US PPI inflation and consumer sentiment eyed: EUR/USD nears resistance

The main economic highlight in Thursday’s session was the (weekly) unemployment filings out of the US for the week ending 3 December. According to the US Department of Labour, unemployment claims rose 230,000, 4,000 higher than the previous upwardly revised 226,000 reading; the release was largely in line with economists’ forecasts. The 4-week average also ended at 230,000, up 1,000 based on the previous week’s moving average value (revised). Continuing claims was higher at 1,671,000 from 1,609,000 the week prior. Overall, however, this data was largely ignored across the markets.

Economic calendar today?

-

YoY Chinese Inflation Rate for November at 1:30 am GMT (Expected: 1.6%; Previous: 2.1%).

-

MoMcUS Producer Price Index (PPI) for November at 1:30 pm GMT (Expected: 0.2%; Previous: 0.2%).

-

US Preliminary University of Michigan (UoM) Consumer Sentiment for December at 3:00 pm GMT (Expected: 56.9; Previous: 56.8).

Technical view for key markets

EUR/USD: Buyers at the wheel?

It has been a somewhat muted week thus far for the EUR/USD currency pair. Kicking things off with the weekly scale, price remains comfortable north of its support level from $1.0298, a barrier that was breached in early November. Overhead has resistance in view at $1.0778: a Quasimodo support-turned resistance. For this reason, and given the upward movement since bottoming at $0.9536, further outperformance could be on the table for the unit, longer term.

Meanwhile on the daily timeframe, resistance forged from $1.0602 is nearby. This comes after price climbed north of the 200-day simple moving average ($1.0353) as well as resistance coming in at $1.0377 (now a marked support). Interestingly, should price overthrow $1.0602, prime resistance can be seen at $1.0954-1.0864. You will also acknowledge that the relative strength index (RSI) remains trawling the underside of the overbought space, and nearing channel support, taken from the low 25.68.

Against the backdrop of the bigger picture, the H1 timeframe has price on the verge of reaching for Quasimodo resistance at $1.0585, followed by a larger Quasimodo resistance coming in from $1.0607 (in between, of course, resides the $1.06 psychological figure).

All three timeframes, therefore, call for additional short-term buying, at least until reaching the $1.06ish region.

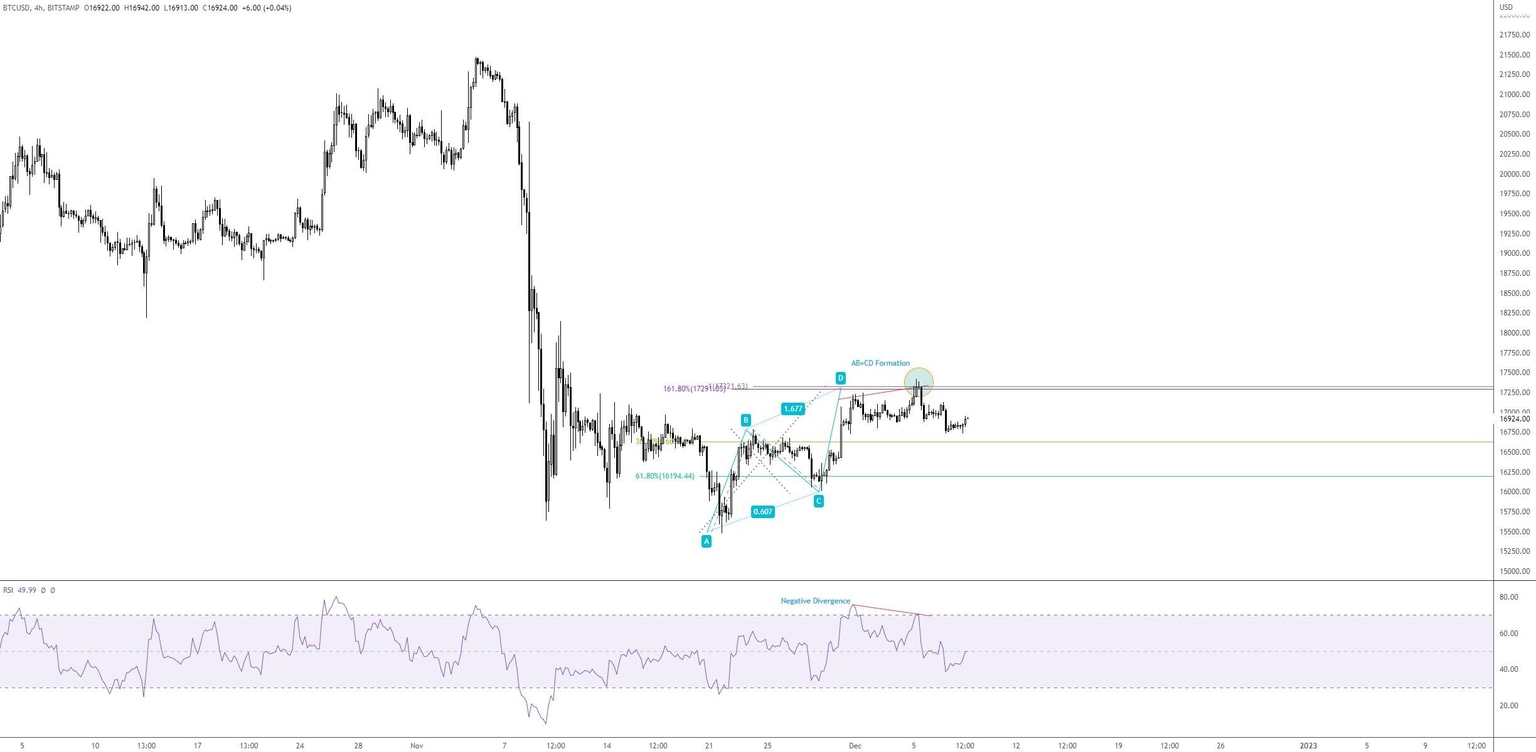

BTC/USD: Medium-term technical harmonic formation in play

The price of bitcoin against the US dollar (BTC/USD) has been entrenched within a notable downtrend since topping in late 2021. Long term, therefore, this has opened the door for sell-on-rally scenarios. Shorter term, nevertheless, price recently touched gloves with the underside of an AB=CD bearish pattern, consisting of a 100% projection at $17,321 and a 1.618% Fibonacci extension from $17,291. The test was also accompanied by the relative strength index (RSI) forging negative (bearish) divergence.

As you can see, the AB=CD (harmonic) resistance has since enticed selling. Common downside targets derived from the AB=CD formation (legs A-D) are fixed at the 38.2% and 61.8% Fibonacci retracements from $16,630 and $16,194, respectively. Consequently, the noted support targets will likely be closely monitored going forward, with a breach perhaps unearthing additional selling.

H4 Timeframe

DAX 40: Inefficient price action?

The DAX 40—Germany’s major stock market index covering the performance of 40 blue-chip companies—is offering interesting price action. The one-sided advance on 10 November formed what is known as inefficient price action (the market favours efficient price action and generally fills inefficient price moves [think of these as similar to gaps as you would see in individual stocks]).

14,077-14,141 demand is a key watch for the index, following a to-the-point reaction from Quasimodo resistance at 14,605. Below current resistance at 14,322, we can see that the area under (yellow oval) the aforementioned demand is inefficient action, meaning price may be drawn to fill this void and test support from 13,969.

Therefore, based on the above analysis, sellers may remain in the driving seat under resistance at 14,322, with short-term breakout selling perhaps unfolding south of demand at 14,077-14,141 towards support at 13,969.

H4 Timeframe

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,