US May Nonfarm Payrolls Preview: Analyzing major pairs' reaction to NFP surprises

- Nonfarm Payrolls in US is expected to rise by 664,000 in May.

- There is a strong correlation between NFP deviations and major pairs' immediate movements.

- A disappointing NFP print is likely to trigger a more significant reaction than a positive one.

The US Bureau of Labor Statistics (BLS) will release the May jobs report on Friday, June 4. Following April’s disappointing figure, investors expect the Nonfarm Payrolls (NFP) to increase by 664,000 and see the Unemployment Rate edging lower to 5.9% from 6.1%.

The general market view is that a positive surprise in the NFP reading is likely to help the greenback outperform its rivals and vice versa. As such, the US Dollar Index, which tracks the USD’s performance against a basket of six major currencies, lost 0.73% on a daily basis on May 7 when the BLS reported that the NFP rose by 266,000 in April to miss analysts’ estimate of 978,000 by a wide margin.

Like this article? Help us with some feedback by answering this survey:

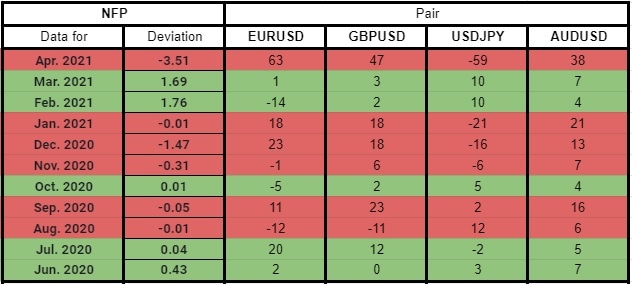

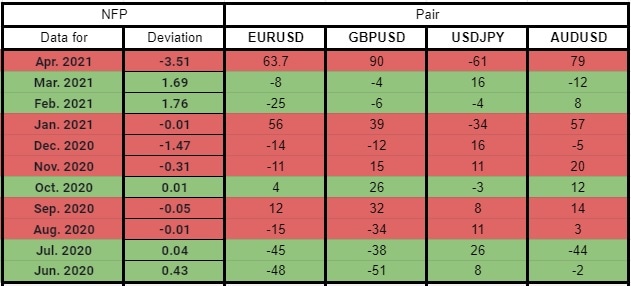

In order to understand how impactful the US jobs report is on the USD’s market valuation, we analyzed the market reaction of four major pairs, EUR/USD, GBP/USD, USD/JPY and AUD/USD, to the previous 11 NFP prints. We omitted the older NFP figures because we believe the numbers registered during the coronavirus outbreak created extreme outliers and distorted the results.

Methodology

The FXStreet Economic Calendar assigns a deviation point to each macroeconomic data release to show how big the divergence was between the actual print and the market consensus. The -3.51 deviation seen in April's NFP reading could be assessed as a relatively big negative surprise. On the other hand, February’s NFP print of 536,000 against the market expectation of 182,000 was a positive surprise with the deviation posting 1.76 for that particular release.

“Deviation: It measures the surprise caused when the Actual data differs from the Consensus. It can oscillate in an open scale usually between -7 and +7.”

Next, we plotted the reaction, in terms of pips, of the major pairs mentioned above 15 minutes, one hour and four hours after the release to see if the general market view held.

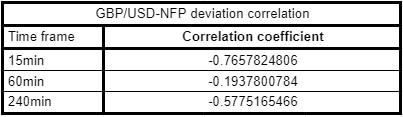

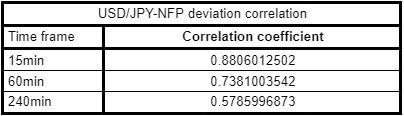

Finally, we calculated the correlation coefficient (r) to figure out which major pair had the strongest correlation at which time frame. When r approaches -1, it suggests there is a significant negative correlation, while a significant positive correlation is identified when r moves toward 1.

Results

There were six negative NFP surprises against five positive surprises in the previous 11 releases. On average, the deviation was -0.89 on disappointing prints and 0.78 on upbeat figures. 15 minutes after a negative surprise, the average gains in the EUR/USD, GBP/USD and AUD/USD were 17, 16.8 and 16.8 pips, respectively, while USD/JPY lost 14.6 pips. On the other hand, EUR/USD, GBP/USD, USD/JPY and AUD/USD rose 0.8, 3.8, 5.2 and 5.4 pips, respectively, on average following positive surprises. This finding suggests that investors are more likely to react immediately to weaker-than-expected NFP prints rather than strong ones.

15-min deviation table

60-min deviation table

240-min deviation table

EUR/USD

EUR/USD has a correlation coefficient of -0.84, -0.56 and -0.55 15 minutes, 60 minutes and 240 minutes after the release, respectively. These numbers suggest that the impact of the NFP deviation on EUR/USD fades away following a strong reaction initially.

GBP/USD

GBP/USD has a correlation coefficient of -0.76, -0.19 and -0.57 15 minutes, 60 minutes and 240 minutes after the release, respectively. These numbers suggest that there is a relatively strong inverse correlation with the pip-change in GBP/USD and the NFP deviation 15 minutes after the release. However, this correlation is virtually non-existent one hour after the release as presented by the flattening trend line seen in the respective chart.

USD/JPY

USD/JPY has a correlation coefficient of 0.88, 0.73 and 0.57 15 minutes, 60 minutes and 240 minutes after the release, respectively. These numbers suggest that the NFP deviation has a strong positive correlation with the pip-change in USD/JPY 15 minutes and one hour after the release.

AUD/USD

AUD/USD has a correlation coefficient of -0.79, -0.18 and -0.56 15 minutes, 60 minutes and 240 minutes after the release, respectively. These numbers suggest that there is a relatively strong inverse correlation with the pip-change in AUD/USD and the NFP deviation 15 minutes after the release. Similar to GBP/USD, AUD/USD shows no interest in the NFP print one hour after the release.

Summary

To summarize, a negative NFP surprise triggers a stronger market reaction than a positive one in EUR/USD, GBP/USD, USD/JPY and AUD/USD pairs. There is a significant correlation between the NFP deviation and pip-change in these pairs immediately after the data release. One hour later, the correlation weakens noticeably in these pairs with the exception of USD/JPY. Four hours after the release, it's difficult to draw a connection between these pairs' movements and the NFP reading.

Found this article useful? Vote it on our survey

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.