US October PCE inflation & ISM Manufacturing PMI Preview: Seen through Fed’s eyes

- The US core Consumption Expenditures Price Index will likely signal easing pressures.

- The US ISM Manufacturing PMI is foreseen to fall into contraction territory.

- EUR/USD could revisit the 1.0500 price zone after the dust settles.

December will kick start with a high note in the United States, as the country publishes the Personal Consumption Expenditures (PCE) Price Index data, the US Federal Reserve’s preferred inflation gauge, while the Institute of Supply Management (ISM) will unveil the November Manufacturing PMI.

Updates on inflation and business growth will be critical ahead of the last US Fed decision of the year, scheduled for December 14.

Core PCE inflation, which excludes volatile food and energy prices, is expected to have risen by 0.3% MoM, while the annual reading is foreseen at 5%, easing from 5.1% in October. On the other hand, the ISM Manufacturing PMI is expected to have fallen into contraction territory, from 50.2 in October to 49.8.

Signs of easing inflation will be encouraging but not a surprise. Neither will confirmation the economy has contracted. Still, a Manufacturing PMI below 50 would undoubtedly hit the US Dollar, while a better-than-anticipated figure could boost the battered American currency.

US Federal Reserve's upcoming decision

The United States Federal Reserve (Fed) has hinted at a potential easing in the pace of tightening. After hiking rates by 75 bps for five consecutive meetings, the central bank is now expected to pull the trigger by a modest 50 bps. Data pulled from the CME FedWatch Tool shows a roughly 70% likelihood of such an outcome, sending the benchmark rate to a range of 4.25% to 4.5%.

Easing price pressures and fears higher rates will slow economic progress could easily explain the upcoming decision, although it is worth noting that Fed officials will always prioritize inflation. Should the related data surprise on the upside, market players could lift bets on another 75 bps and send the Dollar up amid a risk-averse environment which could put stock markets in a selling spiral. A worse-than-anticipated ISM Manufacturing PMI should exacerbate the dismal mood scenario.

Softer-than-anticipated core PCE inflation, alongside an ISM Manufacturing PMI at 50 or above, should trigger optimism. Stock markets will likely rally, while the US Dollar will likely fall against all of its major rivals.

EUR/USD possible scenarios

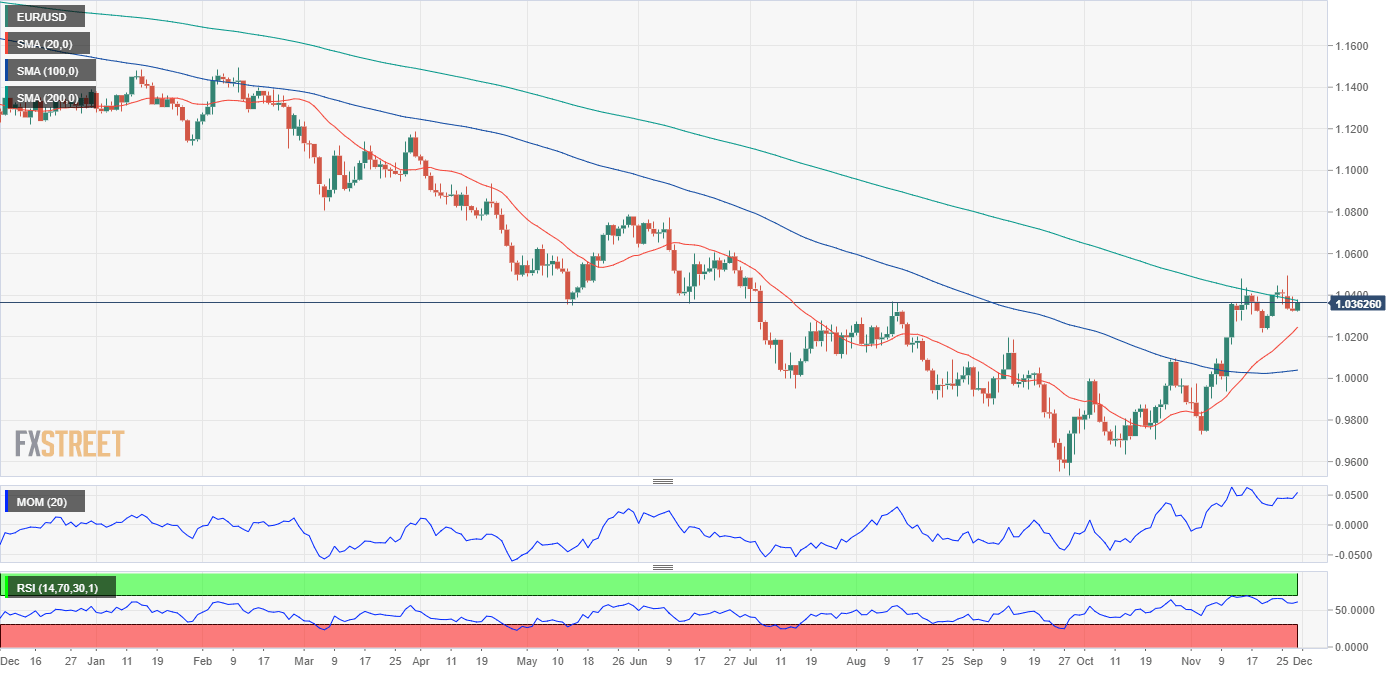

The EUR/USD pair peaked at 1.0496 at the beginning of the week, its highest since last June. It bottomed at 1.0318 on Tuesday, bouncing back from the level and now aims to regain the 1.0400 threshold.

From a technical perspective, the risk skews to the upside, although the lack of action these days has left the daily chart with a neutral-to-bullish tenor. EUR/USD remains stuck around a bearish 200-day Simple Moving Average (SMA), unable to clear the moving average since June 2021. Nevertheless, the 20 SMA continues advancing above a now mildly bullish 100 SMA, reflecting buyers’ strength. The Momentum indicator heads south above its midline, but the Relative Strength Index (RSI) indicator resumes its advance at around 61, also reflecting bulls’ dominance.

EUR/USD can recover its bullish momentum if it closes Wednesday above the 100-day and challenges the weekly high should US data spur optimism. A slide below 1.0300, on the other hand, should open the door for a steeper bearish correction towards 1.0240, the November 21 daily low. Further declines seem unlikely, although if the pair breaks lower, a retest of parity will be on the table.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.