US July PCE Inflation Preview: Fed taper outlook depends on Powell rather than inflation data

- Core PCE inflation is expected to rise to 3.6% on a yearly basis in July.

- Investors could ignore the inflation report ahead of Jackson Hole Symposium.

- EUR/USD could target 1.1900 if it manages to clear the 3-month-old descending trend line.

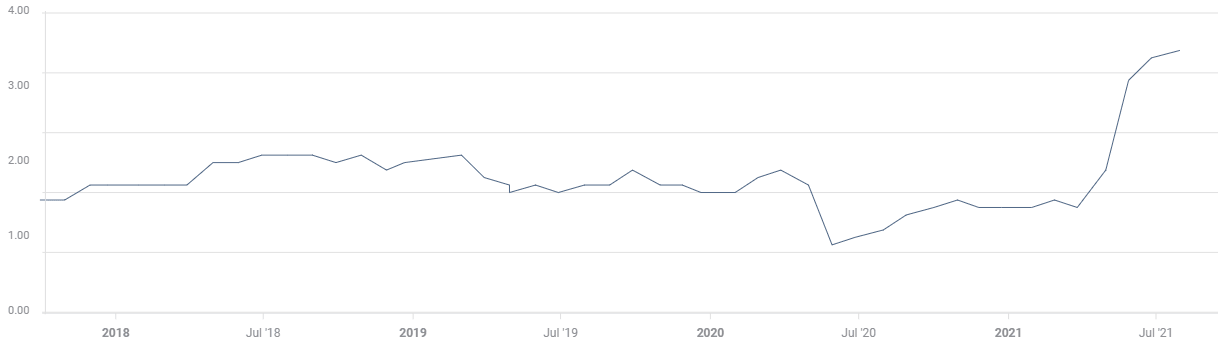

After publishing the second estimate for the second-quarter GDP growth on Thursday, the US Bureau of Economic Analysis will release the Personal Consumption Expenditures (PCE) Price Index figures on Friday, August 27. Investors expect the PCE Price Index to decline to 3.5% on a yearly basis from 4% in June while forecasting the annual Core PCE Price Index, the Federal Reserve’s preferred gauge of inflation, to edge higher to 3.6% from 3.5%.

Annual Core PCE Price Index Chart

In the press conference following the FOMC’s July policy meeting, FOMC Chairman Jerome Powell acknowledged that inflation has increased notably and will likely remain elevated in the coming months before moderating. "Inflation could turn out to be higher, more persistent than expected,” Powell added and said that risks to inflation are to the upside in the near term.

Earlier in the month, the US Bureau of Labor Statistics reported that the Consumer Price Index (CPI) stayed unchanged at 5.4% on a yearly basis in July and the Core CPI declined to 4.3% from 4.5% as expected.

In the meantime, the latest PMI report published by IHS Markit revealed that input price pressures continued to increase in early August. “The rate of input price inflation accelerated to the second-fastest on record (since October 2009), with both manufacturing and service sectors registering a quicker rise in costs,” the publication read.

To summarize, PCE inflation in July should arrive near June’s readings and this shouldn’t come as a surprise to investors, suggesting that the market reaction will remain muted. Furthermore, Powell will be delivering his speech at the Jackson Hole Symposium 90 minutes after the data release and market participants could opt out to wait for Powell’s remarks instead of reacting to the PCE data.

Fed Chair Powell’s Jackson Hole Speech: Caution will win out.

Nevertheless, a stronger-than-expected print could provide a short-lasting boost to the greenback as it would reinforce the view that the Fed will start tapering asset purchases before the end of the year and vice versa. Following the decisive rally witnessed in the previous week, the US Dollar Index reversed its direction this week and seems to have steadied around 93.00.

EUR/USD near-term outlook

After slumping to its lowest level of 2021at 1.1664, the EUR/USD pair managed to stage a decisive rebound before going into a consolidation phase below 1.1800. On the daily chart, the Relative Strength Index (RSI) indicator continues to move sideways around 50, reflecting the pair's indecisiveness.

On the upside, the descending trend line coming from late May seems to have formed strong resistance around the 1.1800 psychological level. With a daily close above that hurdle, EUR/USD could target 1.1825 (50-day SMA) ahead of 1.1900 (psychological level, static resistance).

On the other hand, the initial support aligns at 1.1700 (psychological level). In case sellers drag EUR/USD below that level, the pair could extend its slide and renew 2021 lows below 1.1660.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.