US October PCE price index preview

Today, Australian CPI inflation numbers (Consumer Price Index) have already been seen, and the Reserve Bank of New Zealand has announced a 50-basis point (bp) cut during Asia Pac trading. In addition to Q3 24 US GDP (Gross Domestic Product) data coming in unchanged, the October US PCE price index (Personal Consumption Expenditures) will hit the wires at 3:00 pm GMT and is forecast to have risen on a YY basis (year on year).

PCE data expected to report higher numbers

Market expectations, according to Refinitiv data, suggest YY headline and core (excludes volatile food and energy prices) US PCE data has risen to 2.3% (from 2.1% in September) and 2.8% (from 2.7%), in October, respectively. Additionally, the October Personal Income and Outlays report is anticipated to show a 0.4% gain in personal income compared to 0.3% in September. This may seem surprising in light of the miserable jobs report we just had in October, though we must remember that wage growth has indeed increased.

Rate cut still likely in December

PCE data are closely monitored by the US Federal Reserve (Fed) and is their preferred measure of inflation. The Fed works to an inflation target of 2.0%, and assuming a higher PCE print today, this may be a little too hot for comfort and could prompt the central bank to consider hitting the pause button next month. We also have to remember that Fed Chair Jerome Powell stated that the central bank is not in any rush to cut rates while other Fed members have emphasised caution regarding easing policy too fast.

In my humble opinion, however, today’s PCE data is unlikely to prompt a pause from the Fed in December. Still, I feel we are now approaching a stage of a potentially shallower easing cycle, given inflation remains stubbornly north of the Fed’s inflation target. That said, should higher-than-expected jobs data be received next week, this could boost the chances of a rate hold next month and will likely underpin the US dollar (USD). Money markets are pricing in around 15 bps of easing for the December meeting (investors are assigning a 55% chance that the Fed will cut rates by 25 bps next month over a 45% probability they hold).

Seeing as both CPI and PPI (Producer Price Index) inflation numbers have already been released for October, these data help calculate the PCE figures. You will likely recall CPI inflation data came in line with economists’ estimates; however, YY headline inflation rose to 2.6% in October, increasing from September’s rate of 2.4% and marking the first upward shift since March. The largest upward contributor to CPI inflation was housing – more than half of the rise was down rising prices in housing – with food prices also rising in October. PPI inflation also increased across headline and core measures in October to 2.4% (from 1.9% in September) and 3.1% (from 2.9% in September).

While both the CPI and PCE Indexes attempt to measure consumer prices by tracking changes in the prices of a specific basket of goods and services each month, the CPI assigns a far greater weighting to shelter than the PCE Index does, which highlights that the PCE data could still fail to reach estimates.

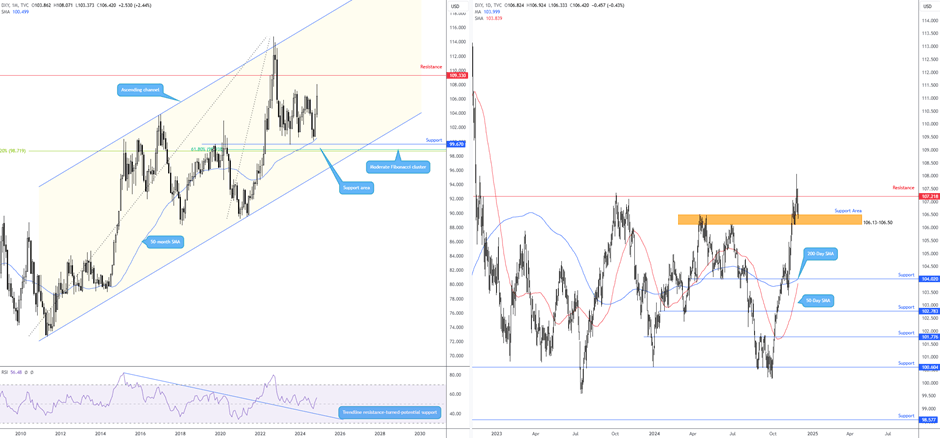

Dollar index fading range resistance

As shown from the daily timeframe of the US Dollar (USD) Index, price action is fading quite a substantial range resistance from 107.21. This is a level the FP Markets Research Team have been watching closely for a while now, as a breakout from here could send the Index towards monthly resistance at 109.33.

However, a daily support area between 106.13 and 106.50 is currently in play, which could, given the room to run for monthly resistance, pose a problem for USD sellers.

Chart created using TradingView

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,