US PPI Preview: Another positive surprise in the pipeline?

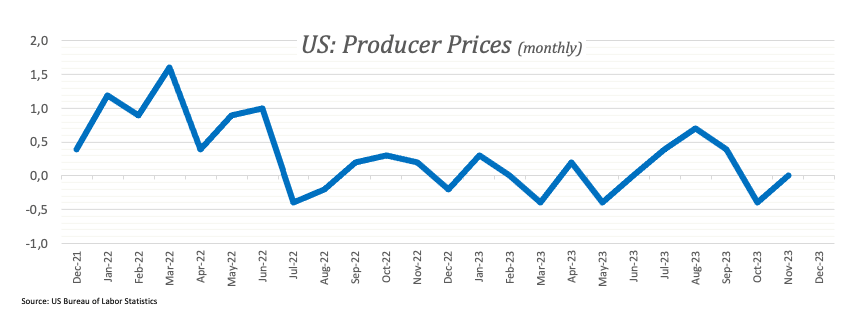

The acceleration of the US Producer Price Index (PPI) is anticipated to continue. In fact, the US Bureau of Labor Statistics predicts the inflation tracked by PPI to edge a tad higher in the last month of 2023, following the previous flat reading and October’s 0.4% monthly decline.

The release of the PPI report has been growing in significance almost pari passu with the publication of monthly inflation figures gauged by the CPI and PCE, all against the backdrop of the current data-dependent stance from the Fed and in light of increasing speculation of rate cuts at some point early in the spring.

The Headline PPI is expected to rise 0.1% MoM and 1.3% from a year earlier. In addition, Core PPI is seen rising at a monthly 0.2% and 1.9% over the last twelve months.

So far, anticipation for PPI appears reasonable, especially when considering the uptick in the Consumer Price Index (CPI) data released on Thursday.

Another positive surprise in the release could lend transitory support to the US Dollar, although the real impact on the Fed’s decision-making process appears blurred (to be optimistic).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.