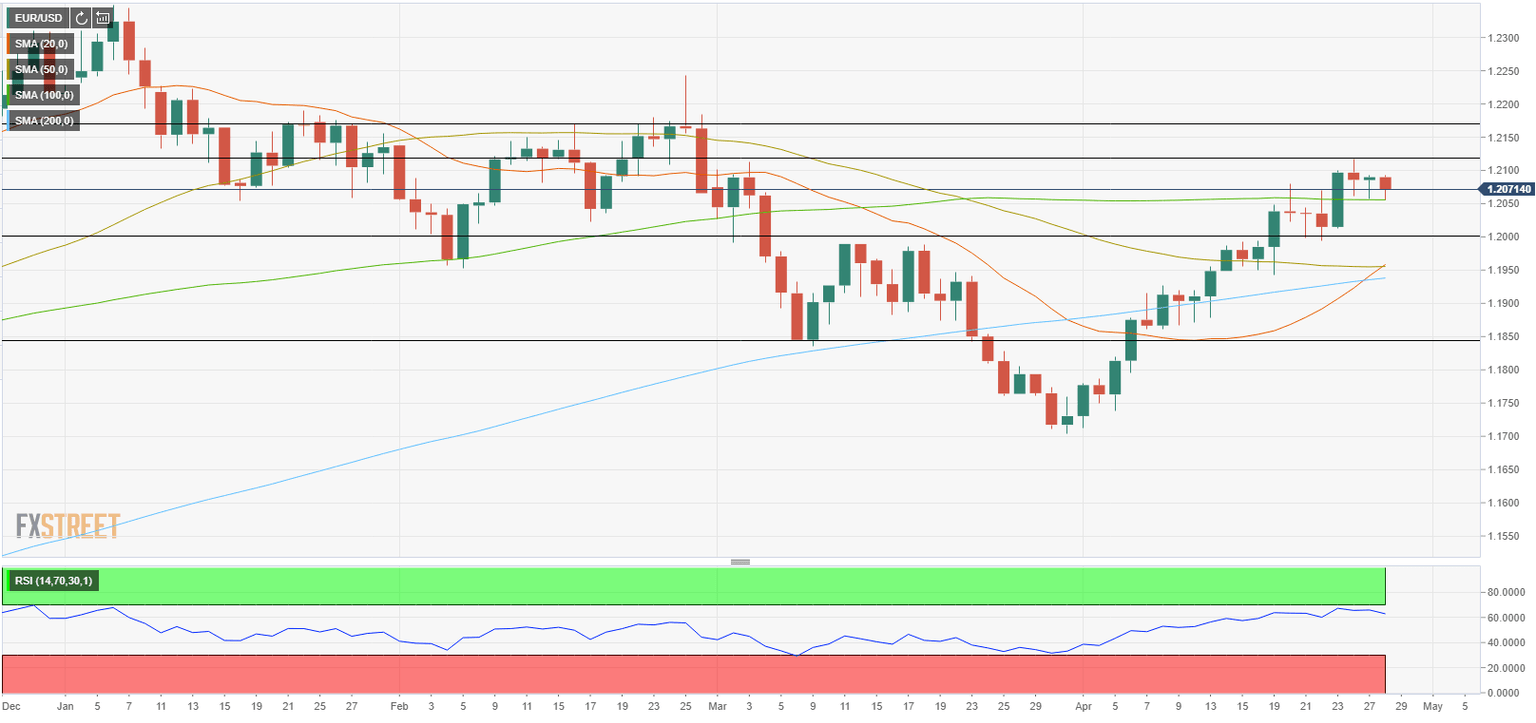

Moreover, the EUR/USD pair could experience heightened volatility on Friday's in case the GDP data from Germany and the eurozone underline the divergence in the strength of the economic recovery. Currently, EUR/USD fluctuates in a relatively tight range above 1.2000. With a daily close below that level, the pair could extend its slide toward the 1.1850 area. On the flip side, resistances are located at 1.2120 and 1.2170.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.