US Michigan Consumer Sentiment Index Preview: Inflation’s dangerous impact

- Consumer sentiment forecast to remain near decade low.

- Soaring inflation may be dragging down consumer attitudes despite solid job growth.

- Retail Sales and Personal Spending unaffected, so far, by plunging sentiment.

American economic optimism has been at a decade low for three months and little improvement is expected as mounting inflation steals the wage gains from a tight labor market.

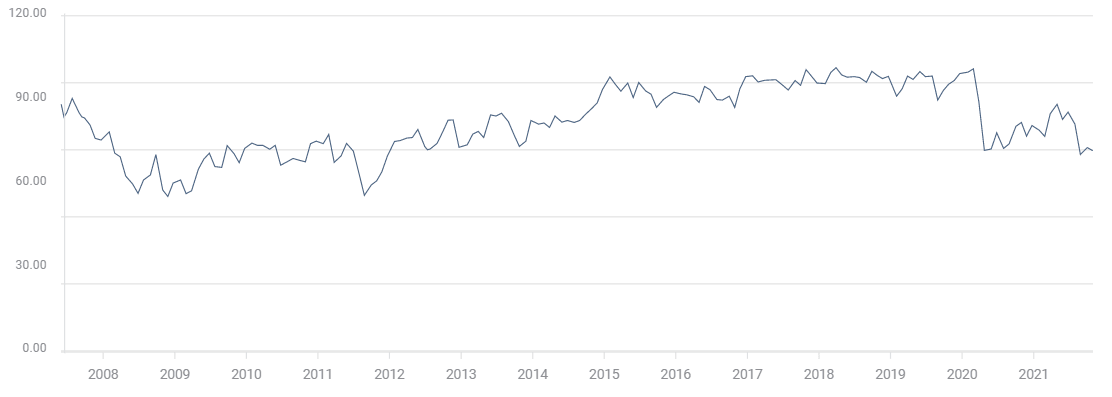

The Michigan Consumer Sentiment Index is forecast to rise slightly to 72.4 in November from 71.7 in October. Since plunging to 70.3 in August, below last April’s pandemic low of 71.8, the Michigan Index has averaged 71.6, its weakest reading in a decade.

Michigan Consumer Sentiment

NFP, JOLTS, and Initial Jobless Claims

Jobs are the normal touchstone for consumer outlook. When workers are confident that employment is readily available and wages are rising, Americans are optimistic.

Nonfarm Payrolls (NFP) rose 531,000 in October and have averaged 403,000 for three months and 646,000 for six. The Job Openings and Labor Turnover Survey (JOLTS) has had an all-time record average of 9.8 million positions on offer each month since February.

JOLTS

FXStreet

The US labor market has had a number of fitful months, particularly in August and September when initial readings of 235,000 and 194,000 seemed to indicate a rapid decline in job creation. October’s performance and upward revision to the two prior months alleviated most of that concern.

Initial Jobless Claims have been under 300,000 for five weeks. At 267,000 in the beginning of November they are approaching the levels of late 2019 before the pandemic lockdowns crushed employment.

Initial Jobless Claims

FXStreet

Several factors, including generous unemployment benefits, pandemic restrictions and Covid fears head the list of reasons why many workers have been slow to return to employment. Job availability is not one. Anyone one in the country who wants to find work can do so.

Inflation and Wages

The labor shortage has forced many employers to raise wages. Annual gains in Average Hourly Earnings have soared from 1.9% in May to 4.9% in October.

Average Hourly Earnings

FXStreet

Unfortunately for American workers, inflation has risen even faster. Wages have not outstripped the Consumer Price Index (CPI) since March. Annual real wages (wages minus inflation) of US workers have declined steadily for seven months: April -3.8%, May -1.9%, June -1.7%, July -1.3%, August -1.3%, September -0.8% and October -1.3%.

CPI

There is little for workers to celebrate in these numbers.

Market potential

Consumer sentiment is usually a data point of secondary importance. What the number tells the market about consumption and the 70% of US economic activity tied to consumer activity is its main interest.

For the November Michigan figures, the risk is for a further deterioration in consumer attitudes. Sooner or later the extremely weak outlook will begin to affect Retail Sales. The longer sentiment is at rock bottom the greater its potential drag on consumption.

The US economy expanded at a 2% annualized rate in the third quarter. Until now consumer spending has been relatively firm. Retail Sales averaged 0.8% in August and September and Personal Spending was 1.0% and 0.6%.

If consumption falters, combined with all of the other labor, supply, inflation and distribution problems, the economy would be hard pressed to maintain positive growth.

Lower or negative US growth would sow doubt for the Federal Reserve’s taper plans, in turn inhibiting US Treasury yields and the dollar.

The Fed may not need an ebullient US consumer for its monetary policy, but it fears a creeping consumer depression.

October’s Retail Sales figures will be reported on November 17.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.