US July Retail Sales: Poor but not yet a trend

- Retail Sales in all categories much lower in July than forecast.

- Inflation and recurring pandemic the likely culprits.

- US equities fall, dollar rises on risk-aversion, yields static.

Americans reduced their spending in July far more than expected as rising Covid cases in several states and surging inflation has undermined the desire and ability of consumers to live expansively.

Retail Sales fell 1.1% last month, almost four times the -0.3% forecast, according to the Commerce Department on Tuesday. Sales excluding automobiles dropped 0.4%, also far beneath the 0.1% forecast.

Retail Sales

Modest positive revisions to the June figures, to 0.7% from 0.6% for sales and to 1.6% from 1.3% for the ex-autos category, did little to ameliorate the negative impact of the July numbers.

The Control Group listing, which mimics the consumption component of the gross domestic product (GDP) calculation, fell 1% on a -0.1% prediction. The June result was revised to 1.6% from 1.3%.

Yesterday’s Michigan Consumer Sentiment numbers had prefigured these very poor consumption numbers.

The Michigan Survey index tumbled to 70.2 in August from 81.2 in July. It was the worst reading since December 2011 and a huge miss as the market consensus was for no change. The 11 point decline was one of the largest single-month falls on record. .

“Over the past half century, the Sentiment Index has only recorded larger losses in six other surveys, all connected to sudden negative changes in the economy,” noted Richard Curtin, chief economist for the University of Michigan’s Surveys of Consumers in the statement accompanying the release.

Market response-equities

Markets were surprisingly sanguine after the unexpected decline in consumer spending.

All three major equity indices lost ground.The Dow lost 282.12 points, 0.79%, closing at 35,343.28, but that was an almost 45% recovery from the low at -505.09 points.

Dow

CNBC

The S&P 500 lost 31.63 points, 0.71% finishing at 4.448.08, recovering about 30% from its low quote. The Nasdaq shed 137.58 points, 0.93%, ending at 14,656.18.

Market response-currencies

Currency markets answered to the rising Covid counts in the US and many other countries around the world with a minor return to the safe-haven dollar.

The greenback rose in all major pairs, with the EUR/USD dropping almost three-quarters of a figure closing at 1.1706. Its lowest finish since November 3, 2020. Since closing at 1.2250 on May 25 the united currency has lost 4.4% versus the US dollar.

The USD/JPY added 39 points, but failed to cross above 110.00, finishing at 109.61.

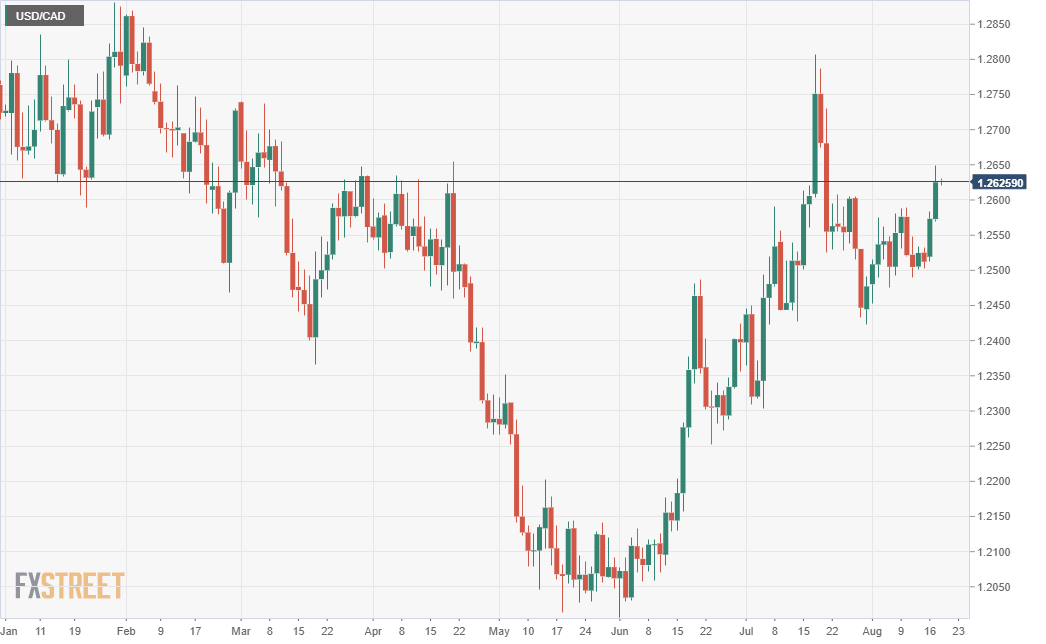

The loonie was damaged by a 1.2% drop in the price of a barrel of West Texas Intermediate (WTI), the North American crude pricing standard, to $66.44.. Since closing at 474.68 on July 5, WTI has dropped 11%.

Market response-Treasury yields

US Treasury returns were mixed with the longer side of the yield curve at the 10-year and 30-year markets adding and subtracting less than one point each at 1.262% and 1.922%. The 2-year Treasury rate climbed to 0.219% from 0.205%.

2-year Treasury

CNBC

Conclusion

For the moment the decline in consumption is an isolated event. It may owe as much to the pressure of inflation on financially strapped households as to fears of the pandemic. Unlike the draconian lockdowns in Australia or New Zealand whose Prime Minister Jacinda Arden has shut the entire country over a five case outbreak, no governors in the US have threatened economic closures. If the current wave in the US continues to mount and spread, it will exact an economic cost as consumers stay home and restrict their purchases.

However, the drop in consumer spending has made the Fed's pending policy decision easier. There will be less pressure for a reduction in bond purchases if the 70% of the economy beholden to consumption begins to slow down. A prolonged slide in consumer spending may even take some of the energy from inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.