US Payrolls Disappoint for the Second Month: Economy seems strong despite Omicron

- December NFP hires 199,000, forecast was 400,000.

- Unemployment falls to 3.9%, underemployment to 7.3%.

- 10-year Treasury yield rises to 1.766% a pandemic high.

- Dollar and equities fall as markets reposition portfolios.

American employers hired far fewer workers than expected in December as the Omicron variant registered vastly more cases in the United States than ever before.

Nonfarm Payrolls added 199,000, less than half the 400,000 forecast, though the unemployment rate dropped to 3.9%, improving on the 4.1% consensus prediction and November’s 4.2%.

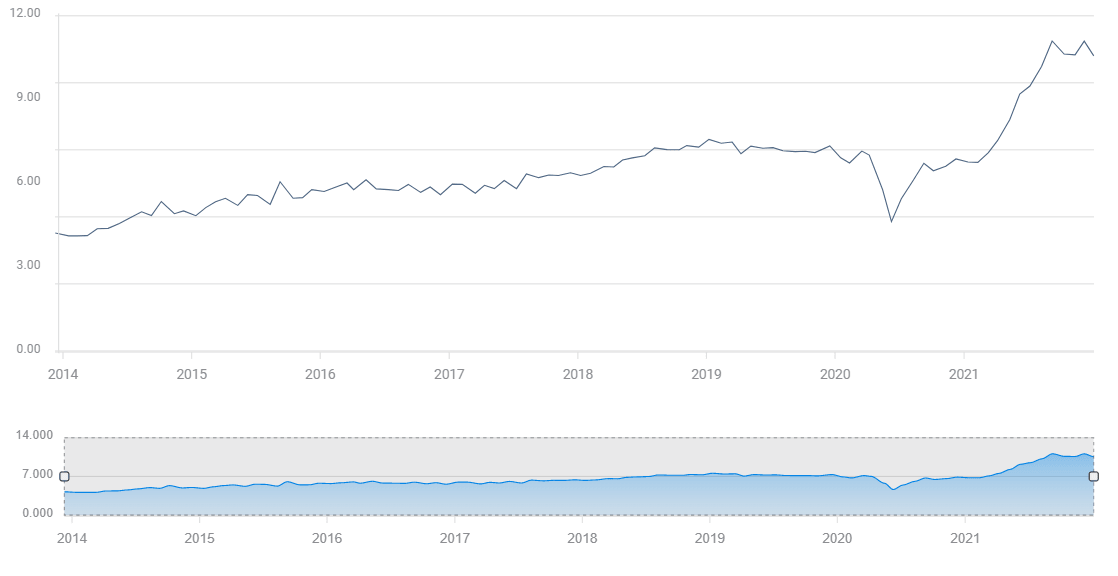

NFP

FXStreet

Average Hourly Earnings rose 0.6% on the month and 4.7% for the year according to data from the Bureau of Labor Statistics (BLS).

The problem for workers is that wage gains have been outstripped by inflation. The Consumer PriceI Index (CPI), was 6.8% higher on the year in November, its fastest pace in four decades, and is expected to rise to 7.1% in December. Even the Fed’s preferred inflation record, the Personal Consumption Expenditure Price Index (PCE), which includes product substitution to produce a lower rate, jumped 5.7% in November.

Inflation appears to be reaching deep into the labor market as worker shortages give employees bargaining power. The 4.5 million voluntary job departures in November, an all-time record, indicates workers realize their position.

PCE

FXStreet

The Labor Force Participation Rate climbed to 61.9%, the highest of the pandemic from 61.8%, but it remains well below the 63.4% rate of January 2020.

Positive Covid diagnosis hit 1 million this past Monday, just a week after the January 2021 record of 251,232 was surpassed. An enormous increase in testing has driven the positive numbers. The US Center for Disease Control and Prevention (CDC) estimates that the mild Omicron variety now accounts for 95% of the US cases.

The December unemployment rate (U-3) was the sixth monthly pandemic low in a row and is close to the 50-year low of 3.5% in February 2020.

A wider measure of joblessness, the underemployment rate (U-6), which includes individuals who have looked for work in the past year as opposed to the one month for the standard U-3 gauge, dropped to 7.3% from 7.7%. It had been forecast to rise to 8%.

Market response

Equities fell as rising US interest rates played havoc with stock positioning.

The S&P 500 dropped 0.4%, 19.02 points to 4,677.03. The Dow was nearly flat, losing 4.81 points to 36,231.66. The S&P 500 lost 1.8% on the week while the Dow was down just 0.29%, as investors rotated out of growth and rate sensitive stocks into value based equities.

The Nasdaq plunged 144.96 points, 0.96 % to 14,935.90, culminating the first week of 2022 trading down 4.5%. Many of the technology stocks in the average are dependent on financing, now subject to escalating costs.

Treasury yields continued their New Year surge. The 10-year return traded as high as 1.801% and settled at 1.766%, its highest close since January 22, 2020. The yield on this commercial benchmark has gained 25.4 basis points from its 1.512% finish on December 31. The 30-year bond added 2.3 basis points to finish at 2.116%. It is up 21.1 basis points from its 2021 conclusion at 1.905%.

10-year Treasury yield

CNBC

The US dollar was modestly lower despite the continuing rise in Treasury rates. The EUR/USD added 70 points to 1.1361 while the USD/JPY dropped to 115.56. The greenback lost ground in all seven major pairs.

Establishment and Household Surveys

The Employment Situation Report, the official BLS name of the payroll report, is composed of two separate surveys.

The establishment survey polls existing companies about their employment decisions, adds in a BLS forecast for the number of jobs created by new businesses and produces the Nonfarm Payroll number.

The household survey contacts a representative sample of American families and individuals and inquires who is working or not and newly hired or fired. This poll provided a very different picture of the US labor market. It showed a gain of 651,000 positions in December and upwardly revised figures of 249,000 in November and 648,000 in October.

With many more people working from home in jobs that may not be classified as employees, as opposed to contract workers, by their companies, the accuracy of the establishment survey in portraying the number people working in the US economy is debatable.

December’s data left total employment in the US 2.9 million below where it was in February 2020.

It is not a lack of jobs that is restraining employment. The Job Openings and Turnover Survey (JOLTS) has averaged over 10 million unfilled positions for nine months, a third higher than the largest single month total before 2021.

JOLTS

Federal Reserve Policy

The US central bank has executed one of the quickest policy turns in its history, a sort of bootleggers turn on interest rates. Having done so, there is almost nothing short of an economic collapse or a dangerous revival of the pandemic, which Omicron is not, that would get the governors to reverse again.

Markets know this and have continued to anticipate higher US interest rates despite two NFP results that would, in normal times, be a huge disappointment.

The combination of price increases and worker demands for higher wages will over time bring consumers to a much higher set of inflation expectations.

The March rate increase is definitely on track.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.

-637771920479058654.png&w=1536&q=95)