US Markit PMIs Preview: Services sector has room for upside surprise, boosting the dollar

- Markit's Services PMI is expected to rise to only 53 points, barely in growth territory.

- America's largest sector has likely rebounded much faster from the Omicron-related slowdown.

- Data from Germany and France also points to a robust bounce in the sector.

- The dollar has room to rise in response to the data.

Hold your horses, Mr. Putin – for a few minutes, markets are set to turn away from the geopolitical drama and take a look at fresh economic data. Markit's preliminary Purchasing Managers' Indexes for February will provide a snapshot of the post-Omicron world. Covid is still raging, but at a far lower rate than earlier. By how much, that is the question.

The focus is on the services sector which was hit by the rapid spread of this contagious coronavirus variant. Consumers limited their visits to physical stores, barbershops and restaurants. While that did not hurt online shopping in January – according to retail sales figures – it weighed on sentiment.

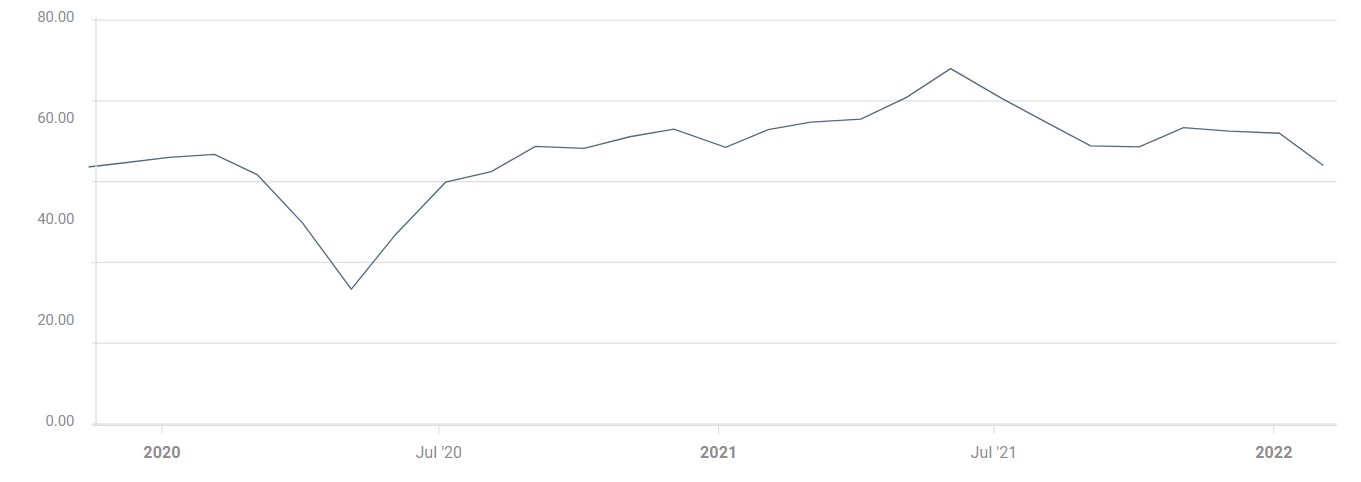

Staff shortages due to the virus and the "Great Resignation" were also factors that pushed the Services PMI down to 51.1 in January. Economists are projecting a rebound in February, but only to 53 points. While that figure reflects expansion – the threshold is 50 – it is a far cry from levels above 60 recorded earlier in the recovery from the pandemic.

Here are the developments in Markit's Service PMI:

Source: FXStreet

Another fact that is critical to consider is figures from other countries that have also undergone Omicron waves. French Services PMI came out at 57.9 points vs. 53.6 that was forecast. Germany's figure came out 56.6, far above the 53 predicted. And in the UK, where the economy is as dependent on services as the US, came out at 60.8 compared with 55.5 expected.

Overall, there is room for a substantial upside surprise.

US dollar reaction

As mentioned earlier, investors are focused on events in Donbass, eastern Ukraine. Statements from Russia's President Vladimir Putin and counterparts in the West also grab the headlines, as do movements in other places of the globe. However, Markit's Services PMI is set to trigger a market reaction.

A better-than-expected figure will likely jolt the dollar higher, as it would raise the chances of a double-dose rate hike by the Federal Reserve. Moreover, it would go with the current risk-off sentiment prompted by geopolitical fears.

In the unlikely case of a disappointing data point, the greenback would suffer a modest drop.

Final thoughts

Markit's Services PMI has room to surprise to the upside, boosting the dollar in the short term, until investors refocus on the Russia-Ukraine standoff.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.